Students can access the CBSE Sample Papers for Class 12 Economics with Solutions and marking scheme Set 7 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Economics Set 7 with Solutions

Time : 3 Hours

Maximum Marks: 80

General Instructions :

- This question paper contains two sections:

Section A – Macro Economics

Section B – Indian Economic Development - This paper contains 20 Multiple Choice Questions of 1 mark each.

- This paper contains Short Answer Questions of 3 marks each to be answered in 60 to 80 words.

- This paper contains 6 Short Answer Questions of 4 marks each to be answered in 80 to 100 words.

- This paper contains 4 Long Answer Questions of 6 marks each to be answered in 100 to 150 words.

Section-A (40 Marks)

Macro Economics

Question 1.

Consider the following statements regarding the investment multiplier in macroeconomics: [1]

Statement 1: The investment multiplier represents the change in equilibrium output resulting from a change in investment expenditure.

Statement 2: The value of the investment multiplier is equal to the reciprocal of the marginal propensity to consume (MPC)

In light of the given statements, select the correct option from the following:

(a) Statement 1 is true and Statement 2 is false.

(b) Statement 1 is false and Statement 2 is true.

(c) Both Statements1 and 2 are true

(d) Both Statements 1 and 2 are false.

Answer:

(a) Statement 1 is true and statement 2 is false

Explanation: Statement 1 is true: The consumption function in macroeconomics assumes that consumption changes at a constant rate as income changes. This means that as income increases, consumption also increases, but not at the same rate. It suggests that individuals tend to save a portion of their additional income rather than spend it all.

Statement 2 is false: Investment multiplier is equal to the reciprocal of marginal propensity to save and not of propensity to consume.

Question 2.

In a closed economy, the following components contribute to the calculation of Gross Domestic Product (GDP): consumption (C), investment (I), government expenditure (G), and net exports (NX). Which of the following options correctly represents the national income identity in this context? [1]

(a) GDP = C + 1 + G + NX

(b) GDP = C -1 + G + NX

(c) GDP = C + 1 – G + NX

(d) GDP = C + 1 + G – NX

Answer:

(a) GDP = C +1 + G + NX

Explanation: In a closed economy, Gross Domestic Product (GDP) represents the total value of all goods and services produced with in the economy. It is calculated by considering various components, including consumption (C), investment (I), government expenditure (G), and net exports (NX). Hence, option a) is the correct choice.

![]()

Question 3.

The investment multiplier represents the relationship between a change in ____________ and the resulting change in ____________ in the economy. [1]

(Choose the correct alternative to fill up the blank)

(a) Government spending; aggregate demand

(b) Investment expenditure; equilibrium output

(c) Consumption; investment multiplier

(d) Taxes; government budget

Answer:

(b) Investment expenditure; equilibrium output

Explanation: When there is an increase in investment expenditure, it leads to a multiplied increase in the equilibrium output or income. The multiplier effect occurs as the initial increase in investment triggers subsequent rounds of spending and income generation throughout the economy.

Question 4.

In the Balance of Payments (BoP) account, India’s services exports for the fiscal year 2022-23 amounted to $322 billion, representing a significant increase of 26.6% as per the RBI report on May, 2023. This transaction will be recorded in the ___________ account on the ___________ side of India’s BoP. (Choose the correct alternative to fill up the blanks). [1]

(a) Current, Credit

(b) Current, Debit

(c) Capital, Credit

(d) Capital, Debit

Answer:

(a) Current, Credit

Explanation: According to the given information, India’s services exports increased by a record 26.6% in the fiscal year 2022-23, reaching a total value of $322 billion. In the Balance of Payments (BoP) framework, services exports are categorized as part of the current account, which records transactions involving goods, services, income, and current transfers. In the BoP account, positive transactions are recorded as credits, and since the services exports increased, it would be recorded as a credit entryin the current account.

Question 5.

“Money plays a crucial role in facilitating transactions and economic activities in an economy. It performs various functions to support the smooth functioning of the monetary system. Based on the given statement, identify the function of money described in the statement: [1]

(a) Medium of exchange

(b) Store of value

(c) Unit of account

(d) Standard of deferred payments

Answer:

(c) Unit of account

Explanation: The function performed by money, as indicated by the given statement, is acting as a unit of account. Money serves as a common measure or unit through which the value of goods and services is expressed. It provides a standardized and widely accepted unit for pricing, comparing, and accounting for the value of different goods and services in the economy.

![]()

Question 6.

Consider the following information regarding round deposits, loans, and reserve ratio: [1]

| Round | Deposits | Loan (75%) | Reserve Ratio (25%) |

| I | 1200 | 900 | 300 |

| II | 900 | …(i)… | 225 |

| ……… | ………. | ……… | ……… |

| ……… | ………. | ………. | ……… |

| Total | …(ii)… | …(iii)… | …(iv)… |

Alternatives:

(a) 675,4800,3600,1200

(b) 1,125, 3,000, 2,100, 900

(c) 675,2,100,900,1,350

(d) 675,3,000,2,100,900

Answer:

(a) 675,4800,3600,1200

Explanation: Based on the given information and calculations, we can determine the missing figures as follows:

(i) In the first row, loans represent 75% of round deposits. So, 75% of 900 is 675. Therefore, the missing figure for loans in the second row (i) is 675.

(ii) The money multiplier in the given case is:

Value of money multiplier = \(\frac{1}{\mathrm{RR}}=\frac{1}{0.25}=4 .\)

Therefore, Total Deposit will be initial Deposit × Money Multiplier = 1200 × 4 = 4800

(iii) Total Loans = Total Deposits × Loan percentage = 4800 × 75% = 3600

(iv) The total reserves can be calculated by multiplying the total round deposits by the reserve ratio.

In this case, it is 4800 x 25% = 1200.

Question 7.

“It examines the relationship between consumer spending, investments, government expenditure, and net exports to understand fluctuations in income and employment.” [1]

The consumption demand depends on two factors- the ____________ and __________.

(a) national income propensity to save

(b) revenue, propensity to spend

(c) national income, propensity to consume

(d) none of the above

Answer:

(c) national income, propensity to consume

Explanation:

The consumption demand depends on the two factors national income and the propensity to consume. Thus, C = a + bY.

Question 8.

Identify the correct factor(s) that may affect the supply of foreign exchange in an economy. [1]

I. Imports of goods and services.

II. Exports of goods and services.

III. Foreign direct investment inflows.

IV. Foreign aid received.

Alternatives:

(a) I and II

(b) II andIII

(c) III and IV

(d) I and IV

Answer:

(a) I and II

Explanation: This option refers to imports of goods and services and exports of goods and services, both of which can affect the supply of foreign exchange. Thus, it is the correct combination. Based on the analysis, the correct answer is a)I and II. Imports of goods and services (factor I) and exports of goods and services (factor II) are the correct reasons that may affect the demand for foreign exchange in an economy.

![]()

Question 9.

Suppose for a given economy, the consumption function is given by C = 100 + 0.8Y and investment expenditure is ₹ 5,000 crore. The equilibrium level of income would be ₹ __________ crore. [1]

(Choose the correct alternative to fill up the blank)

Alternatives:

(a) ₹5,000

(b) ₹10,000

(c) ₹15,000

(d) ₹25,500

Answer:

(d) ₹25,500

Explanation:In the given question, we are provided with the consumption function and investment expenditure. To find the equilibrium level of income, we need to set the total spending (aggregate demand) equal to the total output (national income).

In equilibrium, C + 1 = Y.

The consumption function is given as C = 100 + 0.8Y, where Y represents the national income. And the investment expenditure is given as I = ₹ 5,000 crore.

Substituting the given values, we have:

C +I = Y

(100 + 0.8Y) + 5,000 = Y

100 + 0.8Y + 5,000 =Y

100 + 5,000 = Y- 0.8Y

5,100 = 0.2Y

Y = \(\frac{5,100}{0.2}\)

Y = ₹ 25,500 crore

Based on the calculation, the equilibrium level of income is ₹ 25,500 crore. Therefore, correct option is (d) ₹ 25,500

Question 10.

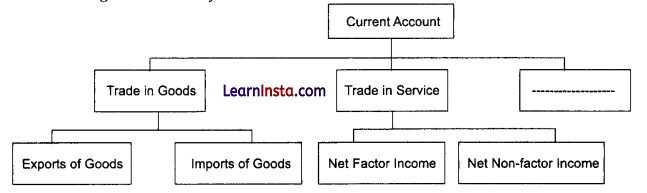

Read the following chart carefully and choose the correct alternative: [1]

Alternatives:

(a) Interest on Loans

(b) Transfer Payments

(c) Investment

(d) Government Aid

Answer:

(b) Transfer Payments

Explanation: Including transfer payments in the current account allows for a comprehensive analysis of a country’s international transactions. It helps to capture the inflows and outflows of funds that occur due to various transfers between residents of different countries. This information is useful for policy makers and economists to understand the overall economic situation, financial flows, and external imbalances of a country.

Question 11.

“Explain the relationship between a trade surplus and the foreign exchange rate.” Do you agree that a trade surplus leads to an appreciation of the domestic currency? Justify your answer with valid reasons. [3]

Answer:

Yes, a trade surplus can lead to an appreciation of the domestic currency. This is because a trade surplus indicates higher demand for the domestic currency to pay for exports, strengthening the balance of payments and attracting foreign investment. Additionally, the excess supply of foreign currency can put downward pressure on its value. However, other factors and policies also influence the foreign exchange rate.

![]()

Question 12.

(A) Calculate Domestic Income from the given details: [3]

| Particulars | Amount (in ₹ crores) | |

| (i) | Subsidies | 3 |

| (ii) | Interest on Public Debt | 2 |

| (iii) | Personal Savings | 16 |

| (iv) | Tax on Profits of Companies | 1 |

| (v) | Personal Taxes | 2 |

| (vi) | Income not distributed to shareholders | 1 |

| (vii) | Indirect Taxes | 17 |

| (viii) | Net Factor Income paid to the rest of the world | 1 |

| (ix) | Current transfers from the government | 3 |

| (x) | Private Consumption Expenditure | 98 |

| (xi) | Net current transfers from rest of the world | 2 |

OR

(B) State the meaning of the following:

(i) Nominal GDP

(ii) Circular Flow of income

(iii) Capital Goods

Answer:

(A) Domestic Income = (x) + (iii) + (v) + (iv) + (vi)- (ii)- (ix)- (xi) + (viii)

= 98 + 16 + 2 +1 +1- 2- 3- 2 +1 = ?112 crores

OR

(B) (i) Nominal GDP: Nominal GDP refers to the total value of all final goods and services produced within an economy during a specific period, usually a year, at current market prices. It represents the monetary value of the economy’s output without adjusting for inflation or changes in price levels.

(ii) Circular Flow of income: The circular flow of income is a simplified representation of the flow of goods, services, and money within an economy. It illustrates the interdependence between households and firms. In this model, households supply factors of production, such as labor and capital, to firms in exchange for income. Firms, in turn, use these factors of production to produce goods and services, which are then sold to households. The circular flow model highlights the continuous flow of income and expenditure between households and firms, showing how they are interconnected in the economy.

(iii) Capital Goods: Capital goods refer to physical assets or durable goods that are used in the production process to produce other goods and services. They are not meant for immediate consumption but are instead used to create additional value or output over an extended period. Examples of capital goods include machinery, equipment, buildings, infrastructure, and technology. Capital goods are essential for businesses to enhance productivity and expand their production capabilities, contributing to economic growth and development.

Question 13.

In a hypothetical economy, the government incurs an investment expenditure of ₹2,000 crore. If the value of the Marginal Propensity to Consume (MPC) increases from 0.75 to 0.85, calculate the change in income due to the change in the value of MPC. [3]

Answer:

To calculate the change in income due to the change in the value of MPC, we need to use the income multiplier formula:

Income Change = \(\Delta I \times\left(\frac{1}{(1-M P C)}\right)\)

Initial MPC = 0.75

Final MPC = 0.85

Investment expenditure (ΔI) = ₹ 2,000 crore

Calculating the change in income:

Income Change (ΔY) =\(\Delta I \times\left(\frac{1}{(1-M P C)}\right)\)

Income Change (ΔY) =\(2,000 \times\left(\frac{1}{(1-0.85)}\right)\)

Income Change (ΔY) =\(2,000 \times\left(\frac{1}{0.15}\right)\)

Income Change (ΔY) = 2,000 × 6.67

Income Change (ΔY) = ₹ 13,340 crore

Therefore, the change in income due to the change in the value of MPC is ₹ 13,340 crore.

![]()

Question 14.

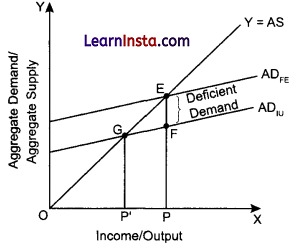

(A) “Deficient demand poses a significant economic challenge, hindering growth and job creation.

Policy makers must adopt measures that stimulate consumer spending, boost investor confidence, and promote sustainable economic recovery.” [3]

Explain the concept of deficient demand. Also explain the role of bank in correcting it.

OR

(B) Discuss the working of the adjustment mechanism in the following situations:

(a) If aggregate demand is greater than aggregate supply.

(b) If Ex-Ante Investment are less than Ex-Ante Savings.

Answer:

(A) A situation in an economy, when the aggregate demand is less than the aggregate corresponding to full employment level, is termed deficient demand.

In the following figure, E is the equilibrium point the economy where AD = AS. But at the curve deficient demand of ADIU, aggregate demand F less than the aggregate supply of EP. Hence, represents the deficient demand in the economy. Deficient demand gives rise to a deflationary gap a leads the economy to an equilibrium level income/output that is less than the full employment level of income. This leads to deflationary pressure on economy and increases the inventory producers. The producers are discouraged to product more as price levels fall. The economy therefore, will attain a new equilibrium at point G with National Income of OP’.

Where,

ADFE = AD at full employment. ADIU = AD an involuntary unemployment. EF = Deficient demand/deflationary gap.

Role of Bank Rate in Correcting the Problem of Deficient Demand: The rate at which the Central Bank lends money to commercial banks is termed as bank rate. In case of deficient demand, the Central Bank reduces the bank rate to increase the money supply in the economy. Reduction in bank rate increases the credit/money creation capacity of commercial banks and also reduces the market rate of interest which encourages people to borrow more. In this way, the Aggregate Demand increases to the level of Aggregate Supply and the economy attains equilibrium.

OR

(B) (a) When AD > AS, then it implies a situation, where the total demand for goods and services is more than the total supply of the goods and services. This implies a situation of excess demand. Due to the excess demand, the producers draw down their inventory and increase production. The increase in production requires hiring of more factors of production, thereby increasing employment level and income. Finally, the income will rise sufficiently to equate the AD with AS, thus the equilibrium is restored back.

(b) When S exceeds I i.e., when withdrawal from the income is greater than injections into the circular flow of income, then it implies that total consumption expenditure is less than what is required to purchase the available supply of goods and services. In other words, we can understand this as high saving implies low consumption, which means that the required output is less than the planned output. Thus, a portion of the supply remains unsold, which leads to unplanned inventory accumulation. In response to this situation, for clearing this unsold stock, the producers plan a cut in the production in the next period. Therefore reduce the employment of labourers. The reduced employment leads to fall in aggregate income in the economy consequently, lesser aggregate saving. The saving will continue to fall, until, it becomes equal to the investment. At a point, where saving and investment are equal, equilibrium is achieved.

![]()

Question 15.

Elaborate the ‘Controller of Money Supply and Credit’ and ‘Custodian of foreign reserve’ function performed by the Reserve Bank of India. [3]

Answer:

The Reserve Bank of India (RBI) performs the function of the ‘Controller of Money Supply and Credit’ by regulating and managing the money supply in the economy. It monitors and controls the flow of money through various tools like reserve ratios, interest rates, and open market operations. By controlling the money supply, the RBI influences inflation, interest rates, and overall economic stability. The RBI also acts as the ‘Custodian of Foreign Reserves’ by managing and safeguarding the country’s foreign exchange reserves. It ensures that there is an adequate level of foreign currency reserves to meet the country’s international payment obligations and maintain stability in the foreign exchange market. The RBI manages the foreign reserves by trading in foreign currencies and maintaining a diversified portfolio of assets.

Question 16. [3]

(A) Calculate

(i) Revenue Deficit and

(ii) Fiscal Deficit from the given data: [2]

| Particulars | Amount (in ₹ crores) |

| Capital receipts net of borrowings | 95 |

| Revenue Expenditure | 100 |

| Interest Payments | 10 |

| Revenue Receipts | 80 |

| Capital Expenditure | 110 |

(B) Define Public Goods [1]

OR

(C) Explain the reallocation of the Resources as an objective of the Government Budget.

(D) Under ‘Pradhan Mantri Awas Yojana’ the government provides subsidies on the interest on loans up to a certain amount on Housing Loans to the poor section of society. Identify and discuss the nature of government expenditure indicated in the given statement.

Answer:

(A) Revenue Deficit: It represents the excess of revenue expenditure over revenue receipts during a fiscal year. Mathematically, Revenue Deficit can be calculated as:

Revenue Deficit = Revenue Expenditure – Revenue Receipts

Fiscal Deficit: It represents the total amount by which the government’s total expenditure exceeds its total revenue during a fiscal year. It includes both revenue and capital expenditure. Mathematically, Fiscal Deficit can be calculated as:

Fiscal Deficit = Total Expenditure – Total Revenue

Now, let’s calculate the values based on the given data:

(i) Revenue Deficit:

Revenue Expenditure = ₹ 100 crores

Revenue Receipts = ₹ 80 crores

Revenue Deficit = Revenue Expenditure – Revenue Receipts

= 100- 80 = ₹ 20 crores

(ii) Fiscal Deficit:

Total Expenditure = Revenue Expenditure + Capital Expenditure

= 100 crores + 110 crores = ₹ 210 crores

Total Revenue = Revenue Receipts + Capital Receipts net of borrowings

= ₹ 80 crores + ₹ 95 crores

= ₹ 175 crores

Fiscal Deficit = Total Expenditure- Total Revenue

= 210- 175 = ₹ 35 crores

(B) Public goods are goods or services that are non-excludable and non-rivalrous in nature. They are provided by the government or public authorities and are available for use by the general public. Non-excludability means that individuals cannot be excluded from consuming or benefiting from the good or service, even if they don’t contribute to its provision. Non-rivalry means that one person’s consumption of the good does not diminish its availability or use for others. Some example of public goods are national defence, public parks, street lighting, and public infrastructure.

(C) The reallocation of resources as an objective of the government budget refers to the government’s aim to efficiently allocate resources in the economy to achieve economic growth and development. Through the budget, the government collects taxes and levies, and then allocates those funds to various sectors and programs based on their priorities. The objective of reallocation of resources is to ensure that resources are directed towards sectors that require investment and development, such as education, healthcare, infrastructure, and social welfare. By allocating funds strategically, the government aims to promote equitable distribution of resources and enhance overall economic productivity and welfare.

(D) The nature of government expenditure indicated in the given statement is a subsidy. Subsidies are a type of government expenditure where financial assistance is provided to individuals or businesses to encourage or support specific activities. In the case of the Pradhan Mantri Awas Yojana, the government is providing subsidies on the interest on housing loans to the poor section of society. This is aimed at making housing more affordable for the economically disadvantaged section of society, enabling them to access loans at lower interest rates. By providing subsidies, the government aims to promote housing affordability, improve living conditions, and support social welfare objectives. Subsidies are a form of transfer payment where the government provides financial support without directly acquiring goods or services in return.

![]()

Question 17.

(A) Giving valid reasons, explain how the following would be treated while estimating domestic income. [3]

(i) Profit earned by a branch of a foreign bank in India.

(ii) Rent received by an Indian resident from Russian Embassy in India.

(B) Is it accurate to say that the GDP of an economy does not account for welfare and equity? Provide valid reasons to support your answer. [3]

Answer:

(A) (i) The profit earned by a branch of a foreign bank in India will be included in the domestic factor income of India. This is because the profit earned by a branch of a foreign bank in India is considered a factor income generated within the domestic territory.

(ii) Rent received by an Indian resident from the Russian Embassy in India will not be included in the domestic factor income of India. This is because the rent received from the Russian Embassy is a transfer payment rather than a factor income.

(B) The given statement “GDP of an economy is an indicator that does not consider welfare and equity” is correct. GDP measures the total value of goods and services produced within an economy, but it does not consider non-monetary factors such as quality of life, environmental sustainability, and income distribution.

GDP focuses on the monetary value of economic activities and does not capture aspects like income inequality or disparities in access to basic necessities. It is possible for a country to have a high GDP while still experiencing significant poverty and inequality.

To evaluate welfare and equity, additional indicators like Human Development Index (HDI), Gini coefficient, and poverty rates should be considered. These indicators provide a more comprehensive assessment of living standards, income distribution, and social inclusiveness.

Section-B (40 Marks)

Indian Economic Development

Question 18.

Identify the correct combination of the ‘Functions of the World Trade Organization (WTO)’: [1]

(a) Monetary Policy, Fiscal Policy, Exchange Rate Management

(b) Dispute Settlement, Trade Negotiations, Monitoring and Surveillance

(c) Income Redistribution, Poverty Reduction, Social Welfare

(d) Market Regulation, Consumer Protection, Anti-Trust Measures

Answer:

(b) Dispute Settlement, Trade Negotiations, Monitoring and Surveillance

Explanation: Dispute Settlement: One of the primary functions of the WTO is to provide a framework for resolving trade disputes among member countries. The WTO has a dispute settlement mechanism that allows countries to bring their trade grievances and seek a resolution through a formal legal process.

Question 19.

Identify which of the following is not a sustainable development indicator? [1]

(a) Carbon Footprint

(b) Human Development Index (HDI)

(c) Gender Inequality Index (GII)

(d) Gross Domestic Product (GDP)

Answer:

(d) Gross Domestic Product (GDP)

Explanation: Sustainable development indicators are used to measure the progress of a country in achieving sustainable development goals. They typically focus on various aspects of social, economic, and environmental well-being. While GDP is an important economic indicator that measures the value of goods and services produced within a country, it does not directly capture the sustainability of development. Sustainable development indicators, on the other hand, take into account factors such as environmental impact, social equity, and human well-being to provide a more comprehensive assessment of sustainability.

![]()

Question 20.

The rapid industrialisation of India after independence was primarily driven by_________: [1]

(Choose the correct alternative to fill up the blank)

I. Import substitution policies

II. Export-oriented policies

III. Liberalisation and globalization reforms

IV. Privatisation of state-owned enterprises

Alternatives:

(a) I, II, III

(b) I, II, IV

(c) II, III, IV

(d) I, III, IV

Answer:

(c) II, III, IV

Explanation: The rapid industrialization of India after independence was mainly influenced by the implementation of export-oriented policies, liberalization and globalization reforms, and privatization of state-owned enterprises.

Question 21.

Study the following picture and answer the given question: [1]

In rural areas, the promotion of self-help groups (SHGs) has been an effective strategy for enhancing the

status and livelihoods of women. Which of the following activities would be considered a diversification

activity for women in SHGs?

(a) Setting up small-scale manufacturing units

(b) Engagingin organic farming practices

(c) Providing micro finance services to the community

(d) Participating in political campaigns and awareness programs

Answer:

(a) Setting up small-scale manufacturing units

Explanation: The diversification activity for women in SHGs refers to engaging in additional income-generating activities apart from their traditional roles. While options (b), (c), and (d) are all important initiatives, setting up small-scale manufacturing units would specifically represent a diversification activity as it involves the establishment of new economic ventures in non-traditional sectors

Question 22.

Read the following statement: Assertion (A) and Reason (R). Choose the correct alternative from those given below: [1]

Assertion (A): Many people migrate to urban area pick up a job for some time, but come back to their villages as soon as the agricultural season begins.

Reason (R): Work in agriculture is seasonal.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

Explanation: People from rural areas migrate to urban areas to pick up a job for some time as they are employed only for a few months or for a particular season of the year and the individual remains unemployed during the remaining months of the year.

![]()

Question 23.

___________ programme was started in China with the aim of industrialisation. [1]

(a) Commune System

(b) Great Leap Forward

(c) One Child policy

(d) Great Proletarian Cultural Revolution

Answer:

(b) Great Leap Forward

Explanation: The Great Leap Forward was an economic and social campaign launched by the Communist Party of China in 1958. Its main goal was to rapidly transform China from an agrarian economy to an industrialized and socialist society. The campaign emphasized the development of rural industry and the collective organization of agricultural production.

Question 24.

Which of the following is a key role played by cooperatives in rural development? [1]

(a) Providing access to credit and financial services

(b) Implementing agricultural diversification programs

(c) Promoting marketing opportunities for rural products

(d) Advocating for sustainable farming practices

Choose the correct option that represents the role of cooperatives in rural development.

Answer:

(a) Providing access to credit and financial services

Explanation: Cooperatives play a crucial role in rural development by providing access to credit and financial services to farmers and rural communities. They enable small-scale farmers and entrepreneurs to access affordable loans, savings, and other financial products, which in turn supports their agricultural activities and overall economic development.

Question 25.

___________ are some examples of social and economic indicators used to measure the development of a country. [1]

(Choose the correct alternative to fill up the blank).

(a) Gross Domestic Product (GDP) and life expectancy

(b) Literacy rate and agricultural productivity

(c) Stock market index and consumer price index

(d) Foreign direct investment and poverty rate

Answer:

(a) Gross Domestic Product (GDP) and life expectancy

Explanation: GDP is a measure of the total value of goods and services produced within a country’s borders during a specific time period. It is often used as an indicator of a country’s economic development and growth. Life expectancy is a measure of the average number of years a person is expected to live. It is used as an indicator of the overall health and well-being of a population.

Question 26.

Read the following statement carefully and choose the correct alternative from the following: [1]

Statement 1: With the aim of economic development, Pakistan adopted the pattern of a mixed economy where both private and public sectors co-exist.

Statement 2: In the late 1970s and early 1980s, Pakistan shifted its policy orientation by denationalising the thrust areas, encouraging the private sector.

(a) Statement 1 is correct, whereas statement 2 is incorrect

(b) Statement 2 is correct, whereas statement1 is incorrect

(c) Both the statements are correct

(d) Both the statements are incorrect

Answer:

(c) Both Statements 1 and 2 are true.

Explanation: With the aim of economic development, Pakistan adopted the pattern of a mixed

economy where both private and public sectors coexist. Pakistan introduced a variety of regulated policy frameworks for import substitution, industrialisation during the 1950s and 1960s. This implies producing goods domestically to substitute imports, discouraging imports, and encouraging and developing domestic industries. The introduction of the Green Revolution mechanised agriculture leading to the increase in the production of food grains. The mechanisation of agriculture was followed by the nationalisation of capital goods industries in the 1970s. In the late 1970s and early 1980s, Pakistan shifted its policy orientation by denationalising the thrust areas, encouraging the private sector.

![]()

Question 27.

From the set of the events given in column I and corresponding facts given in Column II, choose the correct pair of statements: [1]

| Column I | Column II |

| A. Concept of sustainable development | I. Brunt land commission |

| B. Open unemployment | II. Social infrastructure |

| C. Associated with health and housing | III. Number of individuals who are searching of a job work |

| D. Unemployed | IV Willing to work but don’t get jobs |

Choose the correct alternative:

(a) A-I

(b) B-III

(c) C-IV

(d) D-II

Answer:

(a) A-I

Question 28.

“The Prime Minister urged to increase the rural income by increasing non-farm activities.” [3]

Explain how non-farm activities can led to rise in income of people in rural sector.

OR

“Human Capital Formation gives birth to innovation, invention and technological improvements.”

Justify the above statement with valid explanation.

Answer:

Non-farm activities can lead to risein income of people in rural sectorin the following ways.

(i) Animal husbandry: It is that branch of agriculture which is concerned with the breeding, rearing and caring for farm animals. Sheep rearing is an important income augmenting activity in rural areas. Livestock production provides increased stability in income, food security, transport, fuel and nutrition. A significant number of women’s also find employment in the livestock sector.

(ii) Horticulture: It refers to the science or art of cultivation of fruits, vegetables, tuber crops, flowers, medicinal and aromatic plants and plantation crops. India has adopted horticulture as it is blessed with a varying climate and soil conditions. It is an important sector for potential diversification and value addition in agriculture.

(iii) Fisheries: It refers to the occupation devoted to the catching, processing or selling of fish and other aquatic animals. In India, after progressive increase in budgetary allocations and introduction of new technologies in fisheries and aquaculture. In India: West Bengal, Andhra Pradesh, Kerala, Gujarat, Maharashtra and Tamil Nadu are major fish producing states.

OR

I agree with the statement that “Human Capital Formation gives birth to innovation, invention and technological improvements” by :

(i) Expenditure on Education: It is the most effective way of raising a productive workforce in the country. Labour skill of an educated person is more than that of an uneducated person. Individuals invest in education to increase their future income and to raise the standard of living.

(ii) Expenditure on Health: It is also an important expenditure to build and maintain productive labour force and to improve quality of life of people in the society. It makes a man more efficient and therefore more productive. Their contribution to the production process tends to rise and adds more to GDP than a sick person.

(iii) Expenditure on the Job-training:It helps the workers to sharpen their specialised skills.It increases the skill, efficiency and capacity of the workers. It also make workers more creative and innovative which result in increase in production and productivity.

![]()

Question 29.

“Vijay, a young professional, decided to enroll in a specialised vocational training program to enhance his technical skills. This training program provided him with hands-on experience and knowledge in his field of interest.” [3]

Justify the impact of Vijay’s decision on human capital formation

Answer:

Vijay’s enrollment in a vocational training program positively impacts human capital formation. It enhances his technical skills and knowledge, improving employability. Hands-on experience gained boosts productivity and efficiency. The program also fosters personal growth, boosting self-esteem and motivation. Vijay’s decision sets a positive example, encouraging continuous learning. Overall, it enhances Vijay’s skills, knowledge, and employability, contributing to human capital formation.

Question 30.

“China implemented the policy of Dual Pricing, where farmers and industrial units were required to buy and sell fixed quantities of inputs and outputs based on government-fixed prices, while the rest were purchased and sold at market prices.” Justify the given policy with valid arguments in support of your answer. [4]

Answer:

The Dual Pricing policy implemented by China had several justifications. Firstly, it aimed to ensure stability and control over the supply of essential goods by fixing prices for inputs and outputs. This helped prevent excessive inflation and speculative behaviour. Secondly, the policy aimed to support the agricultural sectorby providing fixed prices for agricultural produce, ensuring a fair return for farmers.

Thirdly, the policy promoted industrial development by allowing market prices for non-essential goods, encouraging competition and efficiency. Overall, Dual Pricing helped balance the needs of both the agricultural and industrial sectors, contributing to economic stability and development.

Question 31.

(A) State whether the following statements are true or false and justify your answer: [2]

(i) Skill development programs are solely focused on providing theoretical knowledge.

(ii) “The Pradhan Mantri Fasal Bima Yojana (PMFBY) has been effective in providing crop insurance coverage to farmers and increase crops production” [2]

OR

(B) Discuss the role of government policies in promoting inclusive growth in the Indian economy.

Answer:

(A) (i) False, Skill development programs are designed to provide both theoretical knowledge and practical skills to individuals. These programs aim to enhance the employability of individuals by equipping them with the necessary knowledge and practical abilities required in their respective fields. Practical training, hands-on experience, and industrial exposure are integral components of skill development programs. Therefore, the statement is FALSE.

(ii) True, The Pradhan Mantri Fasal Bima Yojana (PMFBY) is a government scheme aimed at providing crop insurance coverage to farmers in India. It was launched to safeguard farmers’ income and protect them from the risks associated with crop failures due to natural calamities, pests, and diseases. The scheme provides affordable insurance premiums for farmers and ensures timely compensation for crop losses. It has increased the penetration of crop insurance among farmers and has provided them with a safety net against agricultural risks.

OR

(B) Government policies play a crucial role in promoting inclusive growth in the Indian economy. Inclusive growth refers to equitable and sustainable economic development that benefits all sections of society, especially the marginalised and vulnerable groups. The government formulates and implements various policies to address the disparities and ensure that the benefits of economic growth are shared by all.

One of the key areas where government policies focus on promoting inclusive growth is poverty alleviation and social welfare. Programs like the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) provide employment opportunities and social security to rural households. These programs aim to uplift the economically weaker sections of society and reduce income disparities.

![]()

Question 32.

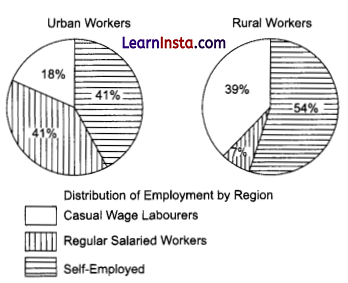

Evaluate the situation depicted in the given image. Suggest the impact of the same on Indian Economy. [4]

Answer:

The difference in employment patterns between rural and urban areas in India has significant implications for the economy. In urban areas, a higher percentage of workers (59%) are hired, indicating formal employment opportunities. In rural areas, a higher percentage of workers (54%) are self-employed, highlighting the prevalence of informal economic activities. This disparity presents challenges in terms of income stability, social protection, and access to formal financial services for selfemployed individuals in rural areas. However, it also reflects the contribution of agriculture to rural livelihoods.

Question 33.

(A) “The agrarian sector played a significant role in the Indian economy before 1990.” [3]

Justify the statement, giving reasonsin support of your answer.

(B) “The Indian government implemented protectionist policies to promote domestic industries.” [3]

Briefly outline and discuss such steps takenby the government to ensure this.

OR

(C) “In India, after 1947, various measures were implemented to promote industrial development.”

In the light of the given statement, discuss any one such measure and its impact on the Indian economy.

(D) “The Navratna Policy of the government helps in improving the performance of the public sector undertakings in India”

Do you agree with the given statement? Give valid reasons in support of your answer

Answer:

(A) The agrarian sector’s significant role in the Indian economy before 1990 can be justified due to several reasons. Firstly, it contributed a substantial share to the country’s Gross Domestic Product (GDP).

Secondly, it was a major source of employment, especially in rural areas, providing livelihoods to a significant portion of the population. Additionally, the sector ensured food security by producing essential crops and reducing dependence on imports. Moreover, it contributed to export earnings, promoted rural development, and maintained socio-economic stability. The government’s support through various policies and initiatives further emphasized the sector’s importance.

(B) The Indian government implemented several protectionist policies to promote domestic industries.

Firstly, it imposed high tariffs and import restrictions on foreign goods to make them expensive and less competitive against domestic products. Secondly, it provided subsidies and financial assistance to domestic industries to lower production costs and encourage growth.

Additionally, the government introduced licensing and permit requirements for imports to regulate and control their entry into the country. These steps aimed to safeguard domestic industries, promote self-sufficiency, and reduce dependence on foreign goods. However, it is important to note that such policies also had limitations, including higher consumer prices and limited access to international markets.

OR

(C) One significant measure implemented in India after 1947 to promote industrial development was the Industrial Policy Resolution of 1956. This policy aimed to establish a mixed economy model and lay the foundation for industrialization in the country.

One of the several key features of industrial Policy Resolution of 1956 is:

Public Sector Development: One of the key aspects of the policy was the promotion of public sector enterprises. The government aimed to establish public sector industries in strategic sectors such as heavy industries, infrastructure, and defence. This led to the establishment of major public sector enterprises like Steel Authority of India (SAIL), Bharat Heavy Electricals Limited (BHEL), and Hindustan Aeronautics Limited (HAL). The development of these industries played a crucial role in building industrial capabilities and infrastructure in the country.

(D) Yes, the given statement is correct. The Navratna Policy of the government aims to enhance the performance and competitiveness of public sector undertakings (PSUs) in India. The policy grants a special status to select PSUs, providing them with increased autonomy and operational flexibility.

It allows these designated PSUs to make strategic decisions regarding investments, joint ventures, mergers, acquisitions, and human resource management. The policy grants select PSUs greater autonomy, enabling them to make strategic decisions, form partnerships, and raise capital.

This fosters competitiveness, innovation, and efficiency within the PSUs, leading to improved financial performance and growth. The Navratna status attracts skilled professionals and encourages technological advancements. However, effective implementation and addressing governance issues remain crucial for sustained performance improvement.

![]()

Question 34.

Read the following text carefully and answer the given questions on the basis of the same and common understanding:

Rise of Electric Vehicles in India: Is it the future of transportation?

India broke into the top three largest car markets in the world in 2022 and continues to grow. With over 40 crore (400 million) people in need of transport solutions, the Government of India (Gol) is pushing for the adoption of electric vehicles (EVs) to reduce fuel consumption and improve the environment. To achieve this, India is part of a handful of countries that support the global EV30@30campaign. This drive aims for at least 30% of vehicle sales to be electric by 2030. As part of this push, the Gol has signed a Memorandum of Understanding (MoU) with Australiain 2022 to source critical minerals. This MoU includes a $5.8M USD investment for a three-year India-Australia Critical Minerals Investment Partnership.

The future of electric vehicles in India:

Critical minerals, such as copper, lithium, nickel, and cobalt, are essential to produce EVs as well as modern technologies including wind turbines, green technologies, smartphones, laptops, and military equipment. Without these critical minerals, massive global supply chain disruptions can occur.

In fact, the global EV30@30 campaign, which India is a part of, aims for 30% of vehicle sales to be electric by 2030. Prime Minister Narendra Modi has also advocated for five elements for climate change in India, known as ‘Panchamrita/ at the 2021 COP26 United Nations Climate Change Conference.

‘Panchamrita’ promises include:

- Increasing non-fossil energy capacity to 500 gigawatts by 2030

- Providing 50% of India’s overall energy needs through renewable energy

- Reducing carbon emissionsby1 Billion tonnes by 2030

- Reducing carbon intensity by 45% by 2030

- Achieving net zero by 2070

Under PM Modi’s leadership, the government has taken several steps to develop and promote the EV ecosystem in India. The Faster Adoption and Manufacturing of Electric Vehicles (FAME II) scheme has been remodelled for consumers, the production-linked incentive (PLI) scheme for Advanced Chemistry Cell (ACC) has been revamped for suppliers, and a PLI scheme for Auto’and Automotive Components valued at 26,000 crore rupees has been launched for manufacturers of electric vehicles. The government’s push for EVs has already yielded positive results.

According to the Minister of. Road Transport and Highways, Nitin Gadkari: “two-wheeler EVs rose by 422%, 3 wheelers by 75%, and 4 wheelers by 230% between 2019 and 2021. The number of electric buses also increased by over 1200% during this period.” To accommodate the growing number of EVs, the Ministry of Power has prescribed at least one charging station to be present every 3 km and at every 25 km on both sides of highways in India. A push for more EVs also means that this will likely evolve into a new, major industry in India which brings about job creation and boosts the GDP. Additionally, levels of per capita income are steadily on the rise and the Indian middle class have more spending money. Therefore, there is more demand for electronics like phones, laptops and power banks; all of which require batteries.

To add, a new sector all-together has opened; the manufacturing of advanced batteries. It is projected by multiple subject-matter experts to be one of India’s largest economic opportunities of the 21st century. All of this sounds great and EVs seem like a no brainer. But then why aren’t we all going for electric cars? Looking at the big picture, there are some major concerns with EVs. For starters, while driving an EV may be more sustainable than a petrol or diesel alternative, more greenhouse gasses are emitted while manufacturing them. Also, as they are only as green as their power sources, some electric models may be less environmentally friendly than petrol counterparts.

For consumers, EVs are also considerably more expensive to buy, and one cannot drive as far in an electric car as compared to a petrol/diesel automobile. For the good or bad, India is establishing itself as a global leader in EV manufacturing. Electric vehicles are expected to accommodate higher renewable energy penetration while strengthening and stabilizing grid operation. Additionally, India is in need of a transportation revolution. Adding more cars running on imported fuel not only clutters already over-congested cities but also increases pollution levels and India’s dependence on foreign oil. Though EVs do come with some things to consider, with an increasing demand for transport solutions, the benefits from adoption of EVs on a large scale can be a practical way forward.

Source: https://timesofindia.indiatimes.com/auto/news/rise-of-electric-vehicles-in-india-is-it-the-future oftransportation/articleshow/97142406.cms?from=mdr

On the basis of the given text and common understanding, answer the following questions:

(i) Define sustainable development. [2]

(ii) Briefly elaborate, any two reasons behind the objective of Green Growth being setup by the Indian Government. [4]

Answer:

(i) Sustainable development refers to a balanced approach to economic growth that considers the social, environmental, and economic aspects of development. It aims to meet the needs of the present generation without compromising the ability of future generations to meet their own needs. Sustainable development involves integrating environmental protection, social equity, and economic development to ensure long-term well-being and prosperity.

(ii) The objective of Green Growth set up by the Indian Government has two key reasons:

Environmental Preservation: The Indian Government aims to promote green growth to address environmental challenges and preserve natural resources. By transitioning to cleaner and more sustainable practices, such as promoting renewable energy, reducing emissions, and adopting eco-friendly technologies, the government seeks to mitigate the negative impacts of economic development on the environment. This includes reducing pollution levels, conserving biodiversity, and minimizing resource depletion.

Economic Opportunities: Green growth initiatives also present significant economic opportunities for India. By investing in renewable energy, energy-efficient technologies, and sustainable infrastructure, the government aims to create new industries, generate employment, and drive economic growth. The manufacturing and deployment of electric vehicles, for example, can lead to job creation and boost the GDP. Additionally, the development of the advanced battery manufacturing sector is seen as a major economic opportunity for India in the 21st century. By pursuing green growth, the Indian Government aims to achieve a balance between economic development and environmental sustainability, ensuring a more sustainable and prosperous future for the country.