Check the below NCERT MCQ Questions for Class 12 Accountancy Chapter 10 Accounting Ratios with Answers Pdf free download. MCQ Questions for Class 12 Accountancy with Answers were prepared based on the latest exam pattern. We have provided Accounting Ratios Class 12 Accountancy MCQs Questions with Answers to help students understand the concept very well.

Accounting Ratios Class 12 MCQs Questions with Answers

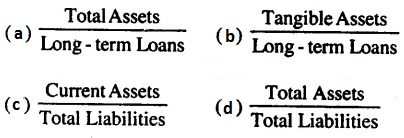

Question 1.

The formula for ascertaining Total Assets to Debt Ratio is:

Answer

Answer: (a)

Question 2.

Proprietory Ratio indicates the relationship between proprietor’s funds and….

(a) Reserve

(b) Share Capital

(c) Total Assets

(d) Debentures

Answer

Answer: (c) Total Assets

Question 3.

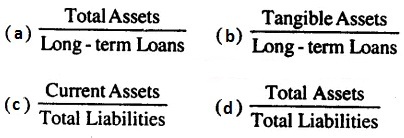

Proprietory ratio is calculated by the following formula:

Answer

Answer: (c)

Question 4.

Which one of the following ratios is most important in determining the long-term solvency of a company ?

(a) Profitability Ratio

(b) Debt-Equity Ratio

(c) Stock Turnover Ratio

(d) Current Ratio

Answer

Answer: (b) Debt-Equity Ratio

Question 5.

Total Assets ₹ 8,10,000

Total Liabilities ₹ 2,60,000

Current Liabilities ₹ 40,000

Debt-equity ratio is:

(a) 0.05 : 1

(b) 0.4 : 1

(c) 2.5 : 1

(d) 4 : 1

Answer

Answer: (c) 2.5 : 1

Question 6.

Equity share capital ₹ 15,00,000

Reserve and Surplus ₹ 7,50,000

Total Assets ₹ 45,00,000

Properletory Ratio ?

(a) 50%

(b) 33.3%

(c) 200%

(d) 60%

Answer

Answer: (a) 50%

Question 7.

Total Assets ₹ 7,70,000

Total Liabilities ₹ 2,60,000

Current Liabilities ₹ 40,000

Total Assets to Debt Ratio is:

(a) 3.5 : 1

(b) 2.56 : 1

(c) 2.8 : 1

(d) 3 : 1

Answer

Answer: (a) 3.5 : 1

Question 8.

Profitability Ratios are generally expressed in :

(a) Simple Ratio

(b) Percentage

(c) Times

(d) None of these

Answer

Answer: (b) Percentage

Question 9.

The ratios are primarily measures of earning capacity of the business.

(a) Liquidity

(b) Activity

(c) Debt

(d) Profitability

Answer

Answer: (d) Profitability

Question 10.

The gross profit ratio is the ratio of gross profit to :

(a) Net Cash Sales

(b) Net Credit Sales

(c) Closing Stock

(d) Net Total Sales

Answer

Answer: (d) Net Total Sales

Question 11.

Operating Ratio is:

(a) Profitability Ratio

(b) Activity Ratio

(c) Solvency Ratio

(d) None of these

Answer

Answer: (a) Profitability Ratio

Question 12.

Which of the following is an operating’ income ?

(a) Sale of Merchandise

(b) Interest Income

(c) Dividend Income

(d) Profit on the sale of old car

Answer

Answer: (a) Sale of Merchandise

Question 13.

Which of the following non-operating expense?

(a) Rent

(b) Selling Expenses

(c) Wages

(d) Loss on Sale of Machinery

Answer

Answer: (d) Loss on Sale of Machinery

Question 14.

The following groups of ratios primarily measure risk

(a) Liquidity, activity and profitability

(b) Liquidity, activity and common stock

(c) Liquidity, activity and debt

(d) Activity, debt and profitability

Answer

Answer: (d) Activity, debt and profitability

Question 15.

To know the return on investment, by capital employed we mean:

(a) Net Fixed Assets

(b) Current Asset-Current Liabilities

(c) Gross Block

(d) Fixed Assets + Current Assets-Current Liabilities

Answer

Answer: (d) Fixed Assets + Current Assets-Current Liabilities

Question 16.

The term fixed assets include :

(a) Cash

(b) Machinery

(c) Debtors

(d) Prepaid Expenses

Answer

Answer: (b) Machinery

Question 17.

Ratio based on figures of profit & loss as well a the Balance sheet are:

(a) Profitability Ratios

(b) Operation Ratio

(c) Liquidity Ratio

(d) Composite Ratio

Answer

Answer: (d) Composite Ratio

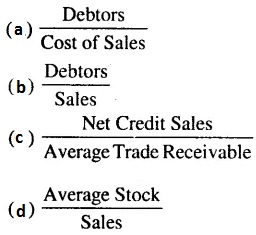

Question 18.

Debtors Turnover Ratio :

Answer

Answer: (c)

Question 19.

When opening stock is ₹ 50,000 closing stock ₹ 60,000 and cost of goods sold is ₹ 2,20,000, then stock turn over ratio is:

(a) 2 times

(b) 3 times

(c) 4 times

(d) 5 times

Answer

Answer: (a) 2 times

Question 20.

What does Creditors Turnover Ratio take into account:

(a) Total credit purchases

(b) Total credit sales

(c) Total cash sales

(d) Total cash purchases

Answer

Answer: (a) Total credit purchases

Question 21.

Cost of goods sold :

(a) Sales – Net profit

(b) Sales – Gross profit

(c) Purchases – Opening Stock

(d) None of the above

Answer

Answer: (b) Sales – Gross profit

Question 22.

The ideal liquid ratio is :

(a) 2 : 1

(b) 1 : 1

(c) 5 : 1

(d) 4 : 1

Answer

Answer: (b) 1 : 1

Question 23.

The ideal current ratio is :

(a) 2 : 1

(b) 1 : 2

(c) 3 : 2

(d) 3 : 4

Answer

Answer: (a) 2 : 1

Question 24.

Operating Ratio is:

(a) Profitability Ratio

(b) Activity Ratio

(c) Solvency Ratio

(d) None of these

Answer

Answer: (a) Profitability Ratio

Question 25.

Profitability Ratio is generally shown in :

(a) Simple Ratio

(b) Percentage

(c) Times

(d) None of these

Answer

Answer: (b) Percentage

Question 26.

If sales is 7 4,20,000 sales returns is 7 20,000 and cost of goods sold 7 3,20,000 gross profit ratio will be :

(a) 20%

(b) 25%

(c) 15%

(d) 10%

Answer

Answer: (a) 20%

Question 27.

Stock turnover ratio comes under :

(a) Liquidity Ratio

(b) Profitability Ratio

(c) Activity Ratio

(d) None of these

Answer

Answer: (c) Activity Ratio

Question 28.

The satisfactory ratio between internal and external equity is. :

(a) 1 : 2

(b) 2 : 1

(c) 3 : 1

(d) 4 : 1

Answer

Answer: (b) 2 : 1

Question 29.

Current Ratio includes:

(a) Stock

(b) Debtors

(c) Cash

(d) All of these

Answer

Answer: (c) Cash

Question 30.

Current Ratio =

(a) Current Assets/Current Liabilities

(b) Liquid Assets/Current Liabilities

(c) Liquid Assets/Current Assets

(d) Fixed Assets/Current Assets

Answer

Answer: (a) Current Assets/Current Liabilities

Question 31.

Liquid Assets include :

(a) Bills Receivable

(b) Debtors

(c) Cash Balance

(d) All of these

Answer

Answer: (d) All of these

Question 32.

Which of the following assets is not taken into consideration in calculating acid-test ratio ?

(a) Cash

(b) Bills Receivable

(c) Stock

(d) None of these

Answer

Answer: (c) Stock

Question 33.

When Cash is 7 10,000 Stock is 7 25,000, B/R is 7 5,000 Creditors is 7 22,000 and Bank Overdraft is 7 8,000 then current ratio is :

(a) 2 : 1

(b) 4 : 3

(c) 3 : 4

(d) 1 : 2

Answer

Answer: (b) 4 : 3

Question 34.

The two basic measures of liquidity are :

(a) Inventory Turnover and Current Ratio

(b) Current Ratio and Liquid Ratio

(c) Current Ratio and Average Collection Period

(d) Current Ratio and Debtors Turnover Ratio

Answer

Answer: (b) Current Ratio and Liquid Ratio

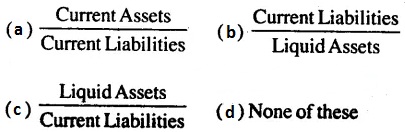

Question 35.

Liquidity Ratio:

Answer

Answer: (c)

Question 36.

The term ‘Current Liabilities’ does not include: .

(a) Sundry Creditors

(b) Debentures

(c) Bills Payable

(d) Outstanding Expenses

Answer

Answer: (b) Debentures

Question 37.

The term‘Current Assets’include

(a) Long-term Investment

(b) Short-term Investment

(c) Furniture

(d) Preliminary Expenses

Answer

Answer: (b) Short-term Investment

Question 38.

Liquid Ratio is also known as:

(a) Current Ratio

(b) Quick Ratio

(c) Capital Ratio

(d) None of these

Answer

Answer: (b) Quick Ratio

Question 39.

To test the liquidity of a concern which of the following ratios is useful ?

(a) Capital Turnover Ratio

(b) Acid Test Ratio

(c) Stock Turnover Ratio

(d) Net Profit Ratio

Answer

Answer: (b) Acid Test Ratio

Question 40.

Which of the following transactions will improve the current ratio ?

(a) Purchase of good for cash

(b) Cash received from customers

(c) Payment of creditors

(d) Credit purchase of goods

Answer

Answer: (c) Payment of creditors

Question 41.

Debt-equity ratio is :

(a) Liquidity Ratio

(b) Activity Ratio

(c) Solvency Ratio

(d) Operating Ratio

Answer

Answer: (c) Solvency Ratio

Question 42.

The formula for finding out Debt-Equity Ratio is:

(a) Long-term Debts/Shareholders’ Funds

(b) Debentures/Equity Capital

(c) Net Profit/Total Capital

(d) None of these

Answer

Answer: (a) Long-term Debts/Shareholders’ Funds

We hope the given NCERT MCQ Questions for Class 12 Accountancy Chapter 10 Accounting Ratios with Answers Pdf free download will help you. If you have any queries regarding CBSE Class 12 Accountancy Accounting Ratios MCQs Multiple Choice Questions with Answers, drop a comment below and we will get back to you soon.