Students can access the CBSE Sample Papers for Class 12 Economics with Solutions and marking scheme Set 5 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Economics Set 5 with Solutions

Time : 3 Hours

Maximum Marks: 80

General Instructions :

- This question paper contains two sections:

Section A – Macro Economics

Section B – Indian Economic Development - This paper contains 20 Multiple Choice Questions of 1 mark each.

- This paper contains Short Answer Questions of 3 marks each to be answered in 60 to 80 words.

- This paper contains 6 Short Answer Questions of 4 marks each to be answered in 80 to 100 words.

- This paper contains 4 Long Answer Questions of 6 marks each to be answered in 100 to 150 words.

Section-A (40 Marks)

Macro Economics

Question 1.

Read the following statements carefully: [1]

Statement 1: Investment is the sum of autonomous investment and induced investment.

Statement 2: Induced investment is influenced by changes in interest rates.

Choose the correct alternative from the following:

(a) Statement1 is true and statement 2 is false.

(b) Statement1 is false and statement 2 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

Answer:

(c) Both statements 1 and 2 are true.

Explanation: Statement 1 is true because investment is the sum of autonomous investment (independent of income) and induced investment (influenced by changes in income). Statement 2 is true because changes in interest rates can effect the level of induced investment.

Question 2.

Foreign exchange transactions dependent on other foreign exchange transactions are called _________. [1]

(a) Current account transactions

(b) Capital account transactions

(c) Autonomous transactions

(d) Accomodating transactions

Answer:

(d) Accomodating transactions

Explanation: Accomodating transactions are undertaken by Central Bank with the view to correct the BOP imbalance and restoring BOP equilibrium.

![]()

Question 3.

Read the following chart carefully and choose the correct alternative: [1]

Alternatives:

(a) GNPMP

(b) NNPFC

(c) NDPFC

(d) GNDFC

Answer:

(c) NDPFC

Explanation: When we subtract depreciation from GDP at factor cost, we arrive at NDP. This adjustment is made to account for the loss in value of capital assets due to depreciation. By deducting depreciation, we obtain a measure of the net output produced by the economy after accounting for the capital consumed or worn out in the production process.

In summary: GDPFC– Depreciation = Net Domestic Product at factor cost (NDPFC)

Question 4.

Suppose in a closed economy, consumption (C) is given by the equation C = 200 + 0.75Y, where Y represents national income. If investment (I) is ₹500, government spending (G) is ₹300, and taxes (T) are ₹250, what is the value of equilibrium national income? [1]

(a) ₹1,000

(b) ₹1,200

(c) ₹4,000

(d) ₹1,600

Answer:

(c) ₹4,000

Explanation: Equilibrium national income occurs when total output (Y) is equal to total spending (C +1 + G). Substituting the given values, we get:

Y =C + I + G

Y = (200 + 0.75Y) + 500 + 300

Y = 1000 + 0.75Y

0.25Y = 1,000

Y = \(\frac{1,000}{0.25}\)

Y = 4,000

Question 5.

In an open economy, if exports (X) are greater than imports (M), which of the following is true? [1]

(a) Trade deficit exists

(b) Trade surplus exists

(c) Current account deficit exists

(d) Current account surplus exists

Answer:

(b) Trade surplus exists

Explanation: When exports (X) are greater than imports (M) in an open economy, it indicates a trade surplus. A trade surplus means that the value of goods and services exported by the country exceeds the value of goods and services imported. This results in a positive balance of trade, suggesting that the country is exporting more than it is importing.

![]()

Question 6.

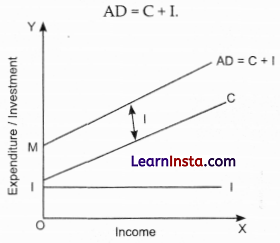

In determination of equilibrium level of income by AD- AS approach, AD is represented by: [1]

(a) C + S

(b) C + I

(c) S + I

(d) C + Y

Answer:

(b) C + I

Explanation: According to the keynesian theory, Aggregate demand is the sum total of consumption demand and investment demand.

Question 7.

If income rises from ₹50,000 to ₹60,000, consumption increases from ₹40,000 to ₹48,000. In this situation, what will be the value of Marginal Propensity to Consume (MPC)? [1]

(a) 0.80

(b) 0.20

(c) 0.10

(d) 0.90

Answer:

(a) 0.80

Explanation:

MPC=\(\frac{\Delta C}{\Delta Y}\)

Given,

ΔC = ₹(48,000- 40,000) = ₹8,000

ΔY = ₹(60,000 – 50,000) = ₹10,000

MPC=\(\frac{8,000}{10,000}\)= 0.8

Question 8.

Identify the correct reason(s) that may decrease the supply of money in an economy: [1]

I. The Central Bank reduces the money supply.

II. Commercial banks reduce their lending activities.

III. Tax rates are increased by the Central Government.

IV. The Central Bank decreases the Bank Rate.

Alternatives:

(a) I, II and III are correct

(b) III and IV are correct

(c) I, III and IV are correct

(d) II and III are correct

Answer:

(d) II and III are correct

Explanation: A decrease in money supply can occur when commercial banks reduce their lending activities and when tax rates are increased by the Central Government. These actions can lead to a reduction in the overall money supply in the economy.

Question 9.

Due to an increase in domestic interest rates, foreign investors find it more attractive to invest in a country. As a result, the country’s capital account and _______ balance will _______. (Choose the correct alternative to fill up the blank) [1]

(a) current account, improve.

(b) current account, deteriorate.

(c) financial account, improve.

(d) financial account, deteriorate.

Answer:

(c) financial account, improve.

Explanation: An increase in domestic interest rates can make the country’s financial assets more attractive to foreign investors seeking higher returns. As a result, there is likely to be an inflow of foreign capital and investment, leading to an improvement in the capital and financial account balance. This shows that the country is receiving more foreign investment than it is investing abroad.

![]()

Question 10.

Fill in the missing figure in the table below based on the given information: [1]

| Year | Total Deposits (in ₹ ‘000 crores) | Total Loans (in ₹ ‘000 crores) | Loan to Deposit Ratio |

| 2017 | 600 | 400 | 66.7% |

| 2018 | ___________ ?(i) | 800 | 80% |

| 2019 | 1200 | __________ ?(ii) | 66.7% |

| 2020 | 900 | 600 | 66.7% |

Alternatives:

(a) 1,000, 800

(b) 900, 800

(c) 800, 900

(d) 900, 1,100

Answer:

(a) 1,000, 800

Explanation: The missing figure for total deposits in 2018 can be calculated using the loan-to-deposit ratio.

Loan-to-Deposit Ratio = \(\frac{\text { Total Loans }}{\text { Total Deposits }}\)

\(\frac{80}{100}=\frac{800}{\text { Total Deposits }}\)

Total Deposits = \(\frac{800}{0.80}\)=1,000

To find the missing figure for total loans in 2019, we can use the loan-to-deposit ratio.

Loan-to-Deposit Ratio = \(\frac{\text { Total Loans }}{\text { Total Deposits }}\)

Loan-to-Deposit Ratio = \(\frac{\text { Total Loans }}{1,200}\)

0.667 = \(\frac{\text { Total Loans }}{1,200}\)

Total Loans = 0.667 x 1,200 = 800

Question 11.

“Exports of goods and services can affect the supply of foreign exchange in an economy”. Do you agree with the given statement? Give valid reason(s) to support your answer. [3]

Answer:

Yes, I agree with the statement that exports of goods and services can affect the supply of foreign exchange in an economy. When a country exports goods and services to other countries, it receives payments in the form of foreign currency, such as dollars, euros, or yen. These foreign currency earnings increase the supply of foreign exchange in the economy.

The increased supply of foreign exchange has several effects. Firstly, it enhances the country’s ability to purchase imports from other nations, as it can use the earned foreign currency to pay for these imports. This helps meet domestic demand for goods and services that may not be adequately produced domestically.

Secondly, a higher supply of foreign exchange strengthens the country’s currency in the foreign exchange market. As the supply of a currency increases, its exchange rate relative to other currencies tends to appreciate. This appreciation makes imports relatively cheaper and exports relatively more expensive, which can impact the trade balance.

Lastly, a larger supply of foreign exchange provides greater liquidity in the economy, facilitating international transactions, foreign investments, and the repayment of foreign debts. It also helps to build foreign exchange reserves, which can be utilised in times of economic instability or to stabilise the exchange rate.

In conclusion, exports of goods and services contribute to an increased supply of foreign exchange, which has hints for international trade, exchange rates, and overall economic stability.

![]()

Question 12.

(A) Consider the following information about a company’s production process and calculate the value added by the company using the Value Added or Product method. [3]

| Items | Amount (in ₹ crores) |

| Raw material cost | 10,000 |

| Wages paid to workers | 5,000 |

| Rent for the factory | 2,000 |

| Depreciation of machinery | 1,500 |

| Sales revenue | 30,000 |

OR

(B) What are some of the limitations associated with utilising GDP as a measure of a country’s welfare?

Answer:

(A) Value Added = Sales Revenue – Intermediate Consumption

Intermediate Consumption = Raw material cost + Wages + Rent

Intermediate Consumption = ₹10,000 + ₹5,000 + ₹2,000 = ₹17,000

Value Added = ₹30,000- ₹17,000 = ₹1 3,000

Therefore, the value added by the company using the Value Added or Product method is ₹13,000.

OR

(B) There are several limitations associated with utilising GDP as a measure of a country’s welfare:

- Non-inclusion of non-market activities: GDP primarily focuses on market-based economic activities, often excluding non-market activities like unpaid household work and volunteer services, which can have significant contributions to welfare.

- Inadequate reflection of income distribution: GDP does not account for income inequality within a country. A high GDP per capita does not necessarily indicate equitable distribution of wealth, and it may overlook disparities that impact overall welfare.

- Neglect of environmental sustainability: GDP does not consider the negative environmental impacts of economic activities. It fails to capture the depletion of natural resources or the costs associated with pollution and ecological damage.

- Quality of life factors: GDP does not reflect important aspects of welfare, such as education, healthcare, social services, and overall quality of life. It doesn’t account for factors like life expectancy, literacy rates, or access to essential services.

- Subjectivity of value: GDP assigns equal value to all economic activities, without considering the intrinsic value or social significance of certain goods and services.

- Underground economy and informal sector: GDP calculations may overlook the contributions of the underground economy and informal sector, which can be substantial in some countries.

In summary, while GDP provides useful economic information, it has limitations as a sole measure of a country’s welfare, as it fails to capture important non-economic factors and disparities within society.

Question 13.

For a hypothetical economy, the government plans to increase its income by ₹ 1,500 crores and the Marginal Propensity to save is 18%. Estimate the increase in investment required to achieve the targeted increase in income. [4]

Answer:

The MPS represents the proportion of additional income that individuals choose to save rather than consume.

Given that the economy plans to increase its income by ₹ 1,500 crores and the Marginal Propensity to Save (MPS) is 18%, we can calculate the increase in investment as follows:

Increase in income = ₹1,500 crore

Marginal Propensity to Save (MPS) = 18% = 0.18

Increase in investment = Increase in income × MPS

Increase in investment = ₹1,500 crore × 0.18

Increase in investment = ₹270 crore

Therefore, to achieve the targeted increase in income of crores, an increase in investment of ₹ 270 crores would be required, assuming the Marginal Propensity to Save remains constant. This additional investment would help stimulate economic activity and contribute to the desired income growth.

![]()

Question 14.

(A) In an economy, Aggregate Demand is less than aggregate Supply. Is the economy in equilibrium? If not, explain the changes that will bring the economy in equilibrium. [4]

OR

(B) An economy is operating at under-employment level of income. What is meant by the given statement? Discuss one fiscal measure and one monetary measure to tackle the situation.

Answer:

(A) If aggregate demand (AD) is less than aggregate supply (AS), then economy is not in equilibrium because an economy is in equilibrium when AS = AD. When AD < AS, flow of goods and services in the economy tends to exceed their demand. As a result, some of the goods would remain unsold. To clear unwanted stocks, the producers would plan a cut in production. Consequently. AS will reduce to become equal to AD. This is how AS adapts itself to AD. In the following figure, equilibrium is struck at point E, where AD = AS. At point E1. Aggregate Supply exceeds Aggregate Demand.

It will cause following changes in the economy:

(i) Stock of the producers would be in excess of the desired limit.

(ii) Profits will start shrinking.

(iii) Desired level of output for the subsequent year will face a cut.

(iv) Levels of income and employment will tend to shrink to the point, where S = I, corresponding

to point E in the diagram. Thus the economy will come back to the state of equilibrium.

OR

(B) An economy is said to be operating at under employment equilibrium level, if the planned \ aggregate expenditure falls short of available output in the economy, corresponding to the full employment level. It results into excess of output available over the anticipated aggregate demand at full employment level. To tackle such a situation the aggregate demand has to be increased up to the level that stocks can be cleared.

Following measures may be taken for the same:

- Decrease in taxes: The government under its fiscal policy may decrease the rate of taxes (both direct and indirect taxes). This will ensure greater purchasing power in the hands of general public. This will help to increase aggregate demand and remove the deflationary gap.

- Increase in money supply: Central Bank through its expansionary monetary policy can increase the money supply in the economy. Central Bank can use tools like bank rate, cash reserve ratio, repo and reverse repo rates etc., to ensure greater money in the hands of general public which would in turn increase the aggregate demand in the economy and be helpful in reducing/removing the deflationary gap.

Question 15.

Elaborate the credit creation function performed by Central Bank and state the factors affecting money supply in the economy. [4]

Answer:

Commercial banks play a significant role in the money creation process, which impacts the overall economy. Understanding the process of credit creation and the factors that influence their ability to expand the money supply is crucial.

Process of Credit Creation:

- Deposit mobilisation: Commercial banks attract deposits from customers, which form the basis of their lending activities.

- Fractional reserve banking: Banks are required to maintain only a fraction of their deposits as reserves. The remaining portion is available for lending and money creation.

- Loans and credit extension: Banks utilise their excess reserves to provide loans and extend credit to individuals and businesses. These loans are typically issued as new deposits in borrowers’ accounts.

Factors Affecting money supply:

- Reserve requirements: Central banks set reserve requirements, dominating the minimum percentage of deposits that banks must hold as reserves. Higher reserve requirements limit the amount of money banks can create through lending.

- Central Bank policies: Monetary policies implemented by the Central Bank, such as interest rate adaption and open market operations, influence the cost of borrowing and the availability of funds for banks to lend.

- Creditworthiness and risk assessment: Banks evaluate the creditworthiness and risk profile of potential borrowers. Lending decisions are influenced by factors such as borrowers’ income, collateral, and credit history.

- Economic conditions: The overall state of the economy, including factors like GDP growth, inflation, and employment levels, can impact the willingness of banks to extend credit and the demand for loans.

In conclusion, commercial banks create money through the process of credit creation, utilising fractional reserve banking. Their ability to expand the money supply is influenced by factors such as reserve requirements, central bank policies, creditworthiness assessments, and prevailing economic conditions. Understanding these dynamics is crucial for understanding the role of commercial banks in the broader monetary system.

![]()

Question 16.

(A) On the basis of the given information, calculate the value of: [3]

(i) Gross Fiscal deficit

(ii) Fiscal deficit

(iii) Primary Deficit [2]

| Items | Amount (in ₹ crores) |

| Revenue Receipts | 500 |

| Revenue Expenditure | 600 |

| Capital Expenditure | 400 |

| Recoveries of Loans | 50 |

| Grants-in-Aid | 100 |

| Net Borrowing | 200 |

| Interest payments | 50 |

(B) The fiscal deficit gives the borrowing requirement of the government. Elucidate. [1]

OR

(C) Explain How can the government utilise budgetary policy to address income inequalities and promote a more equitable distribution of income. [3]

(D) ‘In India there is a lot of disparity between rich and poor’. This disparity is increasing day by day.

Discuss how can budgetary policy be used to reduce inequalities of income? [3]

Answer:

(A) (i) Gross Fiscal Deficit:

Gross Fiscal Deficit = Revenue Expenditure + Capital Expenditure- Revenue Receipts

Gross Fiscal Deficit = 600 + 400- 500

Gross Fiscal Deficit 500 crore

(ii) Fiscal Deficit:

Fiscal Deficit = Gross Fiscal Deficit- Recoveries of Loans- Grants-in-Aid

Fiscal Deficit = 500- 50- 100

Fiscal Deficit = 350 crore

(iii) Primary Deficit:

Primary Deficit = Fiscal Deficit – Interest Payments

Primary Deficit = 350 – 50

Primary Deficit = 300 crore

(B) Fiscal deficit is referred to as the shortfall in government income as compared to its spending. A high fiscal deficit means that the government is borrowing more money than it is earning. A higher fiscal deficit creates a burden of loan and interest payment for future generation. Fiscal deficit is determined by:

Total Expenditure- Total Receipts excluding borrowings

OR

(C) The government can utilise budgetary policy to reduce inequalities in incomes through various measures:

- Progressive Taxation: Implementing a progressive tax system where individuals with higher incomes are taxed at higher rates can help to redistribute wealth and reduce income inequality.

- Welfare Programs: Allocating a significant portion of the budget towards social welfare programs such as healthcare, education, housing, and poverty alleviation can provide support to low-income individuals and narrow the income gap.

- Targeted Subsidies: Providing targeted subsidies for essential goods and services like food, fuel, and utilities can assist lower-income households and mitigate disparities in access to basic necessities.

- Progressive Spending: Focusing government expenditure on sectors that promote inclusive growth, such as education, skill development, and infrastructure in marginalised areas, can enhance opportunities and income prospects for disadvantaged communities.

- Minimum Wage Policies: Implementing and enforcing minimum wage laws can ensure fair salary for workers and help uplift those at the bottom of the income distribution.

By strategically utilising budgetary policy measures, governments can address income inequalities and promotes a more equitable society by providing support, equal opportunities, and essential services to those in need.

(D) The government plays a very important role in increasing the welfare of the people. In under to do that the government intervenes in the economy in the following ways:

- Government uses fiscal instruments of taxation and subsidies.

- Government redistributes income in favour of poor sections of the society by imposing taxes on rich and giving subsidies to the poor.

- Government distribute food grain through fair-price to BPL (Below Poverty Line) population.

![]()

Question 17.

(A) Giving valing reasons explain how the following would be treated while estimating domestic income? [3]

(i) Transfer Income

(ii) Income from sale of second hand goods.

(B) ‘GDP is he true indicator of economic welfare’. Do you agree with he given statement? Give valid reason reasons for your answers. [3]

Answer:

(A) (i) Transfer Incomes (like scholarships, donations, charity, old-age pensions, etc.) are not included in the National income because such receipts are not connected with any productive activity, and there is no value addition.

(ii) Income from the sale of second-hand goods will not be included in national income as their original sale has already been counted. If they are included again, it will lead to double counting.

However, any brokerage or commission received by brokers or commission agents on the sale of such goods will be included as it is an income received for rendering effective service.

(B) GDP is one of the economic indicator, it cannot be considered the “true indicator of economic welfare.” Economic welfare is a broader concept that encompasses various dimensions of well being, including income distribution, quality of life, environmental sustainability, and subjective well-being. It has certain limitations which are-.

- GDP does not account for environmental costs or the depletion of natural resources. A focus on GDP growth alone can lead to unsustainable practices that harm the environment, which ultimately affects the long-term well-being of society.

- GDP measures the quantity of goods and services produced but does not distinguish between the quality of these goods and services. An increase in GDP can come from the production of harmful or low-quality goods and services that do not necessarily improve well-being.

- GDP is a monetary measure, and it does not capture non-monetary factors like happiness, life satisfaction, or social connections, which are crucial for overall well-being

Section-B (40 Marks)

Indian Economic Development

Question 18.

“Liberalisation of the economy under the new economic policy changed the role of RBI in the economy”. Identify the change in role of RBI? [1]

(a) from a ‘regulator’ to ‘facilitator’ of the financial sector

(b) from a ‘controller’ to ‘manager’ of the government debt

(c) both (a) and (b)

(d) none of the above

Answer:

(c) both (a) and (b)

Explanation: The liberalisation of the economy under the new economic policy shifted the role of the Reserve Bank of India (RBI). It transformed the RBI from being a ‘regulator’ of the financial sector to a ‘facilitator/ promoting a more market-oriented and competitive financial system. Additionally, the RBI’s role changed from being a ‘controller’ of government debt to a ‘manager/ allowing greater flexibility in managing government borrowings.

Question 19.

‘A campaign in China in 1958 where people were encouraged to set up industries in their Backyard’ Identify the concept which is being discussed here. [1]

(a) Great Leap Forward

(b) Great Proletarian Cultural Revolution

(c) Anti-Rightist Movement

(d) Four Pests Damping

Answer:

(a) Great Leap Forward

Explanation: The Great Leap Forward (GLF) was a campaign initiated in 1958 in China by Mao’s, which was aimed to modernise the China’s economy. The campaign was directed towards the large scale industrialisation in the country not concentrated only in the urban areas.

![]()

Question 20.

The important implication of the ‘one child norm’ adopted by China is ____________. [1]

I. Low population growth.

II. Decline in the sex ratio.

III. After a few decades, there will be more elderly people in proportion to young people.

IV. The one child policy is discontinued in 1920, where each family were allow to have two childrens.

Alternatives

(a) I, II, III

(b) II, III, IV

(c) I, III, IV

(d) II, IV

Answer:

(a) I, II, III

Explanation: The important implications of the ‘one child norm’ are:

(i) Low population growth.

(ii) Decline in the sex ratio.

(iii) After a few decades, there will be more elderly people in proportion to young people.

(iv) In the long run, China have to provide more social security measures with fewer workers.

Question 21.

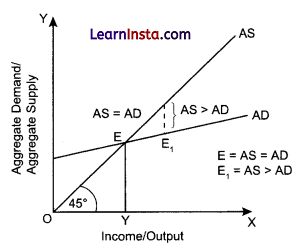

Study the following picture and answer the given question: [1]

The key challenge faced by Indian women in rural entrepreneurship is ____________.

(a) Limited access to capital and financial resources

(b) Lack of skill development and business training

(c) Declining interest in entrepreneurship among women

(d) None of the above

Answer:

(a) Limited access to capital and financial resources

Explanation: The key challenges faced by Indian women in rural entrepreneurship includes limited access to capital and financial resources. Women often encounter difficulties in securing loans or funding for their business ventures, primarily due to factors like lack of collateral, limited financial literacy, and bias in the lending system. This hampers their ability to invest in business growth and expansion.

Question 22.

Read the following statement: Assertion (A) and Reason (R). Choose the correct alternative from those given below: [1]

Assertion (A): FDI leads to economic colonialism.

Reason (R): FDI implies ownership and management of the domestic enterprises by the foreign companies.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

Explanation: While it is true that FDI implies ownership and management of domestic enterprises by foreign companies, it does not necessarily lead to economic colonialism. Economic colonialism refers to the domination and exploitation of a country’s resources and economy by a foreign power. FDI can bring benefits such as technology transfer, job creation, and increased competitiveness, but its impact on a country’s economy depends on various factors and policies.

![]()

Question 23.

__________ is a major source of human capital formation in the country? [1]

(a) Expenditure on education

(b) Expenditure on infrastructure

(c) Expenditure on defences

(d) Expenditure on energy

Answer:

(a) Expenditure on education

Explanation: Expenditure on education is a major source of human capital formation in a country. Human capital refers to the knowledge, skills, and abilities that individuals possess, which contribute to their productivity and economic potential. Investing in education helps to develop and enhance human capital by providing individuals with the necessary knowledge, skills, and training to participate in the workforce and contribute to economic growth.

Question 24.

Social economic zones were set up by China to: [1]

(a) attract foreign investors

(b) develop the backward regions

(c) maintain economic equally

(d) promote private sector

Answer:

(a) attract foreign investors

Explanation: SEZ’s were set up by China to attract foreign investors.

Question 25.

________ is a type of unemployment where the marginal productivity of the workers is zero. [1]

(a) Disguised Unemployment

(b) Involuntary unemployment

(c) Seasonal unemployment

(d) Structural Unemployment

Answer:

(a) Disguised Unemployment

Explanation: Disguised unemployment exists when part of the labour force is either left without work or is working in a redundant manner such that worker productivity is essentially zero. It is a type of unemployment that does not affect aggregate output.

Question 26.

Read the following statements carefully: [1]

Statement 1: Unemployment refers to the situation where individuals are willing and able to work but are unable to find suitable employment.

Statement 2: The work population ratio is a measure that indicates the proportion of the working-age population that is employed.

In the light the given statements, choose the correct alternative from the following:

(a) Statement 1 is true and Statement 2 is false.

(b) Statement 2 is true and Statement 1 is false.

(c) Both Statements 1 and 2 are true.

(d) Both Statements 1 and 2 are false.

Answer:

(c) Both Statements 1 and 2 are true.

Explanation: Unemployment refers to the condition where individuals are willing and able to work but cannot find suitable employment opportunities. The work population ratio, also known as the employment-to-population ratio, is a measure that indicates the proportion of the working-age population that is employed. Both statements accurately describe the concepts of unemployment and the work population ratio.

![]()

Question 27.

Identify the correct sequence of alternatives given in Column II by matching them with respective items in Column I: [1]

| Column I | Column II |

| 1. Demonetisation | (A) 1991 |

| 2. Liberalisation | (B) 1995 |

| 3. WTO | (C) 1951 |

| 4. First five-year plan | (D) 2016 |

Choose the correct alternative:

(a) 1-A, 2-B, 3-C, 4-D

(b) 1-B, 2-A, 3-D, 4-C

(c) 1-D, 2-A, 3-B, 4-C

(d) 1-C, 2-A, 3-B, 4-D

Answer:

(c) 1-D, 2-A, 3-B, 4-C

Question 28.

(A) During the colonial period, some of the major socio-economic changes that occurred under British rule in India. List any three such major changes. [3]

OR

(B) “Infant and maternal mortality rates were alarmingly high during the British period, reflecting the terrible conditions and challenges faced by both infants and women in that era.”

Justify the above statement with valid explanation.

Answer:

(A) British rule brought the establishment of modem education systems, leading to the emergence of a new class of educated Indians. This played a crucial role in shaping Indian scholars and fostering nationalist sentiments.

(i) Land Reforms: The British implemented land reforms, including the Zamindari and Ryotwari systems. These reforms restructured the traditional agrarian system, affecting land ownership and agricultural practices.

(ii) Growth of Industries: The industrial sector witnessed significant growth during this period. However, the growth primarily benefitted British-owned industries, leading to the decline of traditional Indian industries.

(iii) Infrastructure Development: The British administration introduced modern transportation infrastructure, including railways, roads, and ports. This had a profound impact on trade, communication, and economic integration across different regions of India.

OR

(B) The high infant and maternal mortality rates during the British period can be attributed to several reasons:

(i) Inadequate healthcare infrastructure: The healthcare facilities available during that time were often insufficient and lacked proper resources, leading to limited access to prenatal and postnatal care for women. The absence of skilled healthcare professionals and hygienic conditions further increased the risk of barrier during pregnancy and childbirth.

(ii) Malnutrition and poor living conditions: Inadequate access to nutritious food, clean water, and sanitation facilities resulted in weakened immune systems and increased sensitivity to diseases, ultimately contributing to higher mortality rates.

(iii) Limited knowledge of maternal and child healthcare: This included inadequate understanding of prenatal care, nutrition during pregnancy, safe childbirth practices, and new-born care. Without proper education and guidance, women and their infants were at a higher risk of health complications and mortality.

(iv) Colonial policies and socio-economic disparities: The imposition of policies that exploited resources and hindered local development had a detrimental impact on the living conditions of women and infants. Socio-economic disparities, coupled with limited access to healthcare and education, further increased the challenges faced by vulnerable groups.

(v) Infectious diseases and epidemics: The British period saw outbreaks of various infectious diseases, including cholera, smallpox, and malaria. The lack of effective preventive measures and healthcare infrastructure made women and infants particularly open to these diseases, leading to high mortality rates.

These combined factors created a harsh environment for both women and infants, resulting in terribly high mortality rates during the British period.

![]()

Question 29.

“Mohit, after completing his senior secondary, decides to enrol in a technical vocational training program specialising in computer programming to learn essential coding languages, software development skills, and problem-solving techniques. The training equips Mohit with the necessary knowledge and expertise to secure a job as a software developer in a reputable IT firm”.

Explain the impact of Mohit’s decision on human capital formation. [3]

Answer:

Mohit’s decision to enrol in a technical vocational training programme specialising in computer programming has a significant impact on human capital formation. By acquiring essential coding languages, software development skills, and problem-solving techniques, Mohit enhances his knowledge and expertise in the field of IT. This training not only equips him with the necessary technical skills but also hones his problem-solving abilities, critical thinking, and adaptability. As a result, Mohit becomes a valuable asset in the job market, with higher employability and the potential for career advancement. Moreover, his enhanced skill set contributes to the overall human capital of the workforce in the IT industry, fostering innovation, productivity, and economic growth in the sector. Mohit’s decision symbolises the positive impact of investing in vocational training programs for human capital development.

Question 30.

‘Success and failure of developmental strategies adopted by China.’ Justify the given statement ,Also state the areas in which China has the edge over India? [4]

Answer:

Success of Structural Reforms in China:

(i) There was an existence of infrastructure in the areas of education and health, and land reforms.

(ii) There was decentralised planning and the existence of the small enterprise.

(iii) Through the commune system, there was a more equitable distribution of foodgrains.

(iv) There was the extension of essential health services in rural areas.

Failures of structural reforms in China:

- There was a slow pace of growth and a lack of modernisation in the Chinese economy under Maoist rule.

- The Maoist vision of economic development based on decentralisation, self-sufficiency and shunning of foreign technology had failed.

- Despite extensive land reforms, the great leap forward, and other initiatives, the per capita output in 1978 were same as in the mid-1950s.

China has the edge over India:

The Chinese reform process began more comprehensively during the 80s when India was in the midstream of a slow growth process.

Rural poverty in China declined by 85% during the period 1978 to 1989. In India, it declined by 50% during this period; global exposure of the economy has been far wider in China than in India. China’s export-driven manufacturing has recorded exponential growth, while India is only a marginal player in the international markets.

![]()

Question 31.

(A) State and elaborate whether the following statements are true or false, with valid arguments.

(i) “Human Capital Formation gives birth to innovation, invention and technological improvements.” [2]

(ii) Do you think that in the last 50 years, employment generated in the country is commensurate with the growth of GDP in India? [2]

OR

(B) As compared to urban women, more rural women are found working. Why?

Answer:

(A) (i) True “Human Capital Formation gives birth to innovation, invention and technological improvements” by:

(a) Expenditure on Education: It is the most effective way of raising a productive workforce in the country. Labour skill of an educated person is more than that of an uneducated person. Individuals invest in education to increase their future income and raise the living standard.

(b) Expenditure in Health: It is also an important expenditure to build and maintain productive labour force and to improve quality of life of people in the society. It makes a man more efficient and therefore more productive. Their contribution to the production process tends to rise and adds more to GDP than a sick person.

(c) Expenditure on the Job-training: It helps the workers to sharper their specialised skills. It increases the skill, efficiency and capacity of the workers. It also make workers more creative and innovative which result in increase in production and productivity.

(ii) False, I don’t think that in the last 50 years, employment generated in country commensurates with the growth of GDP in India. In 2005, the growth rate in employment was 2.89% while growth rate in GDP was 6.1%. The difference between the growth rate of GDP and the growth rate of employment is indicative of the phenomenon of ‘jobless growth’. Jobless growth is a situation in which there is an overall acceleration in the growth rate of GDP in the economy which is not accompanied by an expansion in employment opportunities. This means that in an economy without generating additional employment, we have been able to produce more goods and services. This is because of the use of capital intensive methods of production.

OR

(B) The difference in participation rates is very high between urban and rural women. In urban areas, for every 100 urban females, only about 14 are engaged in some economic activities. In rural areas, for every 100 rural women, about 26 of them participate in the employment market. Hence, where men are able to earn high incomes, families discourage female members from taking up jobs. Earnings of urban male workers are generally higher than rural males and so urban families do not want females to work.

Apart from this, many activities of the household in which urban women are engaged, are not recognised as productive work, while women working on farms in the rural areas are considered a part of the workforce if they are being paid wages in cash or in the form of foodgrains.

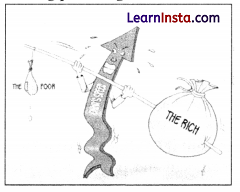

Question 32.

Identify the situation depicted in the image given below. Suggest the impact of indicated situation, on the Indian economy. [4]

Answer:

The situation depicted in the image seems to be illustrating the wealth gap or income inequality in India. Income inequality refers to the unequal distribution of income among individuals or households within a society. It suggests that there is a significant disparity between the affluent or “the rich” and the “poor”.

(i) The impact of income inequality on the Indian economy: The impact can be significant and multifaceted:

(ii) Social and Political Consequences: High levels of income inequality can lead to social unrest, tensions, and increased crime rates. It can also widen the gap between different sections of society, potentially creating social divisions and reducing social Bond. Such divisions may also have political implications, affecting stability and governance.

(iii) Economic Growth and Development: Excessive income inequality can hinder overall economic growth. When wealth and income are concentrated in the hands of a few, it limits the purchasing power of the majority of the population. This can lead to reduced domestic demand, affecting businesses and hindering economic expansion. In contrast, a more equitable distribution of income can contribute to higher consumer spending, investment, and economic growth.

(iv) Human Capital Development: Income inequality can have implications for education and skill development. Those from lower-income backgrounds may have limited access to quality education, healthcare, and other essential services. This can perpetuate a cycle of poverty and hinder the development of a skilled workforce, ultimately impacting productivity and innovation in the economy.

(v) Inequality of Opportunities: Income inequality often translates into unequal access to opportunities, such as employment, entrepreneurship, and upward mobility. When a significant portion of the population is unable to participate fully in economic activities, it restricts their potential contribution to economic growth and development.

Addressing income inequality requires a comprehensive approach involving policies and measures aimed at redistributing wealth, promoting inclusive growth, improving access to education and healthcare, and creating equal opportunities for all sections of society. By narrowing the gap between the rich and the poor, India can foster a more comprehensive and sustainable economic environment.

![]()

Question 33.

(A) What are the key restrictions and measures implemented by the government to balance the goals of industrialisation and safeguarding domestic industries post-1991 economic reforms? [3]

(B) The major policy initiatives i.e., land reforms and green revolution helped India to become selfsufficient in food grains production. [3]

Briefly outline and discuss various policy initiatives of the government of India in this direction.

OR

(C) The policy of import substitution led to protection of the domestic industries against the foreign producers but we failed to promote a strong export surplus.

In the light of given statement discuss the policy of import substitution.

(D) NITI Aayog is a policy think-tank of Government of India that aims to involve the states in economic policy making in India.

Do you agree with the given statement? Given valid reason to support your answer.

Answer:

(A) Post the economic reforms of 1991, the Indian government implemented several key restrictions and measures to balance the goals of industrialisation and safeguarding domestic industries. These include:

(i) Import Tariffs and Custom Duties: The government imposed tariffs and custom duties on imported goods to protect domestic industries from foreign competition. This helped to create a level of playing field and provided a competitive advantage to domestic manufacturers.

(ii) Foreign Direct Investment (FDI) Regulations: The government implemented FDI regulations to control foreign investment and protect domestic industries. Certain sectors were restricted or limited for foreign investment to safeguard domestic players.

(iii) Industrial Licensing and Regulations: The government introduced industrial licensing and regulations to ensure the growth of domestic industries and prevent monopolies or unfair competition. These measures aimed to balance industrial growth along with safeguarding the interests of domestic players.

(iv) Supportive Policies and Incentives: The government implemented various helpful policies and incentives to promote domestic industries, such as subsidies, tax benefits, and preferential treatment for domestically manufactured goods.

(B) (i) Land Reforms: Land reforms were implemented to address the unequal distribution of land ownership and provide access to land for the landless farmers. These reforms aimed to increase agricultural productivity and create a more equitable agricultural system. By redistributing land and empowering farmers, land reforms contributed to increased agricultural output.

(ii) Green Revolution: The Green Revolution, initiated in the 1960s, focused on improving agricultural productivity through the adoption of high-yielding crop varieties, modem agricultural techniques, and increased use of fertilizers and irrigation. This initiative significantly boosted food grains production, particularly in wheat and rice cultivation. It helped India transform from a food-deficit nation to self-sufficient in food grains, ensuring food security for its population.

Both land reforms and the Green Revolution were significant in increasing agricultural productivity, improving rural livelihoods, and reducing poverty. These initiatives were critical in India’s journey towards achieving self-sufficiency in food grains production and ensuring food security for its growing population.

OR

(C) The statement “The policy of import substitution led to the protection of domestic industries against foreign producers, but we failed to promote a strong export surplus” is generally true. Import substitution industrialisation (ISI) was a policy approach adopted by many developing countries, including India, during the mid 20th century. The objective of ISI was to protect domestic industries from foreign competition by imposing high tariffs, import restrictions, and promoting the production of goods domestically that were previously imported. This policy aimed to foster industrialisation and reduce dependency on foreign goods.

While ISI did protect domestic industries and promote self-sufficiency in certain sectors, it had limitations when it came to promoting a strong export surplus. ISI often focused on meeting domestic demand rather than encouraging export-oriented production. As a result, many industries became inward-looking, producing goods primarily for the domestic market.

This approach limits the development of export-oriented industries and hindered competitiveness in the global market. The emphasis on protecting domestic industries created lack of incentives for companies to invest in research and development, innovation, and international competitiveness.

Additionally, the focus on import substitution led to a neglect of export promotion strategies, such as developing export infrastructure, providing incentives for exporters, and market diversification. As a consequence, India’s export sector faced challenges in competing internationally, leading to a trade imbalance and a weaker export surplus. It was only after the economic reforms of 1991, which embraced liberalization and globalisation, that India started prioritising export promotion and gradually opened up its markets to international competition.

Since then, India has made progress in developing export-oriented industries and increasing its export surplus. However, it is important to note that the legacy of import substitution policies had a lasting impact on India’s export competitiveness, and the country still faces challenges in achieving a consistently strong export surplus.

(D) NITI Aayog, which stands for National Institution for Transforming India, is indeed a policy thinktank of the Government of India. It was established on January 1, 2015, to replace the Planning Commission, with the objective of involving the states in economic policy making and promoting cooperative federalism in India.

NITI Aayog’s primary role is to provide strategic and technical advice to the central and state governments on various policy matters, including economic planning, social development, and sustainable growth. It acts as a platform for dialogue and coordination between the central government and the states, fostering cooperative federalism.

NITI Aayog plays a crucial role in facilitating policy formulation, research, and analysis. It undertakes studies, conducts research, and provides policy recommendations to address critical issues facing the country. It also collaborates with various stakeholders, including government departments, experts, academia, and industry, to foster innovation and promote evidence-based policy making.

By involving the states in economic policy making, NITI Aayog aims to ensure that the development agenda is inclusive, integrated, and aligned with the needs and aspirations of the diverse regions and populations of India. It encourages active participation and engagement of the states in policy formulation, implementation, and monitoring, promoting a cooperative and collaborative approach to governance and economic development.

![]()

Question 34.

Read the following text carefully and answer the given questions on the basis of the same and common understanding:

One of the current challenges facing the Indian economy is the need to create an eco-friendly business environment that promotes sustainable development and mitigates the impact of climate change. India, being the world’s third-largest emitter of greenhouse gases, has been grappling with environmental issues such as air pollution, water scarcity, and deforestation. Data from the Ministry of Environment, Forest, and Climate Change indicates that India has made significant progress in renewable energy capacity addition. As of 2021, the country’s total renewable energy installed capacity stands at over 100 GW, with a target of reaching 175 GW by 2022.

Furthermore, the government has launched the National Clean Air Programme (NCAP) to address air pollution issues in 122 cities across the country. The program focuses on reducing particulate matter (PM) and aims to achieve a 20-30% reduction in PM10 and PM2.5 concentrations by 2024. The government has also introduced the concept of green financing. The Reserve Bank of India (RBI) has issued guidelines for banks to encourage lending for renewable energy and other environmentally sustainable projects. Additionally, the Securities and Exchange Board of India (SEBI) has mandated the inclusion of environmental, social, and governance (ESG) parameters in the disclosure requirements for listed companies.

The transition to a sustainable economy requires widespread adoption of green technologies, infrastructure development, and greater awareness among businesses and consumers. Collaboration between the government, industry stakeholders, and civil society is crucial to drive the necessary changes and overcome the challenges posed by climate change and environmental degradation.

On the basis of the given text and common understanding, answer the following questions:

(i) How is the Indian government addressing air pollution issues? [2]

(ii) How has the Indian government encouraged green financing and sustainable practices? [4]

Answer:

(i) The government has launched the National Clean Air Programme (NCAP), which aims to reduce air pollution in 122 cities covering the country. The program focuses on reducing particulate matter (PM) concentrations, with a target of achieving a 20-30% reduction in PM10 and PM2.5 levels by 2024.

(ii) The government has initiated guidelines for banks to promote green financing, encouraging lending for renewable energy and other environmentally sustainable projects. Additionally, the inclusion of environmental, social, and governance (ESG) parameters in the disclosure requirements for listed companies by the Securities and Exchange Board of India (SEBI) aims to drive sustainable practices and responsible investment decisions.