Students can access the CBSE Sample Papers for Class 12 Economics with Solutions and marking scheme Set 6 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Economics Set 6 with Solutions

Time : 3 Hours

Maximum Marks: 80

General Instructions :

- This question paper contains two sections:

Section A – Macro Economics

Section B – Indian Economic Development - This paper contains 20 Multiple Choice Questions of 1 mark each.

- This paper contains Short Answer Questions of 3 marks each to be answered in 60 to 80 words.

- This paper contains 6 Short Answer Questions of 4 marks each to be answered in 80 to 100 words.

- This paper contains 4 Long Answer Questions of 6 marks each to be answered in 100 to 150 words.

Section-A (40 Marks)

Macro Economics

Question 1.

Read the following statements carefully: [1]

Statement 1: The multiplier effect refers to the phenomenon where an initial change in spending leads to a larger change in national income.

Statement 2: The value of the multiplier depends on the marginal propensity to save (MPS).

Choose the correct alternative from the following:

(a) Statement 1 is true and statement 2 is false.

(b) Statement 2 is true and statement 1 is false.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

Answer:

(c) Both statements 1 and 2 are true.

Explanation: Statement 1 is true because the multiplier effect occurs when an initial change in spending leads to a larger change in national income. Statement 2 is also true because the value of the multiplier depends upon the marginal propensity to save (MPS), which determines how much of an increase in income is saved rather than spent.

Question 2.

If factor cost is greater than market price, it means that: [1]

(a) Indirect taxes < subsidies

(b) Indirect taxes > subsidies

(c) Indirect taxes = subsidies

(d) None of these

Answer:

(a) Indirect taxes < subsidies

Explanation: If factor cost is greater than market price, then it means Indirect taxes < Subsidies. Market price can be less than factor cost when subsidies will be more than the indirect tax. Hence, market price- indirect tax + subsidies = Factor cost

Question 3.

Read the following hypothetical text and answer the given questions: [1]

Exchange rate between Indian Rupee and US Dollar has changed from 71.49 (November, 2020) to 72.82 (January 2021) through changes to market forces of demand and supply. Therefore, it is believed that India’s balance of payments this year is going to be “very strong” Commerce and Industry Minister Piyush Goyal said on Monday.

Change from 1$ = 71.49 INR to 72.82 is called as __________ of Indian Currency.

(a) Appreciation

(b) Depreciation

(c) Revaluation

(d) Devaluation

Answer:

(b) Depreciation

Explanation: The change from 1$ = 71.49 INR to 72.82 is called depreciation. Depreciation refers to a decrease in the value of a currency relative to another currency. In this case, the Indian Rupee has depreciated against the US Dollar, meaning it now takes more Rupees to buy one US Dollar.

![]()

Question 4.

In an economy, the Marginal Propensity to Consume (MPC) is 0.8. If the government increases its spending by 200, what will be the change in equilibrium national income? [1]

(a) 1,000

(b) 1,200

(c) 1,400

(d) 1,600

Answer:

(a) 1,000

Explanation: To calculate the change in equilibrium national income, we can use the formula:

ΔY = \(\left(\frac{\Delta \mathrm{G}}{(1-\mathrm{MPC})}\right)\), where ΔY constitute the change in national income and AG represents the change in government spending.

Given that the marginal propensity to consume (MPC) is 0.8 and the government increases its spending by 200, we can substitute these values into the formula:

ΔY = \(\left(\frac{\Delta \mathrm{G}}{(1-\mathrm{MPC})}\right)\)

ΔY = \(\left(\frac{200}{(1-0.8)}\right)\)

ΔY = \(\left(\frac{200}{0.2}\right)\)

ΔY = 1,000

Therefore, the change in equilibrium national income will be 1,000.

Question 5.

In the balance of payments, an outflow of capital represents- [1]

(a) The country’s current account surplus.

(b) The country’s current account deficit.

(c) Foreign direct investment coming into the country.

(d) Domestic investment going abroad.

Answer:

(d) Domestic investment going abroad.

Explanation: In the balance of payments, an outflow of capital refers to domestic investment going abroad. It represents the movement of funds from the home country to foreign countries for the motive of making investments. This can include activities such as foreign portfolio investments, foreign direct investments by domestic firms in other countries, or even individuals investing in foreign assets. It is important to note that an outflow of capital is different from the current account surplus or deficit, which refers to the net balance of trade in goods and services, income from abroad, and unilateral transfers.

Question 6.

___________ is the narrower among the all measures of money supply. [1]

(a) M1

(b) M2

(c) M3

(d) M4

Answer:

(a) M1

Explanation: The narrow supply of money includes only the most liquid assets which can be easily converted in to cash. Ml concept deals with the most liquid money.

Question 7.

In order to encourage investment in the economy, the Central Bank may__________. [1]

(a) Reduce Cash Reserve Ratio

(b) Increase Cash Reserve Ratio

(c) Sell Government securities in open market

(d) Increase Bank Rate

Answer:

(a) Reduce Cash Reserve Ratio

Explanation: When there is a need to pump funds into the market, the RBI lowers the CRR rate, which in turn, helps the banks provide loans to a large number of business and industries for investment purposes.

![]()

Question 8.

____________ represents the value of output measured using constant prices and adjusted for inflation? [1]

(a) Real GDP

(b) Nominal GDP

(c) Gross National Product (GNP)

(d)) Net National Product (NNP)

Answer:

(a) Real GDP

Explanation: Real GDP represents the value of output adjusted for inflation and measured using constant prices. It helps eliminate the impact of price changes over time, allowingfor a more accurate comparison of economic performance between different periods.

Question 9.

Identify the correct reason(s) that may affect the supply of foreign exchange in an economy. [1]

I. Export of goods and services.

II. Inflows of foreign direct investment (FDI).

III. Outflows of remittances to residents working abroad.

IV. Purchase of domestic assets by foreign investors.

Alternatives:

(a) I and II

(b) II and III

(c) III and IV

(d) I and IV

Answer:

(a) I and II

Explanation:

I. Export of goods and services: When a country exports goods and services, it receives payment in foreign currency. This increases the supply of foreign exchange in the economy.

II. Inflows of foreign direct investment (FDI): Foreign direct investment involves foreign investors investing in domestic companies or establishing new businesses in the country. This brings in foreign currency, increasing the supply of foreign exchange.

Therefore, reasons I and II correctly recognise factors that can affect the supply of foreign exchange in an economy.

Question 10.

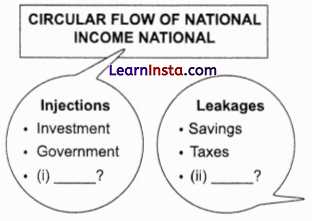

Read the following diagram carefully and choose the correct alternative: [1]

__________ is an injection into and ______________ is a leakage from the circular flow of income.

Alternatives:

(a) Exports, Imports

(b) Imports, Imports

(c) Exports, Exports

(d) Imports, Exports

Answer:

(a) Exports, Imports

Explanation: Exports represent an injection into the circular flow of income. When a country sells goods and services to other countries, it receives payments from abroad, which increases its income and adds to the circular flow. On the other hand, imports represent a leakage from the circular flow of income. When a country purchases goods and services from other countries, payments are made to foreign entities, reducing the country’s income and generate a leakage from the circular flow.

![]()

Question 11.

“A decrease in foreign direct investment (FDI) has a significant impact on a country’s current account balance.”

Do you agree with the given statement? Give valid reason(s) in support of your answer. [3]

Answer:

Yes, I agree with the given statement that a decrease in foreign direct investment (FDI) has a significant impact on a country’s current account balance. Several valid reasons support this statement:

(i) Trade Balance: FDI plays a crucial role in promoting exports and enhancing a country’s competitiveness. A decrease in FDI can result in reduced capital inflows, which may lead to a decline in domestic production and exports. This imbalance between exports and imports can contribute to a deterioration of the country’s trade balance and, consequently, its current account balance.

(ii) Capital Inflows: FDI represents a considerable source of capital inflows into-a country. A decrease in FDI means there is less foreign investment entering the country, potentially reducing the availability of funds for investment, infrastructure development, and other productive activities. This can negatively impact the country’s economic growth and export capacity, further increasing the current account balance.

(iii) Foreign Currency Reserves: FDI inflows contribute to a country’s foreign currency reserves, which are crucial for meeting import payments and servicing external debts. A decrease in FDI can limit the availability of foreign currency reserves, making it more challenging to finance imports and honor external obligations. This can strain the current account balance, particularly if imports continue to outpace exports.

In summary, a decrease in FDI can have a significant impact on a country’s current account balance by affecting the trade balance, capital inflows, and foreign currency reserves. These factors contribute to the overall balance of payments and highlight the importance of FDI in maintaining a favourable current account balance.

Question 12.

(A) On the basis of the given data, calculate the Net National Product at Factor Cost and Personal Income: [3]

| Component | Amount (in ₹ crores) |

| Net Domestic Product at Factor Cost | 600 |

| Depreciation | 100 |

| Net Factor Income from Abroad | 50 |

| Net Indirect Taxes | 120 |

| Net National Disposable Income at Factor Cost | 550 |

| Net Current Transfers from Rest of the World | 30 |

| Personal Savings | 100 |

| Direct Personal Taxes | 50 |

OR

(B) Write down the identities of calculating the GDP of a country by three methods.

(i) Product method or value added method

(ii) Income method

(iii) Expenditure method

Answer:

(A) To calculate the Net National Product at Factor Cost, we add net factor income from abroad to Net Domestic Product at Factor Cost:

Net National Product at Factor Cost = Net Domestic Product at Factor Cost + Net Factor Income from abroad

= 600 + 50 = 650 crores

To calculate Personal Income, we use the formula:

Personal Income = Net National Disposable Income at Factor Cost + Net Current Transfers from Rest of the World + Personal Saving- Direct Personal Taxes

Plugging in the given values:

Personal Income = 550 + 30 + 100- 50 = 630 crores

Therefore, the Net National Product at Factor Cost is 650 crores, and the Personal Income is 630 crores.

OR

(B) (i) Product method or value added method: It is that method which measures National Income in terms of value addition by each producing enterprise in the economy.

It is calculated as: Gross Value Added in the Primary Sector at Market Price + Gross Value Added in the Secondary Sector at Market Price + Gross Value Added in the Tertiary Sector at Market Price = GDPMP

GDPMP – Depreciation = Net Domestic Product at Market Price (NDPMp)

NDPMP – Net Indirect Tax = Net Domestic Product at Factor Cost (NDPFc)

NDPFC + NFIA = National Income (NNPFC)

(ii) Income method: Under this method, National Income is measured in terms of factor payments

to the owners of factors of production. It is calculated as:

Compensation of Employees + Operating Surplus + Mixed Income of the Self-employed = Net Domestic Income at Factor Cost + NFIA = National Income.

(iii) Expenditure method: Under this method, National Income is measured in terms of expenditure on the purchase of final goods and services produced in the economy. It is calculated as:

Private Final Consumption Expenditure + Government Final Consumption Expenditure + Gross Domestic Fixed Capital Formation + Change in Stock + Net Exports = GNPMP

NDPFC = GDPMP + NFIA- Depreciation- Net Indirect Taxes.

![]()

Question 13.

Assume that an economy plans to increase its income by ₹3,700 crores and the Marginal Propensity to save (MPS) is 28%. Estimate the increase in investment required to achieve the targeted increase in income. [4]

Answer:

To estimate the increase in investment required to achieve the targeted increase in income, we need to use the concept of the marginal propensity to save (MPS). The MPS represents the portion of additional income that individuals choose to save rather than spend.

Given :

Targeted increase in income = ₹3,700 crores

Marginal Propensity to save (MPS) = 28% or 0.28

The formula to calculate the change in investment is:

\(\text { Change in Investment }=\frac{\text { Targeted increase in income }}{(1-\text { MPS })}\)

Let’s calculate the change in investment:

\(\text { Change in Investment }=\frac{3,700}{(1-0.28)}\)

\(\text { Change in Investment }=\frac{3,700}{0.72}\)

Change in Investment = ₹5,138.89 Cr. (rounded to the nearest crore)

Therefore, to achieve the targeted increase in income of ₹3,700 crore, an increase in investment of approximately ₹5,138.89 crore (rounded to the nearest crore) would be required, taking into account the marginal propensity to save of 28%.

Question 14.

(A) ‘In an economy, money multiplier affects the expansion of the money supply’. Elaborate. [4]

OR

(B) “In the Indian economy, the Reserve Bank of India (RBI) contribute to the maintenance of financial stability and the promotion of effective monetary policy.” Discuss the measures taken by RBI.

Answer:

(A) The money multiplier is a concept that explains the potential impact of changes in bank reserves on the overall money supply in an economy. It refers to the ratio by which the initial change in bank reserves can multiply the total money supply.

The money multiplier is based on the proportioned reserve banking system. When banks receive deposits, they are required to keep a fraction of those deposits as reserves. The remaining portion is available for lending, which can be used to create new deposits in other banks, leading to further credit creation and the expansion of the money supply.

The formula to calculate the money multiplier is:

\(\text { Money Multiplier }=\frac{1}{\text { Reserve Ratio }}\)

For example, if the reserve ratio is 0.1 (10%), the money multiplier would be \(\frac{1}{0.1}\) 10. This means that for every initial increase in bank reserves, the total money supply can potentially expand by a factor of 10.

However, it’s important to note that the actual impact of the money multiplier may be limited by factors such as the willingness of banks to lend, the demand for credit, and the behavior of depositors. Additionally, regulatory requirements and central bank policies can influence the reserve ratio and affect the money multiplier’s magnitude.

Overall, the money multiplier exhibits how changes in bank reserves can have a multiplied effect on the money supply, reflecting the inter-connectedness and potential expansion of the banking system’s credit creation process.

OR

(B) Reserve Bank of India is the Central Bank of India and is responsible for overseeing the country’s monetary policy, maintaining financial stability, and regulating the banking and financial system.

(i) Financial Stability:

Regulatory Authority: The RBI serves as the primary regulatory authority for banks, financial institutions, and Non-Banking Financial Companies (NBFCs) in India. It formulates and enforces regulations to ensure the stability and soundness of the financial system. Supervision and Monitoring: The RBI conducts regular inspections and assessments of banks and financial institutions to identify risks and prevent possible failures. It also monitors systemic risks and takes necessary actions to maintain stability.

(ii) Monetary Policy:

Formulation and Implementation: The RBI is responsible for formulating and implementing monetary policies in India. It controls key policy rates, such as the repo rate, to influence borrowing costs and control inflation.

Open Market Operations: The RBI conducts open market operations by buying or selling government securities to manage liquidity in the banking system and regulate interest rates.

Reserve Requirements: The RBI sets reserve requirements, such as the cash reserve ratio (CRR) and statutory liquidity ratio (SLR), to control the amount of funds, banks must keep as reserves, impacting the availability of credit.

(iii) Currency Management:

Currency Issuance: The RBI has the authority to issue and manage the currency in circulation, ensuring an adequate supply of currency notes and coins in the economy.

Exchange Rate Management: The RBI directs and manages the exchange rate of the Indian rupee against other currencies to maintain stability in foreign exchange markets.

(iv) Developmental Functions:

Development of Financial Markets: The RBI promotes the development of efficient and robust financial markets, including money markets, government securities markets, and foreign exchange markets.

Financial Inclusion: The RBI initiates measures to enhance financial inclusion, ensuring access to banking services for underserved and marginalised populations.

Overall, the RBI plays a vital role in maintaining financial stability in formulating and implementing monetary policies, managing the. currency, and encouraging the development of the financial system in India.

![]()

Question 15.

Given the following data, find the missing value of Government Final Consumption Expenditure and Mixed Income of Self-Employed. [4]

| S. No. | Amount (in ₹ crores) | Amount (in ₹ crores) |

| (i) | National Income | 71,000 |

| (ii) | Gross Domestic Capital Formation | 10,000 |

| (iii) | Government Final Consumption Expenditure | ? |

| (iv) | Mixed Income of Self-Employed | ? |

| (v) | Net Factor Income from Abroad | 1,000 |

| (vi) | Net Indirect Taxes | 2,000 |

| (vii) | Profits | 1,200 |

| (viii) | Wages and Salaries | 15,000 |

| (ix) | Net Exports | 5,000 |

| (x) | Private Final Consumption Expenditure | 40,000 |

| (xi) | Consumption of Fixed Capital | 3,000 |

| (xii) | Operating Surplus | 30,000 |

Answer:

Mixed-Income of Self-employed

= (i)- [(viii) + (xii) + (v)]

= 71,000- [15,000 + 30,000 + 1,000]

= 71,000- 46,000

= ₹25,000 crores

Government final consumption expenditure

= (i)- [M + (ii) + (v) + (ix)] + (vi) + (xi)

= 71,000- (40,000 + 10,000 + 1,000 + 5,000) + 2,000 + 3,000

= 71,000- 5,000 + 5,000

= ₹ 20,000 crores.

Question 16.

(A) The following data pertains to a country’s government budget: [3]

(i) Budget deficit

(ii) Primary deficit [2]

| Component | Amount (in ₹ crores) |

| Government Revenue | 800 |

| Government Expenditure | 900 |

| Transfer Payments | 100 |

| Indirect Taxes | 200 |

| Direct Taxes | 300 |

| Capital Expenditure | 150 |

| Subsidies | 50 |

(B) Elaborate the objective of ‘allocation of resources’ in the Government Budget. [1]

OR

(C) How does a balanced budget differ from a deficit budget and a surplus budget? Provide a brief explanation. [3]

(D) ‘Under the Budget of 2023-24, total receipts other than borrowings is estimated at ₹27.2 lakh crore and the total expenditure is estimated at ₹45 lakh crore’. [3]

Define revenue receipts in a Government Budget. Explain how Government Budget can be used to bring in price stability in the economy.

Answer:

(A) The budget deficit is calculated as Government Expenditure minus Government Revenue:

Budget Deficit = Government Expenditure- Government Revenue = 900- 800 = 100 crores

The primary deficit is calculated as Budget Deficit minus Interest Payments:

Primary Deficit = Budget Deficit- Interest Payments

To calculate Interest Payments, we subtract Transfer Payments, Indirect Taxes, and Direct Taxes from Government Revenue:

Interest Payments = Government Revenue- (Transfer Payments + Indirect Taxes + Direct Taxes)

= 800- (100 + 200 + 300)

= 200 crores

Plugging in the values, we get:

Primary Deficit = 100 – 200 =- 100 crores

Therefore, the budget deficit is 100 crores, and the primary deficit is -100 crores.

(B) The government of a country, through its budgetary policy, directs the allocation of resources in a manner such that there is a balance between the goals of profit maximisation and social welfare by ensuring that there should be production of necessity goods as well as comfort and luxury goods and the goods which cannot be provided through market mechanism like, roads, parks, street lights etc., provided by government. Government provides more resources into socially productive sectors where private sector is not involved. Moreover, the Government allocates more funds for the production of socially useful goods and draws away resources from some other sectors to promote balanced economic growth of different regions.

OR

(C) A balanced budget, a deficit budget, and a surplus budget differ in terms of the financial position of the government and the relationship between government expenditures and revenues. A balanced budget occurs when government expenditures match government revenues. In other words, the total amount of money spent by the government is equal to the total amount of money collected through taxes, fees, and other sources of revenue. With a balanced budget, there is neither a deficit nor a surplus, showing that the government’s income covers its expenses.

A deficit budget, on the other hand, occurs when government expenditures exceed government revenues. This means that the government is spending more money than it is collecting in revenue. To cover the deficit, the government may need to borrow money or use its reserves. A deficit budget indicates that the government is working at a shortfall and is relying on borrowing to finance its expenses.

A surplus budget, oppositely, occurs when government revenues exceed government expenditures. In this case, the government is collecting more money than it is spending. A surplus budget signifies that the government has extra funds available after meeting its expenses, which can be used to reduce debt, invest in infrastructure, create reserves, or fund other priorities. In summary, a balanced budget indicates that government expenditures equal government revenues, a deficit budget means expenditures exceed revenues, and a surplus budget implies revenues exceed expenditures. The budgetary position of the government and the relationship between income and expenses determine the type of budget the government is operating with.

(D) Receipts which do not create a liability for the government or do not lead to reduction in assets, are known as revenue receipts. Revenue receipts are receipts of the government which are not redeemable, i.e. they cannot be re-claimed from the government. These are divided into tax and non-tax revenue:

(i) Tax revenue: It consists of the proceeds of taxes and other duties levied by the Central and the State Governments, Tax revenues comprise of direct taxes and indirect taxes.

(ii) Non-tax revenue: Non-tax revenue of the government mainly consists of interest receipts on account of loans by the government, dividend and profits on investments made by the government, fees and other receipts for services rendered by the government, Grants-in-aid from foreign countries and international organisation are also a part of non-tax revenue.

The Government Budget is a statement of estimated receipts and expenditures of the government during the financial year. One of the objective of the Government Budget is to achieve economic stability.

Government tries to establish economic stability by its budgetary policies related income and expenditure. Economic stability refers to a situation without fluctuations in price levels and stability of exchange rate in an economy. Economic stability is achieved by protecting, the economy from harmful effects of various trade cycles and its phases, i.e., boom, recession, depression and recovery.

![]()

Question 17.

(A) In the context of investment in an economy, how does induced investment differ from autonomous investment? [3]

(B) “When price of a foreign currency falls, the supply of that foreign currency also falls.” Do you agree with the given statement? Give valid reason for your answer. [3]

Answer:

(A) Induced investment and autonomous investment are two distinct concepts in the context of investment in an economy.

Induced investment refers to the investment that changes in response to changes in the overall level of economic activity, particularly changes in aggregate demand. It is influenced by factors such as consumer demand, business expectations, and interest rates. When aggregate demand increases, businesses tend to invest more to expand their production capacity and meet the growing demand.

Similarly, a decrease in interest rates can stimulate investment as businesses find it more cheap to borrow and undertake new projects.

On the other hand, autonomous investment is not directly influenced by changes in economic activity. It represents investment that occurs independently of short-term fluctuations in demand. Factors driving autonomous investment include technological advancements, research and development, long-term business strategies, and government initiatives aimed at promoting innovation.

Understanding the distinction between induced and autonomous investment helps in analysing the dynamics of investment decisions and their relationship with economic conditions. It also assists policy makers in formulating strategies to promote sustainable investment and economic growth.

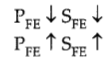

(B) It is true that when price of a foreign currency falls, the supply of that foreign currency also falls. This is because of the direct relation between the two, i.e.

Suppose that the price of a foreign currency say dollar in India falls from₹ 60 to ₹ 50. This means that Indian goods will now become expensive for America. So, it will buy less of Indian goods. As a result, the supply of foreign currency i.e., US $ will fall.

Graphically, the supply curve of foreign exchange is normally upward sloping.

Explaining this with the help of the given supply curve of foreign currency.

At the given price of foreign currency OP, supply of foreign currency ($) is OQ. But when the price of foreign currency falls to OP(0)/ the supply of foreign currency also falls from OQ to OQ0.

Section-B (40 Marks)

Indian Economic Development

Question 18.

Which of the following is not a common goal of the Five Year Plans in India? [1]

(a) Poverty alleviation

(b) Infrastructure development

(c) Human resource development

(d) Privatisation of public sector enterprises

Answer:

(d) Privatisation of public sector enterprises

Explanation: The goal of privatisation of public sector enterprises is not typically considered as one of the common goals of the Five Year Plans in India. The Five Year Plans primarily focus on promoting economic growth, reducing poverty, improving infrastructure, and developing human resources. Privatisation of public sector enterprises involves the transfer of ownership and control of state-owned enterprises to the private sector. While privatization has been followed in India as a policy objective in recent years, it is not traditionally considered as a common goal of the Five Year Plans.

Question 19.

A campaign was started in China in 1958 where people were encouraged to set up industries in their backyard. Identify this campaign. [1]

(a) Great Leap Forward

(b) Great Proletarian Cultural Revolution

(c) Anti-Rightist Movement

(d) Four Pests Damping

Answer:

(a) Great Leap Forward

Explanation: The Great Leap Forward (GLF) was a campaign initiated in 1958 in China by Mao’s, which was aimed to modernise the China’s economy. The campaign was directed towards the large scale industrialisation in the country not concentrated only in the urban areas.

![]()

Question 20.

___________ were major policy initiatives in the early years of independent India? (Choose the correct alternative to fill up the blank) [1]

(I) Land reforms to address agrarian issues

(II) Nationalisation of key industries and banks

(III) Introduction of economic planning through Five Year Plans

(IV) Two out of three of the above

Alternatives:

(a) I, II, III

(b) I and III

(c) II and IV

(d) I, III, IV

Answer:

(d) I, III, IV

Explanation: In the early years of independent India, major policy initiatives were undertaken to address various economic challenges. Land reforms were implemented to tackle issues related to agrarian structure, land distribution, and peasant rights. Additionally, economic planning was introduced through Five Year Plans to advise and promote socio-economic development. However, the nationalisation of key industries and banks was a later policy initiative and not a significant measure in the early years after independence.

Question 21.

Study the following picture and answer the given question: [1]

Successful examples of rural entrepreneurship by Indian women include ______________.

(a) Handloom weaving and textile production

(b) Organic farming and agro-processing

(c) Government employment schemes and subsidies

(d) None of the above

Answer:

(b) Organic farming and agro-processing

Explanation: Many women in rural areas have accepted organic farming practices, growing crops without the use of chemical fertilizers and pesticides. They have then advanced into agro-processing by adding value to their produce, such as making jams, pickles, or packaged food products. These initiatives not only promote sustainable farming practices but also create employment opportunities and enhance rural incomes.

Question 22.

Read the following statement: Assertion (A) and Reason (R). Choose the correct alternative from those given below: [1]

Assertion (A): China adopted the measure of the one-child norm.

Reason (R): The critical implication of the one-child norm in China is the low population growth.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

Explanation: The critical consequence of the one-child norm in China is the low population growth. This measure also led to the fall in the sex ratio in China, i.e., the proportion of females per thousand males. However, the country believes that more older adults will be in proportion to young people in the coming decades. This will indulge the country to provide social security measures with fewer workers.

Question 23.

_________ is the main reason for the food grain production in Pakistan? [1]

Choose the correct alternative:

(a) The five-year plan was the main reason for the rise in food grain production in Pakistan

(b) The green revolution was the main reason for the rise in food grain production in Pakistan

(c) The mixed economy was the main reason for the rise in food grain production in Pakistan

(d) The government policy was the main reason for the rise in food grain production in Pakistan

Answer:

(b) The green revolution was the main reason for the rise in food grain production in Pakistan

Explanation: The green revolution, implemented in the 1960s and 1970s, aimed to boost agricultural productivity and ensure food security. The introduction of high-yielding varieties of crops, such as wheat and rice, doubled with the adoption of modem agricultural techniques, resulted in a substantial increase in agricultural output and productivity in Pakistan.

Question 24.

Read the following statements carefully: [1]

Statement 1: India’s economy primarily relies on manufacturing, while China’s economy has a strong focus on the service sector.

Statement 2: India’s population is larger than China.

Alternatives:

(a) Statement 1 is true and Statement 2 is false.

(b) Statement 1 is false and Statement 2 is true.

(c) Both Statements 1 and 2 are false.

(d) Both Statements 1 and 2 are true.

Answer:

(b) Statement 1 is false and Statement 2 is true.

Explanation: India and China have diversified economies, with significant contributions from both manufacturing and the service sector. While India has a robust service sector, including IT and software services, China has excelled in manufacturing industries. India indeed had a larger population than China, making it the most populous country globally.

![]()

Question 25.

Self-Help Groups (SHGs) are an effective tool for promoting financial inclusion and empowering rural communities because they _____________. [1]

(i) Encourage savings and provide access to credit

(ii) Facilitate women empowerment and social cohesion

(iii) Strengthen the agricultural sector and promote technological advancements

Alternatives:

(a) (i) and (ii)

(b) (ii) and (iii)

(c) (i), (ii) and (iii)

(d) (i), (ii) and (iii)

Answer:

(d) (i), (ii) and (iii)

Explanation: Self-Help Groups (SHGs) encourage savings among members and provide access to credit, enabling them to meet their financial needs. Additionally, SHGs often focus on women empowerment and social cohesion by encouraging collective decision-making and providing a platform for skill development and capacity building.

Question 26.

Indian agriculture exhibits a considerable amount of ____________. [1]

(a) under employment and disguised unemployment

(b) unemployment

(c) disguised employment

(d) voluntary employment

Answer:

(a) under employment and disguised unemployment

Explanation: Indian agriculture exhibits a considerable amount of under-employment and disguised unemployment. Since, farmers are large in number with each having limited land resources. Hence, many farmers are working on a limited piece of land, resulting in disguised unemployment and underemployment.

Question 27.

Identify the correct sequence of alternatives given in Column II by matching them with respective items in Column I: [1]

| Column I | Column II |

| A. Edge of Pakistan over India | (i) In the area of skilled workforce. |

| B. Edge of India over Pakistan | (ii) Global exposure of the economy has been far wider in China than in India. |

| C. Edge of China over India | (iii) China’s export-driven manufacturing has recorded exponential growth. |

| D. Edge of China over Pakistan | (iv) Migration of people from rural to urban areas. |

Choose the correct alternative:

(a) A-(iii), B-(i), C-(ii), D-(iv)

(b) A-(iv), B-(i), C-(iii), D-(ii)

(c) A-(iv), B-(i), C-(ii), D-(iii)

(d) A-(iv), B-(ii), C—(iii), D-(ii)

Answer:

(c) A-(iv), B-(i), C-(ii), D-(iii)

![]()

Question 28.

(A) Comment on the growth rate trends witnessed in China and India in the last two decades. [3]

OR

(B) China’s rapid industrial growth can be traced back to its reforms in 1978. Do you agree? Elucidate.

Answer:

(A) India, with democratic institutions, performed moderately, but the majority of its people still depend on agriculture. Infrastructure is lacking in many parts of the country. It is yet to raise the standard of living of more than one-fourth of its population that lives below the poverty line. On the other hand, the lack of political freedom and its implications in China are the major concern in the last two decades.

The country used the market system without losing political commitment and succeeded in raising the level of growth along with poverty alleviation. China used the market mechanism to create additional social and economic opportunities. The country has also ensured social security in the rural areas by retaining collective farming known as Commune System. Public intervention in social infrastructure prior to the introduction of the economic reforms has brought positive results in the human development indicators of China.

OR

(B) Yes, it cannot be denied that China’s rapid industrial growth is an aggregate outcome of the various economic reforms introduced in phases since 1978. In the initial phase, reforms were initiated in the agriculture, foreign trade and investment sectors. The system of collective farming known as the Commune System was implemented. Under this system, the land was divided into small plots that were allocated to the individual households. These households were allowed to keep the remaining income from land after paying the taxes to the government.

In the later phase, reforms were initiated in the industrial sector. During this phase, the private firms and village and township enterprises were allowed to produce goods and services and compete with the state-owned enterprises. The reforms also included dual pricing. The dual pricing implies that the farmers and the industrial units were required to buy and sell a fixed quantity of inputs and output at a fixed price, and the remaining quantities were traded at the market price. Gradually, with the rapid increase in aggregate production in the later years, the quantities traded in the market increased by many folds. The reforms also included the setting up of Special Economic Zones to attract foreign investors.

Therefore, China’s rapid industrial growth is attributable to the success of different phases of its economic reforms.

Question 29.

“Meera, a young entrepreneur, starts her own small business in the fashion industry. Recognizing the importance of business management skills, Meera attends a series of entrepreneurship workshops and seminars”.

Explain the impact of Meera’s decision on human capital formation. [3]

Answer:

Meera’s decision to attend entrepreneurship workshops and seminars has a significant impact on human capital formation. By actively seeking out opportunities to enhance her business management skills, Meera invests in her own professional development and knowledge acquisition. The workshops and seminars provide her with valuable insights into various aspects of running a business, including market analysis, financial management, marketing strategies, and customer relations. This knowledge not only improves Meera’s ability to effectively manage her own business but also positions her as a potential mentor or resource for other entrepreneurs in her industry. Through her decision to develop her business management skills, Meera contributes to the overall growth of human capital in the entrepreneurship sector, encouraging innovation, creativity, and economic development.

![]()

Question 30.

“The consequences of rapid urbanisation in countries like Bangladesh and Nepal include infrastructure strain and environmental degradation”.

Justify the given statement with valid arguments in support of your answer. [4]

Answer:

The given statement that rapid urbanization in countries like Bangladesh and Nepal leads to infrastructure strain and environmental degradation can be justified with valid arguments.

Firstly, rapid urbanisation puts a huge strain on existing infrastructure systems. The sudden influx of population in urban areas overwhelms the capacity of transportation networks, water supply, sanitation systems, and housing. Insufficient infrastructure leads to overcrowding, traffic congestion, inadequate access to clean water, and inadequate waste management, hampering the overall quality of life in urban areas.

Secondly, rapid urbanisation often results in environmental degradation. The conversion of agricultural land into urban settlements leads to deforestation and loss of natural habitats. Increased construction activities contribute to air and noise pollution. Moreover, the lack of proper urban planning and inadequate waste management practices can result in water pollution, degradation of ecosystems, and strain on natural resources.

These consequences can have significant social, economic, and ecological impacts. Overburdened infrastructure limits economic growth and hampers sustainable development. Environmental degradation affects the well-being of residents and puts pressure on the ecosystems and biodiversity. Addressing these challenges requires comprehensive urban planning, investment in sustainable infrastructure, and the implementation of effective environmental policies. Balancing urbanization with environmental conservation is crucial for creating livable, resilient, and sustainable cities in countries experiencing rapid urbanisation like Bangladesh and Nepal.

Question 31.

(A) State and elaborate whether the following statements are true or false with valid arguments:

(i) Mechanisation of the Indian agriculture was one of the cause of Green Revolution in India. [2]

(ii) Small scale industries ensure a more equitable distribution of national income and wealth. [2]

OR

(B) Discuss briefly any two salient features of India’s pre-independence occupational structure.

Answer:

(A) (i) True, mechanisation of Indian agriculture played a significant role in triggering the Green Revolution in India. The adoption of modem agricultural machinery and technologies, such as tractors, irrigation systems, and improved seeds, helped increase agricultural productivity and efficiency. Mechanisation allowed farmers to cultivate larger areas, enhance crop yields, and reduce labour-intensive farming practices. This shift towards mechanized agriculture, coupled with the use of high-yielding varieties and chemical fertilizers, contributed to a substantial increase in agricultural production, particularly in staple crops like wheat and rice. The Green Revolution, driven by mechanisation, led to increased food production, improved food security, and a significant boost to the agricultural sector in India.

(ii) True, Small-scale industries play a vital role in promoting a more equitable distribution of national income and wealth in an economy. These industries typically employ a significant portion of the labour force, particularly in rural and semi-urban areas, providing employment opportunities and income generation for a large number of people. By decentralising economic activity and supporting local entrepreneurship, small-scale industries help in reducing regional disparities and income inequalities.

Furthermore, these industries often have a higher labourintensive nature, which provides employment for unskilled or low-skilled workers, contributing to inclusive growth. The growth of small-scale industries also fosters the development of ancillary and supporting industries, creating a multiplier effect on employment and income generation. Therefore, promoting and supporting small-scale industries which can contribute to a more equitable distribution of national income and wealth, ensuring broader involvement in economic growth.

OR

(B) Occupational structure refers to distribution of working persons across different industries and sectors.

The two salient features of India’s pre independence occupational structure are :

(a) Pre-dominance of Primary Occupation: The agricultural sector accounted for the largest share of workforce with approximately 75%. The manufacturing and service sector accounted for the remaining 10% and 15% respectively.

(b) Regional Variation: Another striking aspect was the growing regional variation.

(i) The states of Tamil Nadu, Andhra Pradesh, Kerala, Karnataka, Maharashtra and West Bengal witnessed a decline in dependence of workforce on agricultural sector with a commensurate increase in the manufacturing and service sector.

(ii) During the same time, there had been an increase in the workforce’s share in agriculture in states such as Odisha, Rajasthan and Punjab.

![]()

Question 32.

Identify the situation depicted in the given image. Suggest the impact of the indicated situation, on the Indian economy. [4]

Answer:

The situation depicted in the given image highlights the critical issue of child labour in the Indian economy. Child labour refers to the employment of children in work that is harmful to their physical, mental, or emotional well-being, depriving them of their right to education and a childhood. The slogan mentioned in the image “A child is meant to learn, not to earn” underscores the importance of providing children with access to education and nurturing their overall development rather than exploiting them for economic gains. Child labour is of grave concern in India, with a significant number of children engaged in hazardous and exploitative work, such as in factories, agriculture, domestic work, and informal sectors.

The widespread presence of child labour indicates underlying challenges such as poverty, lack of social protections, inadequate enforcement of labour laws, and limited access to quality education. Addressing the problem requires comprehensive efforts including strengthening child labour laws, promoting education for all children, poverty alleviation measures, and raising awareness about the detrimental consequences of child labour.

By prioritising education and creating an environment where children can learn and grow, the Indian economy can foster a skilled and productive workforce for sustainable development while ensuring the rights and well-being of its future generation.

![]()

Question 33.

(A) “The Prime Minister urged to increase the rural income by increasing non-farm activities.” [3]

Explain how non-farm activities can lead to rise in income of people in rural sector.

(B) Rural people not only face problems with regard to finance, but also encounter difficulties in marketing their goods. [3]

Justify the statement, giving reasons in support of your answer

OR

(C) “Less woman found in regular salaried employment” In the light of the given statement, discuss some reasons for the same.

(D) Rapid expansion of the banking system had a positive effect on rural farm and non-farm output, income and employment. Do you agree with the given statement? Give valid reasons in support of your answer.

Answer:

(A) Non-farm activities can lead to rise in income of people in rural sector in the following ways.

(i) Animal husbandry: It is that branch of agriculture which is concerned with the breeding, rearing and caring for farm animals. Sheep rearing is an important income augmenting activity in rural areas. Livestock production provides increased stability in income, food security, transport, fuel and nutrition. A significant number of women also find employment in the livestock sector.

(ii) Horticulture: It refers to the science or art of cultivation of fruits, vegetables, tuber crops, flowers, medicinal and aromatic plants and plantation crops. India has adopted horticulture as it is blessed with a varying climate and soil conditions. It is an important sector for potential diversification and value addition in agriculture.

(iii) Fisheries: It refers to the occupation devoted to the catching, processing or selling of fish and other aquatic animals. In India: West Bengal, Andhra Pradesh, Kerala, Gujarat, Maharashtra and Tamil Nadu are major fish producing states.

(B) Rural people not only face problems with regard to finance but also encounter difficulties in marketing their goods. This situation poses challenges to their economic well-being and overall development.

Here are some of the difficulties faced by rural communities in marketing their goods:

(i) Limited Market Access: Rural areas often lack proper infrastructure and transportation facilities, making it difficult for farmers and rural entrepreneurs to reach broader markets for their goods. Limited association restricts their access to buyers, resulting in reduced opportunities to sell their products.

(ii) Inadequate Information and Market Intelligence: Rural producers often lack access to timely and accurate market information, such as pricing trends, demand patterns, and market requirements. This delays their ability to make informed decisions about what to produce, when to produce, and how to price their goods.

(iii) Fragmented Supply Chains: Rural producers often operate within fragmented supply chains, where multiple intermediaries are involved between the producers and end consumers. This results in increased transaction costs, reduced profitability, and dares in maintaining quality standards and meeting market demands.

(iv) Lack of Market Linkages and Networks: Limited access to formal market linkages and networks makes it challenging for rural producers to connect with potential buyers, negotiate fair prices, and establish long-term business relationships. This often leaves them vulnerable to corrupt middlemen and limits their bargaining power.

(v) Quality and Standardisation Issues: Meeting quality standards and adhering to market requirements can be a challenge for rural producers, especially small-scale farmers and artisans.

Lack of infrastructure, technical knowledge, and resources for quality control and certification restrict their ability to access higher-value markets. By addressing these challenges, rural communities can improve their marketing capabilities, gain better access to markets, and improve their overall economic prospects.

OR

(C) Less woman are found in regular salaried employment due to the following reasons:

(i) Lack of education facilities: Female education is not given due importance in India and hence, majority of the woman in India do not have the educational qualification and professional skills required for regular salaried employment.

(ii) Discouragement from family in India: Many families still do not want the female members to step out from the house for work especially if it is for long hours, as in regular salaries employment.

(iii) Family responsibilities: Household work and responsibility of children and other family members do not allow the women to devote time and energy in regular employment.

(iv) Wage discrimination: Gender based wage discrimination is prevalent in India which demotivates the women in regular salaried employment and they prefer being at home or opt for self-employment opportunities.

(v) Security issues: Rise in crime against woman has also been a reason of woman withdrawing from regular employment due to security concerns. Late working hours in private sector firms and MNCs are not found suitable by most of the woman.

(D) I agree with the given statement that the rapid expansion of the banking system has had a positive effect on rural farm and non-farm output, income, and employment. Here are some valid reasons to support this argument:

(i) Access to Credit: The expansion of the banking system in rural areas provides farmers and rural entrepreneurs with improved access to credit. Accessible and cheap credit enables farmers to invest in modem agricultural practices, purchase better inputs, and adopt new technologies. Similarly, non-farm entrepreneurs can obtain capital for business expansion, leading to increased output and income.

(ii) Investment in Productivity Enhancement: With access to banking services, rural households can save money, deposit funds, and access loans for productive purposes. This allows them to invest in income-generating activities, such as acquiring farm machinery, expanding livestock, or establishing small-scale enterprises. These investments in productivity improvement contribute to increased output, higher incomes, and improved employment opportunities.

(iii) Financial Inclusion and Risk Mitigation: The expansion of the banking system promotes financial inclusion, bringing marginalised rural communities into the formal financial sector. This inclusion provides access to various financial services, including insurance and risk mitigation tools. Farmers can protect themselves against natural disasters, price shifts, and other risks, which can positively impact their output and income stability.

(iv) Technological Advancements and Information: Banking services in rural areas often come bundled with technology-driven solutions, such as mobile banking and digital payment systems. These technological advancements enhance efficiency, reduce transaction costs, and improve access to market information. This empowers rural producers to make informed decisions, engage in better market connection, and benefit from timely price information, positively affecting output, income, and employment.

(v) Skill Development and Entrepreneurship: The banking system’s presence in rural areas also promotes skill development and entrepreneurship. Banks offer training programs, financial literacy initiatives, and support for skill development projects. These efforts enhance the capabilities of rural individuals, fostering entrepreneurship and creating opportunities for selfemployment, which donate to income generation and employment creation.

In conclusion, the rapid expansion of the banking system in rural areas has proven to be beneficial for rural farm and non-farm sectors. It smooth the way for access to credit, encourages investments in productivity, promotes financial inclusion, provides technological advancements, and supports skill development and entrepreneurship. These factors collectively have a positive effect on rural output, income, and employment.

![]()

Question 34.

Read the following text carefully and answer the given questions on the basis of the same and common understanding:

The Indian economy has witnessed a significant transformation in recent years with the rapid adoption of digital payment systems. In the wake of the demonetisation drive in November 2016, there was a surge in the adoption of digital payment methods. The subsequent implementation of various digital payment platforms and government initiatives further fueled the growth of digital transactions. Data from the Reserve Bank of India (RBI) highlights the impressive growth of digital payments. In the financial year 2020-2021, the total volume of digital transactions stood at 48.3 billion, amounting to ₹ 4,572 lakh crore. This represented a significant increase of 30.19% in volume and 36.71% in value compared to the previous financial year.

Mobile wallet transactions, driven by popular platforms like Paytm, PhonePe, and Google Pay, have witnessed exponential growth. The adoption of Unified Payments Interface (UPI), a real-time payment system developed by NPCI, has played a pivotal role in the growth of digital transactions.

The growth of digital transactions has not only transformed the way Indians transact but has also led to several positive outcomes for the economy. It has reduced the reliance on cash, curbed black money, and enhanced transparency in financial transactions. Additionally, digital payments have facilitated financial inclusion, especially for individuals without access to traditional banking services. The Indian government’s initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) and the National Digital Payments Mission (NDPM) have been instrumental in driving the digital payment revolution. In conclusion, the growth of digital transactions in India has brought about a paradigm shift in the way people transact and has had a profound impact on the economy. The impressive data on digital payment volumes and values substantiate the success of various government initiatives and the growing acceptance of digital payment platforms. As India continues to embrace a digital-first economy, the sustained growth of digital transactions is expected to drive economic efficiency, financial inclusion, and propel India towards becoming a cashless society.

On the basis of the given text and common understanding, answer the following questions:

(i) How has the growth of digital transactions evolved in recent years? [2]

(ii) What are the key outcomes and benefits of the digital payment revolution in India? [4]

Answer:

(i) The growth of digital transactions in India has been remarkable. According to data from the RBI, in the financial year 2020-2021, the total volume of digital transactions reached 48.3 billion, with a value of ?4,572 lakh crore. This represents a considerable increase of 30.19% in volume and 36.71% in value compared to the previous financial year.

(ii) The growth of digital transactions has brought about several positive outcomes. It has reduced the reliance on cash, curbed black money, and enhanced transparency in financial transactions.

Additionally, it has facilitated financial inclusion, allowing individuals without access to traditional banking services to participate in the formal economy. The digital payment revolution has also moved India towards becoming a cashless society, driving economic efficiency and paving the way for a digital-first economy.