Students can access the CBSE Sample Papers for Class 11 Accountancy with Solutions and marking scheme Set 5 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 11 Accountancy Set 5 with Solutions

Time Allowed : 3 hours

Maximum Marks: 70

General Instructions:

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts, Part A and B.

- Question Nos. 1 to 15 and 25 to 29 carries 1 mark each.

- Questions Nos. 16 to 18,30 to 32 carries 3 marks each.

- Questions Nos. 19,20 and 33 carries 4 marks each

- Questions Nos. from 21 to 24 and 34 carries 6 marks each

- There is no overall choice. However, an internal choice has been provided in 7 questions of one mark, 2 questions of three marks, 1 question of four marks and 2 questions of six marks

Part – A (Financial Accounting – I)

Question 1.

Errors which are committed due to wrong posting of transactions, wrong detailing or balancing of accounts, etc. are called …………..

(A) Error of Omission

(B) Error of Commission

(C) Compensating Error

(D) None of the these [1]

Answer:

(B) Error of Commission

Question 2.

Assertion: Accounting is a process of identifying the transactions to be recorded.

Reason: Accounting is complete when information is communicated to various groups interested in the functioning of business entity.

(A) Both A and R are correct, and R is the correct explanation of A.

(B) Both A and R are correct, but R is not the correct explanation of A.

(C) A is correct, but R is incorrect.

(D) A is incorrect, but R is correct. [1]

Answer:

(B) Both A and R are correct, but R is not the correct explanation of A.

Question 3.

One-sided errors are the errors which affect:

(A) One account

(B) Two accounts

(C) More than two accounts

(D) Both (B) and (C)

OR

Furniture purchased from M/s Delhi Furnishings for ₹ 40,000 was entered into the Purchases Book. It is an error of ………….

(A) Error of Omission

(B) Error of Commission

(C) Compensating Error

(D) Error of Principle

Answer:

(A) One account

OR

(D) Error of Principle

Explanation: Errors which take place due to wrong classification of capital and revenue nature of items are called errors of principle.

Question 4.

……………. voucher records a transaction entailing multiple debits and one credit or multiple credits and one debit. [1]

(A) Extraordinary Voucher

(B) Multiple Voucher

(C) Efficient Voucher

(D) Compound Voucher

OR

…………….. account will be credited on receipt of ₹ 5,000 from Mr. Z whose account was written off as bad debts. [1]

(A) Bad Debt Account

(B) Bad Debt Recovered Account

(C) Provision for Bad Debt Account

(D) Debtors Account

Answer:

(D) Compound Voucher

OR

(B) Bad Debt Recovered Account

Question 5.

Consider the following statements with regard to Accrual Basis of Accounting:

(i) Gives a true and fair view of the profit & loss and financial position, as adjustments relating to outstanding and prepaid expenses and accrued and advance income are taken into account.

(ii) More scientific as compared to cash basis.

(iii) Recognized under the Companies Act and used more widely by business enterprises.

(iv) Distinguishes between capital and revenue expenditure.

Which of the following alternatives state the advantage of using such a basis of accounting:

(A) (i), (ii) and (iii)

(B) (ii), (iii) and (iv)

(C) (i), (ii) and (iv)

(D) (i), (ii), (iii) and (iv) [1]

Answer:

(D) (i), (ii), (iii) and (iv)

Question 6.

Which of the following is not an example of provisions:

(A) Provision for depreciation

(B) Provision for taxation

(C) Premium on issue of shares

(D) Provision for discount on debtors [1]

OR

Consider the following statements about depreciation:

(i) Depreciation is a non-cash expense.

(ii) Depreciation is charged on current assets.

(iii) Depreciation is decline in the market value of tangible fixed assets.

(iv) The main cause of depreciation is wear and tear caused by its usage.

Which of the above statement/s are true?

(A) (i) and (ii)

(B) (i) and (iii)

(C) (i) and (iv)

(D) (ii) and (iv) [1]

Answer:

(C) Premium on issue of shares

Explanation: Provisions means setting aside an amount for meeting a known future liability. Premium on issue of shares is a capital profit and not a provision.

OR

(C) (i) and (iv)

Question 7.

Assertion: Accounting assists in managing the business enterprise.

Reason: Accounting helps the management in decision-making to run the business efficiently and effectively.

(A) Both A and R are correct, and R is the correct explanation of A.

(B) Both A and R are correct, but R is not the correct explanation of A.

(C) A is correct, but R is incorrect.

(D) A is incorrect, but R is correct. [1]

Answer:

(B) Both A and R are correct, but R is not the correct explanation of A.

Question 8.

Pick the odd one out:

(A) Single Column Cash Book

(B) Double Column Cash Book

(C) Triple Column Cash Book

(D) Petty Cash Book [1]

OR

Consider the following statements:

(i) Journal is a book of secondary entry.

(ii) One debit account and more than one credit account in a entry is called compound entry.

(iii) Assets sold on credit are entered in sales journal.

(iv) Cash and credit purchases are entered in purchase journal.

Choose the statement/s which are not correct:

(A) (i), (ii) and (iii)

(B) (i), (ii) and (iv)

(C) (i), (iii) and (iv)

(D) (i), (ii), (iii) and (iv) [1]

Read the following hypothetical situation, answer question nos. 9 and 10.

The concept of money measurement states that only those transactions and happenings should be recorded in organisation which can be expressed in terms of money such as sale of goods or payment of expenses or receipt of income, etc. are to be recorded in the books of account. All those transactions or happenings which cannot be expressed in monetary terms, for example, the appointment of a manager, capabilities of its human resources or creativity of its research department or image of the organisation among people in general do not find a place in the accounting records of a firm.

Change in prices, the value of money does not remain the same over a period of time. The value of rupee today on account of rise in prices is much less than what it was, say ten years back. Therefore, in the Balance Sheet, when we add different assets bought at different points and different time, say building purchased in 1995 for ₹ 2 crore, and plant in 2005 for ₹ 1 crore we are in fact adding heterogenous values, which cannot be clubbed together.

Answer:

(D) Petty Cash Book

Explanation: Petty Cash Book is the type of cash book maintained by the petty cashier, while the others are different types of cash books.

OR

(C) (i), (iii) and (iv)

Question 9.

The enthusiasm and motivation of employees to work is very important for an organisation, but still it is not recorded. Under which accounting concept is it not recorded?

(A) Money Measurement

(B) Matching Cost

(C) Accounting Period

(D) Dual Aspect [1]

Answer:

(A) Money Measurement

Question 10.

As the change in the value of money is not reflected in the books of accounts, which of the following statements is true?

(A) Accounting data gives a true and fair view of a business

(B) Accounting data does not give a true and fair view of a business

(C) Accounting data should be shown at market value

(D) None of these [1]

Answer:

(A) Accounting data gives a true and fair view of a business

Question 11.

means accounting information of a current year can be compared with that of the previous years.

(A) Adaptability

(B) Comparability

(C) Compatibility

(D) All of the above [1]

Answer:

(B) Comparability

Explanation: Comparability means accounting information of a current year can be compared with that of the previous years. Comparability enables intra-firm and inter-firm comparison. This assists in assessing the outcomes of various policies and programmes adopted in different time horizons by the same or different businesses.

Question 12.

According to which principle, a business transaction should be supported by documentary evidence and no entry shall be passed without its supporting documents.

(A) Objectivity

(B) Full Disclosure

(C) Cost Concept

(D) Revenue Recognition [1]

Answer:

(A) Objectivity

Explanation: According to this principle, a business transaction should be supported by documentary evidence. No entry shall be passed without its supporting documents. Objectivity means the document should contain facts in an unbiased manner. Accounting should be done without favour or prejudice. This concept will thus ensure the dependability, reliability and trust worthiness of the accounting information.

Question 13.

This principle implies that the accounting report should be full and accurate. If there is any material fact which can affect the profitability of the business in future, it must disclose it to the users whether it is legally required or not. Which principle are we talking about?

(A) Matching Cost

(B) Going Concern

(C) Full Disclosure

(D) Consistency [1]

Answer:

(C) Full Disclosure

Question 14.

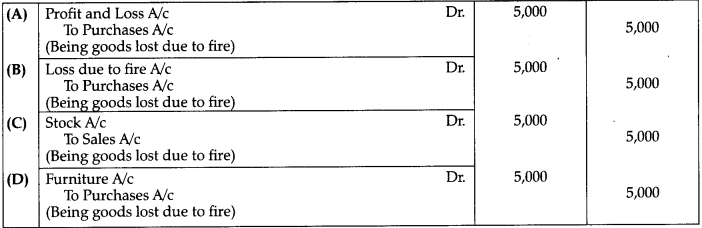

There was a loss due to fire of goods worth ?10,000. Which of the following journal entry will be passed:

Answer:

Option (B) is correct

Question 15.

……………… is a code of conduct imposed by customs, law or professional body for the benefit of public accountants and accountants.

(A) Accounting Standard

(B) Accounting Principles

(C) Accounting Concepts

(D) All of the these [1]

OR

IASC is now renamed as International Financial Reporting Board in which year?

(A) 1973

(B) 1983

(C) 1977

(D) 1987 [1]

Answer:

(A) Accounting Standard

OR

(A) 1973

Question 16.

Accounting provides quantitative information about the financial transactions which are useful in making economic decisions. Accounting collects, records, classifies and summarises the financial information which is communicated to its users. In the same context explain any three external users of accounting. [3]

OR

The accounting concepts and accounting standards are generally referred to as the essence of financial accounting. Comment. [3]

Answer:

Three external users of accounting are :

(i) Creditors : The persons to whom business owes money are the creditors of the business. Since they have advanced some money or money’s worth to the business, their fate is tagged to the prosperity of the concern.

(ii) Potential Investors : It is only after getting a detailed information about the profitability of the concern that investors take decisions regarding investment to be made in that particular business. Accounting information is of great use to them in this connection.

(iii) Government : Accounting information is required by the government for fixing GST, assessing the profitability of the concern, computing national income and determining the growth rate of industry.

OR

The generally accepted accounting principles in the form of basic accounting concept have been accepted by the accounting profession to achieve uniformity and comparability in the financial statement. This is aimed at increasing the utility of these statements to various users of the accounting information. But the difficulty is that GAAP permits a variety of alternative treatments for the same thing. For example, various methods of calculation of cost of inventory are permissible which may be followed by different enterprises. This may cause problem to external users of information, which becomes inconsistent and incomparable.

This necessitates to bring in uniformity and consistency in the reporting of accounting information. Recognising this need, the Institute of Chartered Accountants of India (ICAI) constituted an Accounting Standard Board (ASB) in April, 1977 developing Accounting Standards. The main function of ASB is to identify areas in which uniformity in standards is required and develop draft standards after wide discussions with representatives of the government, public sector undertakings, industry and other organisations.

Accounting standards are written statements of uniform accounting rules and guidelines or practices for preparing the uniform and consistent financial statement and for other disclosures affecting the users of accounting information. However, the accounting standards cannot override the provision of applicable laws, customs usage and business environment in the country

Question 17.

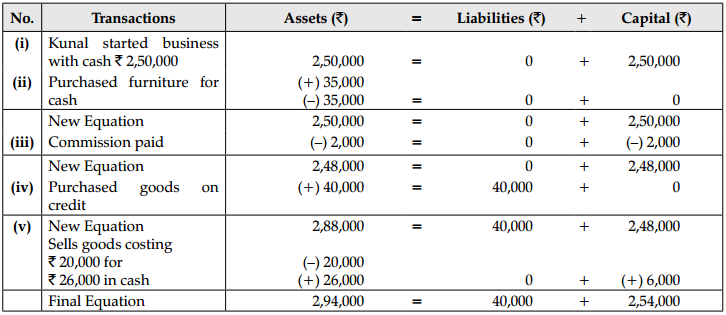

Prepare accounting equation on the basis of the following:

| Particulars | ₹ |

| (i) Kunal started business with cash | 2,50,000 |

| (ii) He purchased furniture for cash | 35.000 |

| (iii) He paid commission | 2,000 |

| (iv) He purchased goods on credit | 40.000 |

| (v) He sold goods (costing ₹ 20,000) | 26.000 |

Answer:

Question 18.

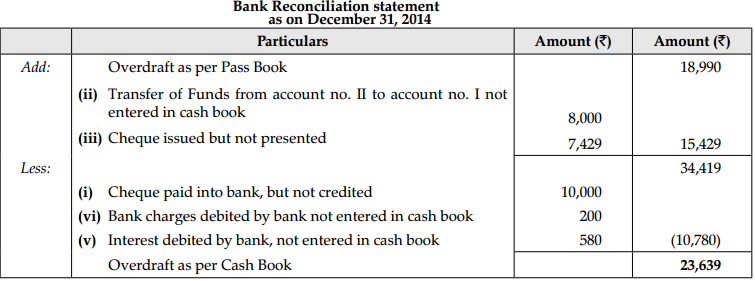

Raghav & Co. has two bank accounts : Account No. I and Account No. II. From the following particulars relating to Account No. I, find out the balance of the account on December 31,2014 according to the cash book of the firm.

(i) Cheque paid into bank prior to December 31,2014 but credited after that date for ₹ 10,000

(ii) Transfer of funds from account No. II to account No. I recorded by the bank on December 31,2014 but entered in the cash book after that date for ₹ 8,000.

(iii) Cheques issued prior to December 31,2014 but not presented until after that date for ₹ 7,429.

(iv) Bank charges debited by bank not entered in the cash book for ₹ 200.

(v) Interest debited by bank not entered in the cash book ₹ 580.

(vi) Overdraft as per Pass Book ₹ 18,990.

Answer:

Question 19.

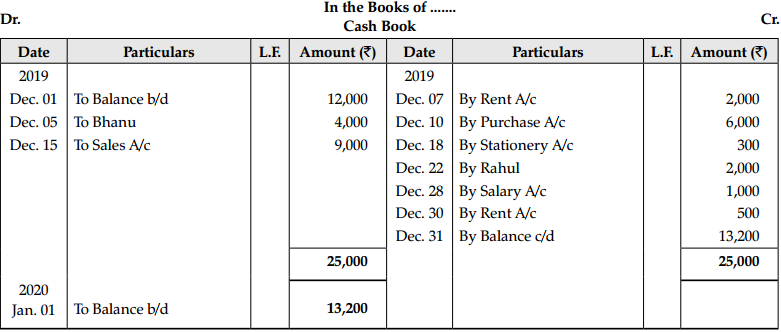

Enter the following transactions in a simple cash book for the year December 2019:

| Date | Particulars | ₹ |

| Dec. 01 | Cash in hand | 12,000 |

| Dec. 05 | Cash received from Bhanu | 4,000 |

| Dec. 07 | Rent paid | 2,000 |

| Dec. 10 | Purchase goods for cash | 6,000 |

| Dec. 15 | Sold goods for cash | 9,000 |

| Dec. 18 | Purchase stationery | 300 |

| Dec. 22 | Cash paid to Rahul on account | 2,000 |

| Dec. 28 | Paid salary | 1,000 |

| Dec. 30 | Paid rent | 500 |

Answer:

Question 20.

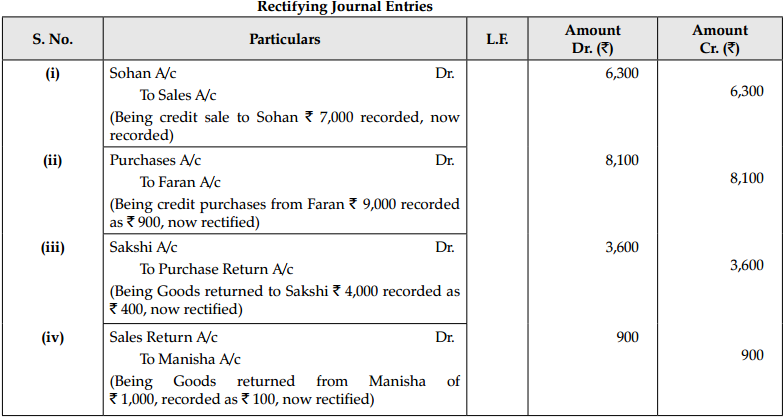

Rectify the following errors:

(i) Credit sales to Sohan ₹ 7,000 were recorded as ₹ 700.

(ii) Credit purchases from Faran ₹ 9,000 were recorded as ₹ 900.

(iii) Goods returned to Sakshi ₹ 4,000 were recorded as ₹ 400.

(iv) Goods returned from Manisha ₹ 1,000 were recorded as ₹ 100. [4]

Answer:

Question 21.

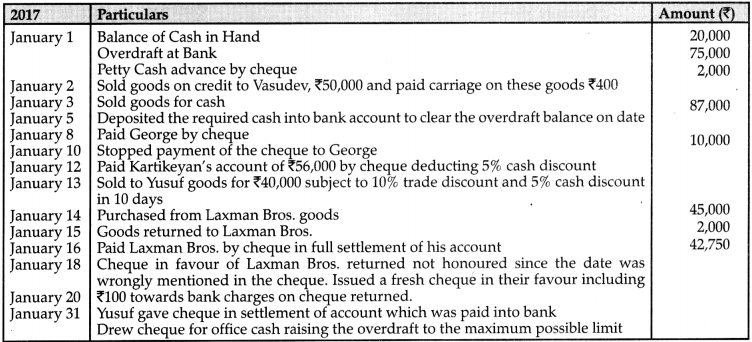

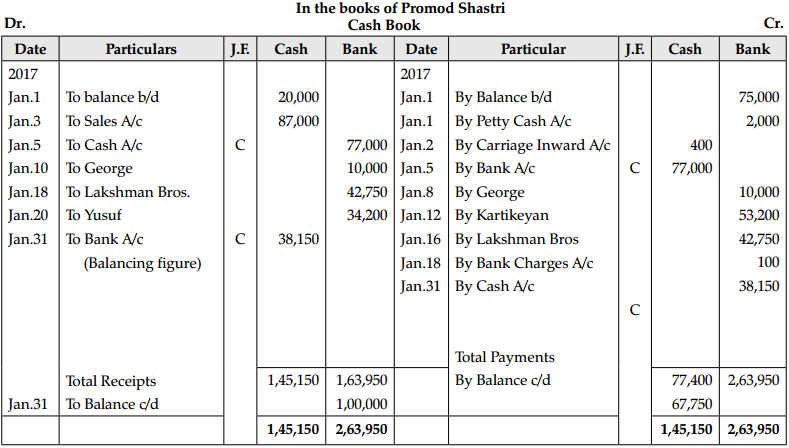

Enter the following transactions of Promod Shastri in the Cash Book. Promod Shastri has an overdraft arrangement with the bank subject to a maximum limit of ₹ 1,00,000:

OR

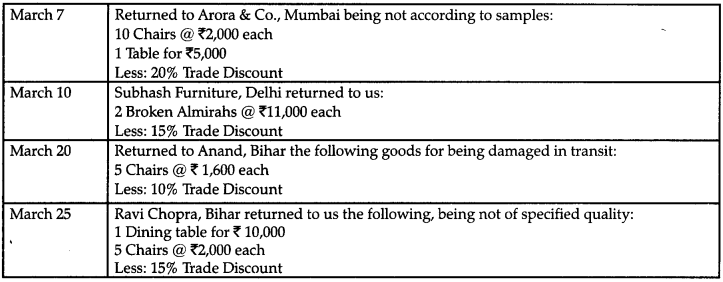

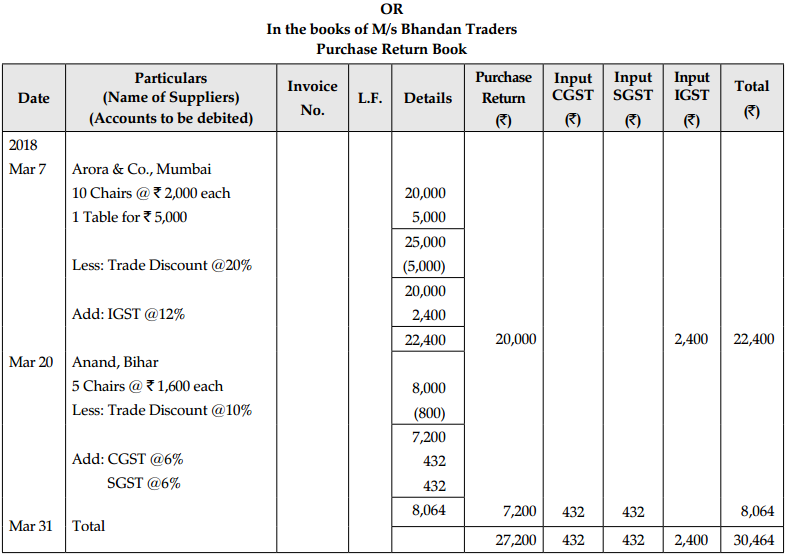

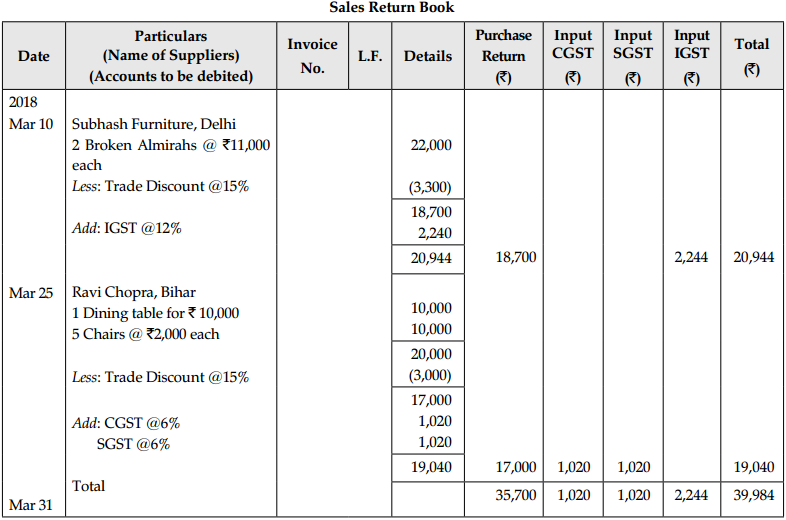

Prepare Return books of M/s Bhandan Traders, Bihar from the following transactions assuming CGST @ 6% and SGST @ 6%, IGST @12%:

2018

Answer:

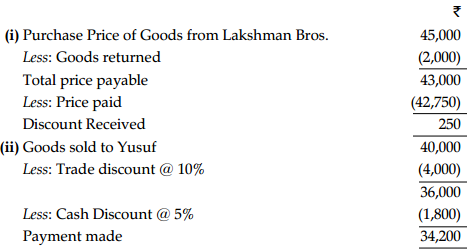

Working Notes:

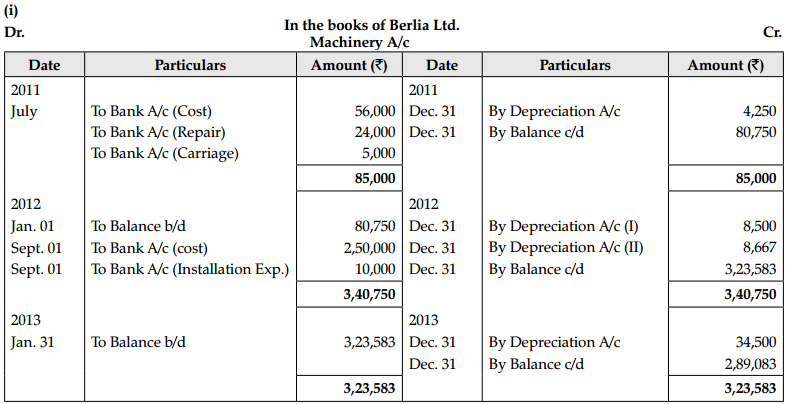

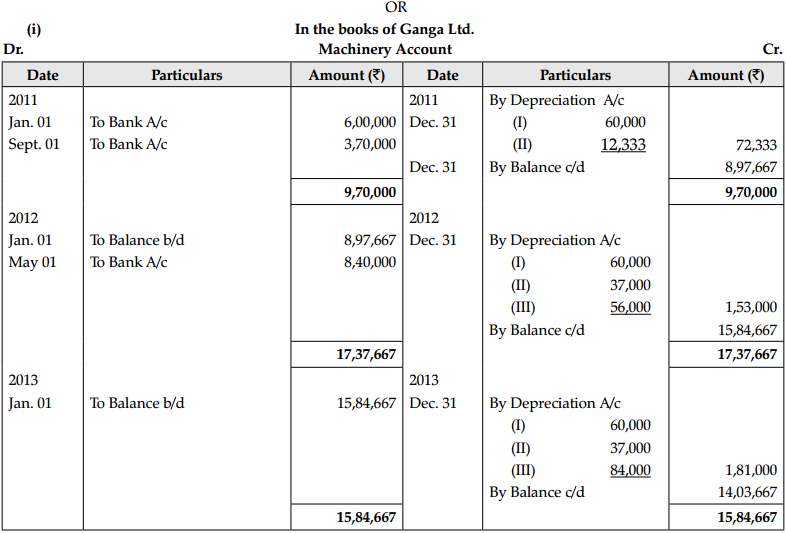

Question 22.

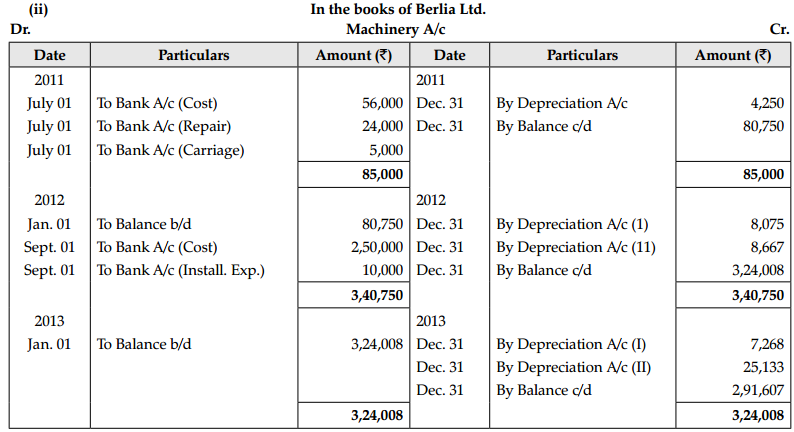

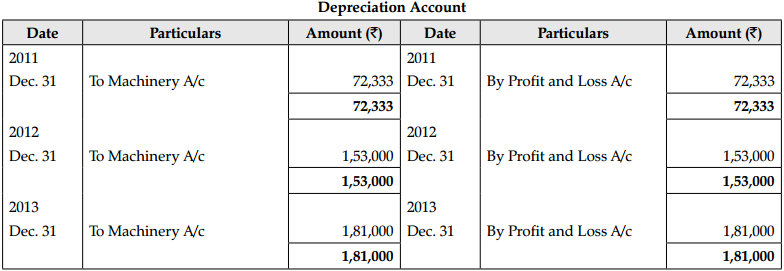

Berlia Ltd. purchased a second hand machine for ₹ 56,000 on July 01,2011 and spent ₹ 24,000 on its repair and installation and ₹ 5,000 for its carriage. On September 01,2012, it purchased another machine for ₹ 2,50,000 and spent ₹ 10,000 on its installation.

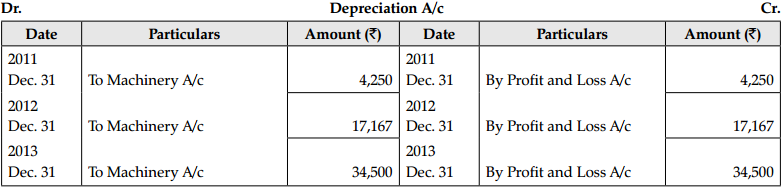

(i) Depreciation is provided on machinery @ 10% p.a. on original cost method annually on December 31. Prepare Machinery Account and Depreciation Account from the year 2011 to 2013.

(ii) Prepare Machinery Account and Depreciation Account from the year 2011 to 2013 if depreciation is provided on machinery @ 10% p.a. on written down value annually on December 31. [6]

OR

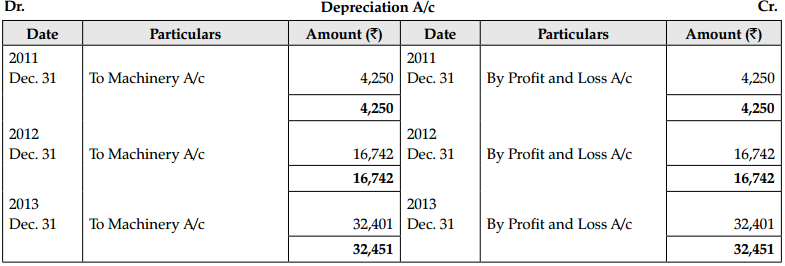

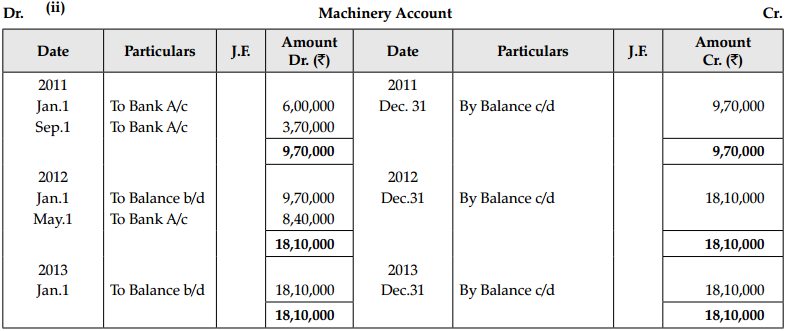

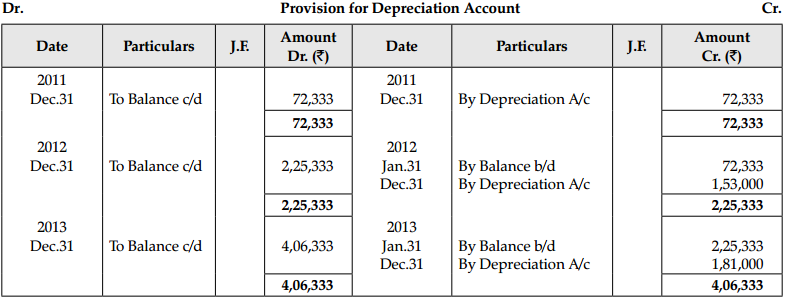

Ganga Ltd. purchased a machinery on January 01,2011 for ₹ 5,50,000 and spent ₹ 50,000 on its installation. On September 01,2011 it purchased another machine for ₹ 3,70,000. On May 01,2012 it purchased another machinery for ₹ 8,40,000 (including installation expenses).

Depreciation was provided on machinery @ 10% p.a. on original cost Method annually on 31st December. Prepare: [6]

(i) Machinery Account and Depreciation Account for the years 2011,2012 and 2013.

(ii) If depreciation is accumulated in Provision for Depreciation Account then prepare Machinery Account and

provision for Depreciation Account for the year 2011,2012 and 2013. [6]

Answer:

Question 23.

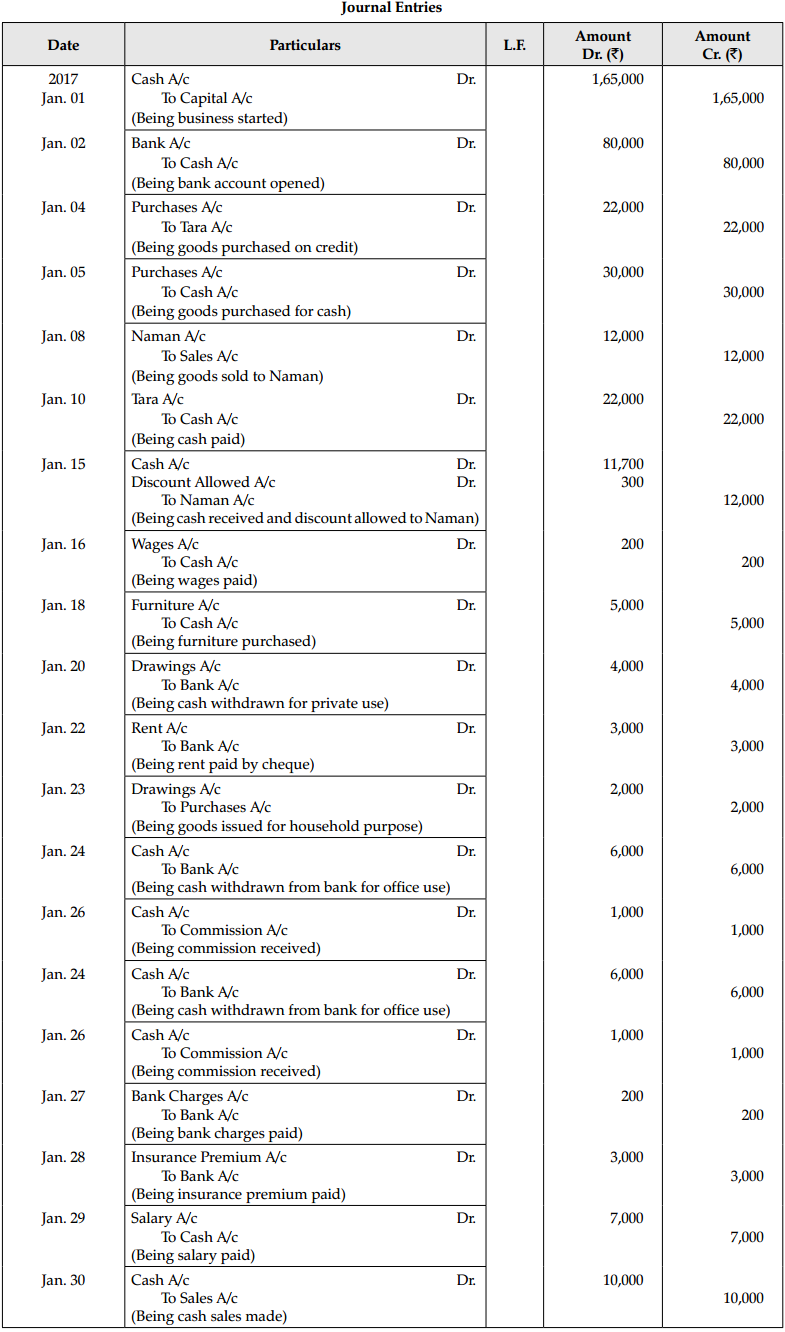

Journalize the following transactions:

| 2017 | Particulars | ₹ |

| Jan. 01 | Started Business with cash | 1,65,000 |

| Jan. 02 | Open Bank Account in PNB | 80,000 |

| Jan. 04 | Goods purchased from Tara | 22,000 |

| Jan. 05 | Goods purchased for cash | 30,000 |

| Jan. 08 | Goods sold to Naman | 12,000 |

| Jan. 10 | Cash paid to Tara | 22,000 |

| Jan. 15 | Cash received from Naman | 11,700 |

| Discount allowed | 300 | |

| Jan. 16 | Paid wages | 200 |

| Jan. 18 | Furniture purchased for office use | 5,000 |

| Jan. 20 | Withdrawn from bank for personal use | 4,000 |

| Jan. 22 | Issued cheque for rent | 3,000 |

| Jan. 23 | Goods issued for household purpose | 2,000 |

| Jan. 24 | Drawn cash from bank for office use | 6,000 |

| Jan. 26 | Commission received | 1,000 |

| Jan. 27 | Bank charges | 200 |

| Jan. 28 | Cheque given for insurance premium | 3,000 |

| Jan. 29 | Paid salary | 7,000 |

| Jan. 30 | Cash sales | 10,000 |

Answer:

Question 24.

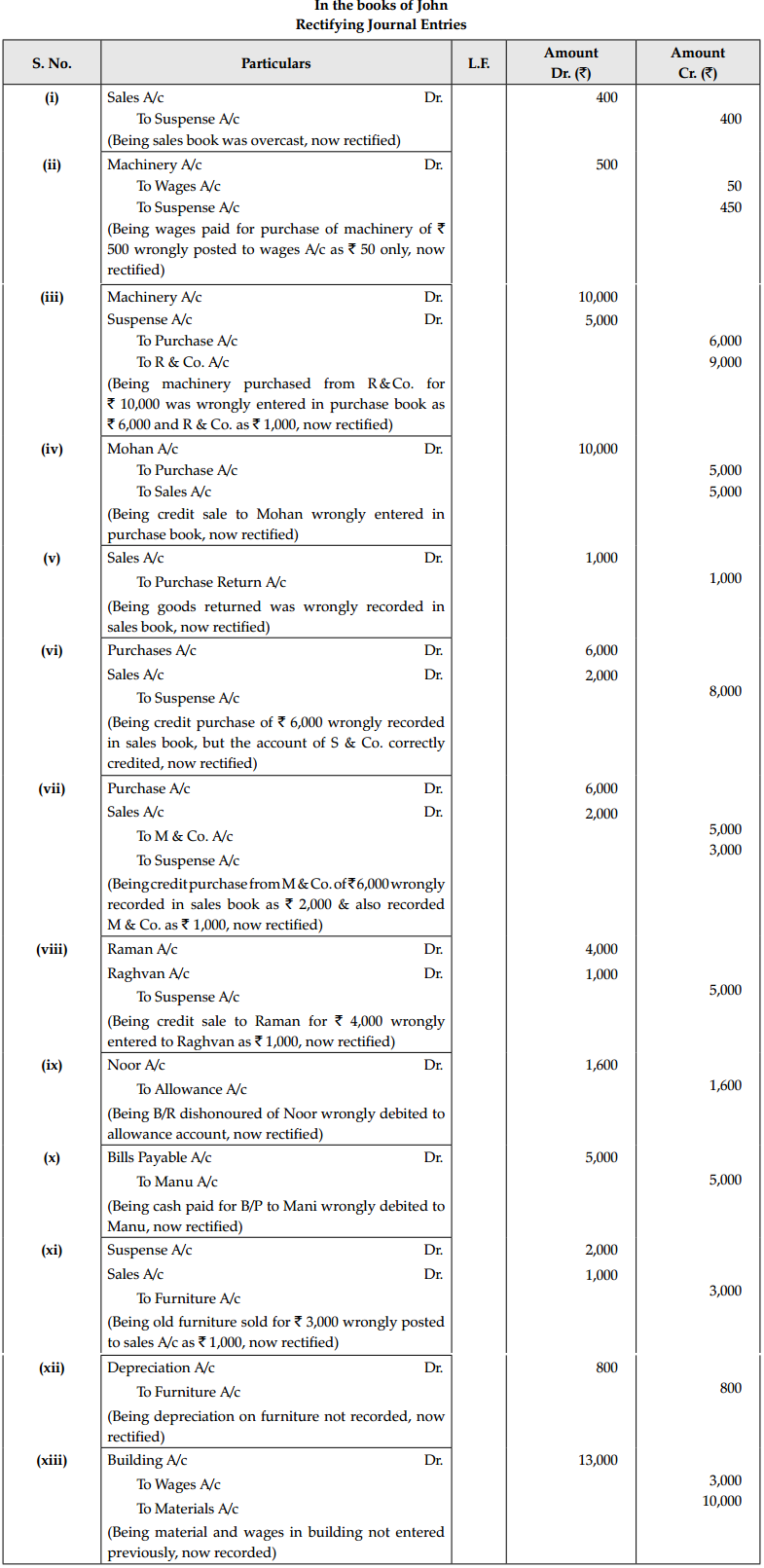

Trial balance of John did not agree, he put the difference to Suspense Account and discovered the following errors:

(i) In the sales book for the month of January total of Page No. 2 was carried forward to page No. 3 as ₹ 1,000 instead of ₹ 1,200 and total of page No. 6 was carried forward to page No. 7 as ₹ 5,600 instead of ₹ 5,000.

(ii) Wages paid for installation of machinery ₹ 500 was posted to wages account as ₹ 50. .

(iii) Machinery purchased from R & Co. for k 10,000 on credit was entered in Purchase Book as ? 6,000 and posted to R & Co. as ₹ 1,000.

(iv) Credit sales to Mohan ₹ 5,000 were recorded in Purchases Book.

(v) Goods returned to Ram ₹ 1,000 were recorded in Sales Book.

(vi) Credit purchases form S & Co. for ₹ 6,000 were recorded in Sales Book as ₹ 2,000. However, S & Co. was correctly credited.

(vii) Credit purchases from M & Co. ₹ 6,000 were recorded in Sales Book as ₹ 2,000 and posted there from to the credit of M & Co. as ₹ 1,000.

(viii) Credit sales to Raman ₹ 4,000 posted to the credit of Raghvan as ₹ 1,000.

(ix) Bill receivable for ₹ 1,600 from Noor was dishonoured and posted to debit of Allowances Account.

(x) Cash paid to Mani ₹ 5,000 against acceptance was debited to Manu.

(xi) Old furniture sold for ₹ 3,000 was posted to Sales Account as ₹ 1,000.

(xii) Depreciation provided on furniture ₹ 800 was not posted.

(xiii) Material ₹ 10,000 and wages ₹ 3,000 were used for construction of building.

Pass the necessary journal entries in order to rectify the errors.

Answer:

Part – B (Financial Accounting – II)

Question 25.

How will the dishonoured cheques be adjusted in the Final Accounts if there is a bank overdraft?

(A) In the debit side of the Trading Account and in the liability side of the Balance Sheet.

(B) In the debit side of the Profit and Loss Account and in the liability side of the Balance Sheet.

(C) Subtracted from the Accounts Receivables in the asset side of the Balance Sheet and added to Bank Overdraft in the liability side of the Balance Sheet.

(D) Added to the Accounts Receivables in the asset side of the Balance Sheet and Added to Bank Overdraft in the liability side of Balance Sheet. [1]

OR

The sale on approval basis will be reduced from in the Trading Account and reduced from the

(A) Sales, Capital

(B) Sales, Debtors

(C) Sales, Creditors

(D) Sales, Stock [1]

Answer:

(D) Added to the Accounts Receivables in the asset side of the Balance Sheet and Added to Bank Overdraft in the liability side of Balance Sheet.

OR

(B) Sales, Debtors

Question 26.

How will the closing stock not mentioned in the trial balance be adjusted while making the final accounts?

(A) Debit side of the Trading Account and in the Liability side of the Balance Sheet.

(B) Credit side of the Profit and Loss Account and in the asset side of the Balance Sheet.

(C) Credit side of the Trading Account and in the asset side of the Balance Sheet.

(D) Debit side of the Profit and Loss Account and in the liability side of the Balance Sheet. [1]

Answer:

(C) Credit side of the Trading Account and in the asset side of the Balance Sheet.

Explanation: In the case of closing stock, it is shown in the credit side of the Trading Account as it affects the trade and then shown in the asset side of the balance sheet as stock-in-hand. The opening stock in the trial balance will be only shown in the Trading Account and not in the balance sheet.

Question 27.

Statement I: Incomplete Record means accounting records not maintained according to dual aspect concept of accounting principles.

Statement II: Statement of Affairs is a statement prepared to know profit earned or losses incurred during the year.

(A) Both Statements are correct.

(B) Both Statements are incorrect.

(C) Statement I is correct and Statement II is incorrect.

(D) Statement I is incorrect and Statement II is correct. [1]

OR

Who among the following would keep single entry system of book keeping: [1J

(A) Small Businessman

(B) Public Limited Company

(C) Private Limited Company

(D) None of the these

Answer:

(C) Statement I is correct and Statement II is incorrect.

Explanation: Statement of Profit and Loss is a statement prepared to know profit earned or losses incurred during the year on the basis of Statement of Affairs and other information available.

OR

(A) Small Businessman

Question 28.

Consider the following statements:

(i) To calculate gross profit or gross loss.

(ii) To ascertain gross profit ratio and to compare current year’s gross profit ratio with that of the desired and proposed target in order to assess the efficiency and effectiveness.

(iii) To measure the adequacy and reasonability of indirect expenses incurred by ascertaining ratio between indirect expenses and gross profit.

(iv) To compare current year’s actual performance with desired and planned performance.

Which of the following statement/s are not the purpose of making Profit and Loss Account?

(A) (i), (ii) and (iv)

(B) (i) and (iii)

(C) (i) and (ii)

(D) Only (iv) [1]

Answer:

(D) Only (iv)

Explanation: The purpose of preparing Profit & Loss Account:

(i) To calculate net profit or net loss.

(ii) To as certain net profit ratio and to compare current year’s net profit ratio with that of the desired and proposed target in order to assess the efficiency and effectiveness.

(iii) To measure the adequacy and reasonability of indirect expenses incurred by ascertaining ratio between indirect expenses and net profit.

(iv) To compare current year’s actual performance with desired and planned performance.

(v) To provide various provisions and reserves to meet unforeseen future conditions and to toughen the financial position of the business.

Question 29.

…………….. is a statement prepared to ascertain values of assets and liabilities of a business on a particular date.

(A) Trial Balance

(B) Balance Sheet

(C) Profit and Loss Account

(D) Trading Account [1]

Answer:

(B) Balance Sheet

Explanation: Trial Balance is prepared to check for errors in the accounts before final accounts are prepared. Trading Account is prepared to find out the gross profit earned by the firm. Profit and Loss Account is prepared to ascertain the net profit earned by the firm. Balance Sheet is prepared to ascertain the financial position of the firm.

Question 30.

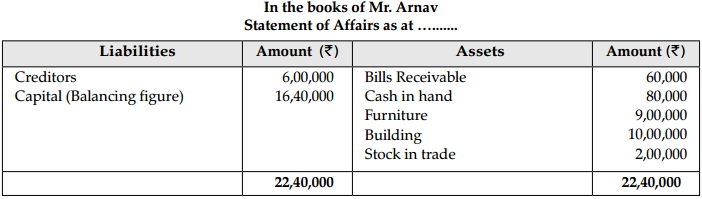

Mr. Arnav does not keep proper records of his business. He provided the following information. You are required to prepare a statement showing the profit or loss for the year. [3]

| Particulars | ₹ |

| Capital at the beginning of the year | 15,0,000 |

| Bills Receivable | 60,000 |

| Cash in hand | 80,000 |

| Furniture | 9,0,000 |

| Building | 10,0,000 |

| Creditors | 6,0,000 |

| Stock in trade | 2,00,000 |

| Further capital introduced | 3,20,000 |

| Drawings made during the period | 80,000 |

Calculate the statement of affairs at the beginning and at the end of the year and calculate the statement of profit or loss.

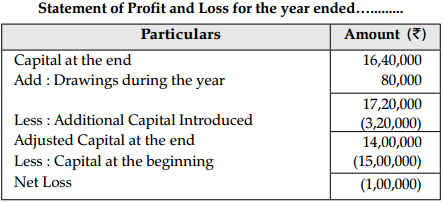

OR

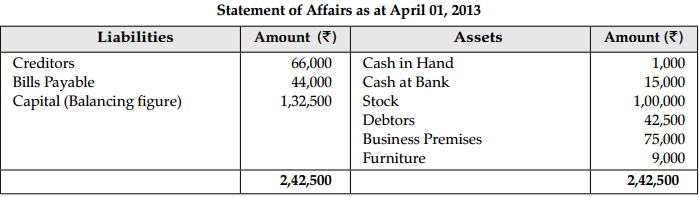

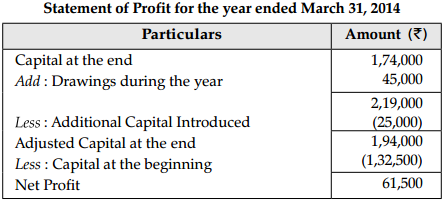

Mr Akashat keeps his books on incomplete records. The following information is given to you:

| Particulars | April 01, 2013 | March 31, 2014 |

| Cash in hand | 1,000 | 1,500 |

| Cash at bank | 15,000 | 10,000 |

| Stock | 1,00,000 | 95,000 |

| Debtors | 42,500 | 70,000 |

| Business Premises | 75,000 | 1,35,000 |

| Fu mi turc | 9,000 | 7,500 |

| Creditors | 66,000 | 87,000 |

| Bills Payable | 44,000 | 58,000 |

During the year he withdrew ₹ 45,000 and introduced ₹ 25,000 as additional capital in the business. Compute the profit or loss of the business. [3]

Answer:

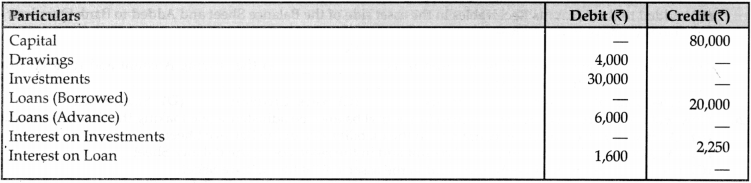

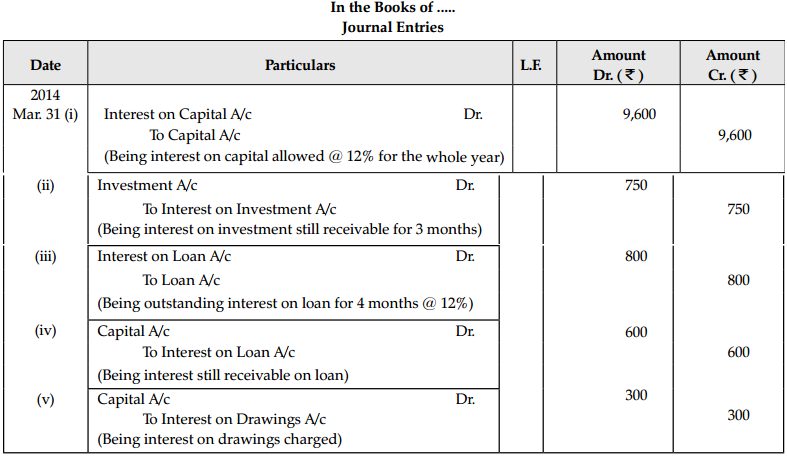

Question 31.

Pass adjusting journal entries from the following information from the Trial Balance as on 31st March, 2014 and the additional information given:

Additional information (Adjustments) :

(i) Interest on capital is to be allowed @ 12%.

(ii) Interest on investment for the last quarter (three months, i.e., quarter to 12 months, a year) is still receivable.

(iii) Interest on loan is still to be paid for 4 months @ 12%.

(iv) Interest on loan still receivable is ₹ 600.

(v) Interest on drawings amounted to ₹ 300. [3]

Answer:

Question 32.

Net sales during the year 2022 are ₹ 14,15,000. Gross profit is 20% on sale. Find out Cost of Good Sold. Also explain how are Net Sales calculated ? [3]

Answer:

Gross Profit = Net Sales – Cost of goods sold

So, Cost of goods sold = Net Sales – Gross Profit on sales

= ₹ 14,15,000 – ₹ 20,100 x ₹ 14.15,000

= ₹ 14,15,000 – ₹ 2,83,000

= ₹ 11.32,000

Net Sales are calculated after deducting the amount of sales return from total sales. Total sales comprise of cash sales as well as credit sales.

Question 33.

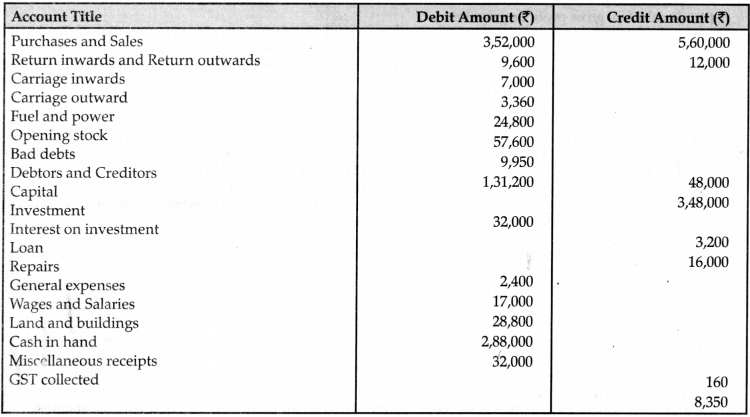

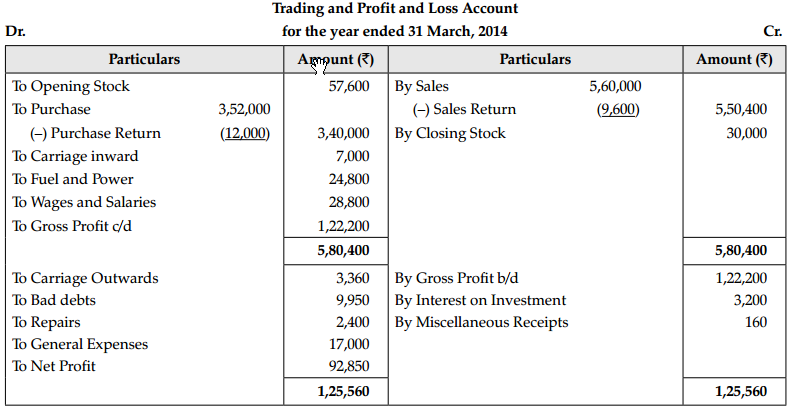

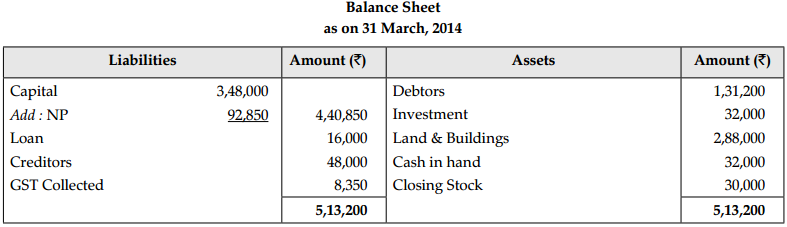

Prepare Trading and Profit and Loss Account and Balance Sheet from the following particulars as on March 31, 2014:

Closing Stock ₹ 30,000

OR

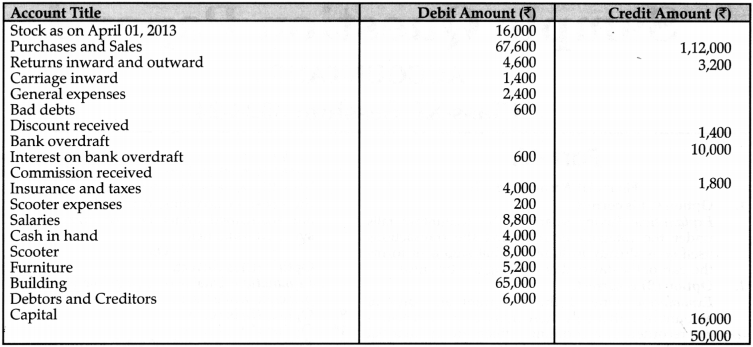

From the following trial balance of Mr. A. Lai, prepare Trading and Profit & Loss Account and Balance Sheet as on March 31, 2014:

Closing stock ₹ 15,000. [4]

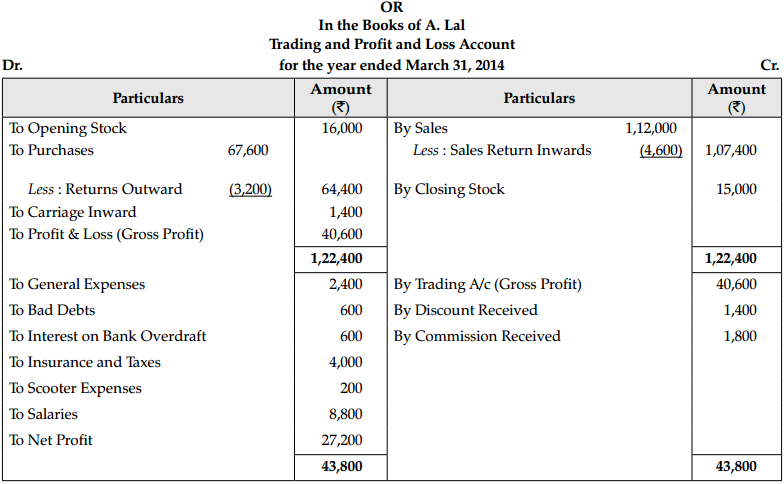

Answer:

Question 34.

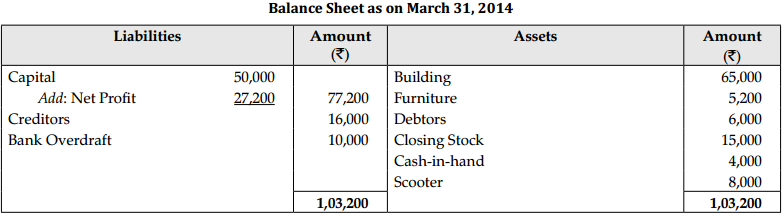

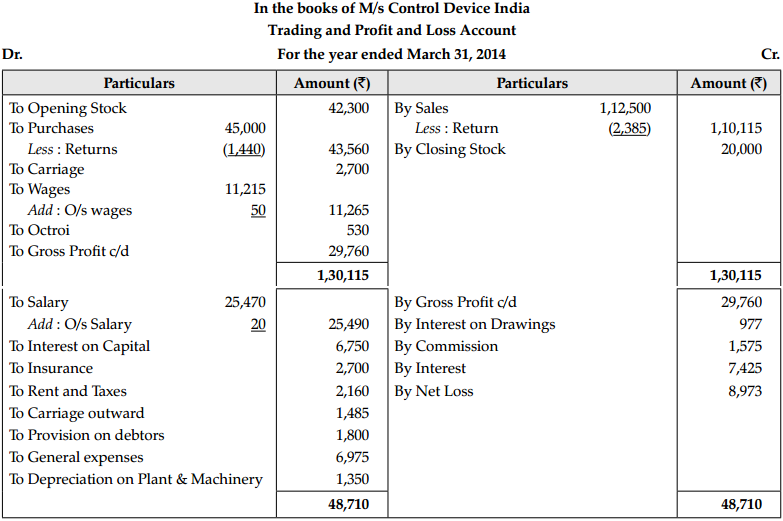

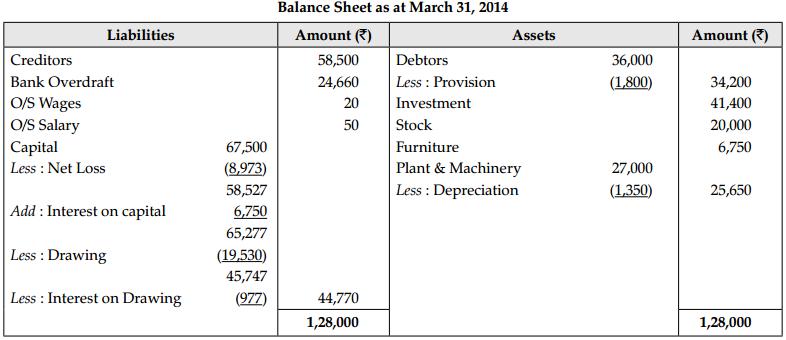

Prepare Trading and Profit and Loss Account and Balance Sheet of M/s Control Device India on March 31, 2014 from the following balances as on that date:

Adjustments:

(i) Closing stock was valued ₹ 20,000.

(ii) Interest on capital @ 10%.

(iii) Interest on drawings @ 5%.

(iv) Wages outstanding ₹ 50.

(v) Outstanding salary ₹ 20.

(vii) Make a 5% provision on debtors.

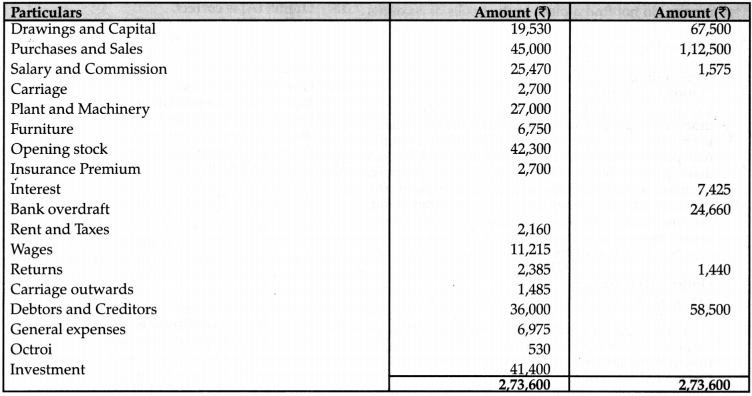

Answer:

Working Notes :

(i) Calculation of Interest on Capital

Interest on Capital = ₹ 67,500 x \(\frac {10}{100}\) = ₹ 6,750

(ii) Calculation of Interest on Drawings

Interest on Drawings = ₹ 19 530 x \(\frac {5}{100}\) = ₹ 977

(iii) Depreciation on Plant and Machinery = ₹ 27,000 x \(\frac {5}{100}\) = ₹ 1,350

(iv) Provision on Debtors = ₹ 36,000 x \(\frac {5}{100}\) = ₹ 1,800