Students can access the CBSE Sample Papers for Class 12 Economics with Solutions and marking scheme Set 3 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Economics Set 3 with Solutions

Time : 3 Hours

Maximum Marks: 80

General Instructions :

- This question paper contains two sections:

Section A – Macro Economics

Section B – Indian Economic Development - This paper contains 20 Multiple Choice Questions of 1 mark each.

- This paper contains Short Answer Questions of 3 marks each to be answered in 60 to 80 words.

- This paper contains 6 Short Answer Questions of 4 marks each to be answered in 80 to 100 words.

- This paper contains 4 Long Answer Questions of 6 marks each to be answered in 100 to 150 words.

Section-A (40 Marks)

Macro Economics

Question 1.

Read the following statements carefully: [1]

Statement 1: Investment Multiplier increases with Increase in Marginal Propensity to save.

Statement 2: Investment Multiplier is the ratio of change in investment and change in Income.

Choose the correct alternative from the following:

(a) Statement 1 is true and statement 2 is false.

(b) Statement 2 is true and statement1 is false.

(c) Both statements1 and 2 are true.

(d) Both statements1 and 2 are false.

Answer:

(a) Statement 1 is true and statement 2 is false.

Explanation:

Investment Multiplier is reciprocal of MPS. As MPS increases, Multiplier decreases and vice-versa.

\(K=\frac{1}{\text { MPS }}\)

MPS = 0.2, then K =\(\frac{1}{0.8}\)=1.25

Now,

if MPS = 0.5, then K = \(\frac{1}{0.5}\) = 2

Investment Multiplier is the ratio of change in Income (AY) and change in Investment (AI).

\(\mathrm{K}=\frac{\Delta \mathrm{Y}}{\Delta \mathrm{I}}\)

Question 2.

While Calculating National Income under Income Method, Which of the following will be taken as component(s) of Operating Surplus? [1]

Alternatives:

I. Royalty and Profit

II. Employer’s Contribution to Provident Fund

III. Retirement Pension and Wages and Salaries

IV. Interest and Rent

(a) I and IV

(b) II and III

(c) I and III

(d) II, III and IV

Answer:

(a) I and IV

Explanation: Operating surplus includes rent, interest, profit and royalty. Employer’s contribution to Provident Fund, Retirement pension and wages and salaries are part of compensation of employees.

![]()

Question 3.

Given the Consumption Function, C = 500 + 0.4Y, where C is Consumption Expenditure and Y is National Income. Value of Average Propensity to Save is _________ at Income level of Rs. 1000 crores. [1]

(a) 0.9

(b) 0.6

(c) 0.1

(d) 1

Answer:

(c) 0.1

Explanation: APS refers to average propensity save, which defines the amount of savings in every 1 rupee of income. When Savings are negative or when Consumption exceeds Income. It occurs below Break Even Point.

Y = 1,000 crores

C = 500 + 0.4Y

C = 500 + 0.4 (1,000)

C = 500 + 400

C = 900 crores

Savings = Income- Consumption

S = Y- C = 1,000- 900 = 100 crores

APS = \(\frac{S}{Y}=\frac{100}{1,000}=0.1\)

Question 4.

As per The Economic Times, published dated July 3, 2023: [1]

“India’s 2022 Global Commercial Services Exports share doubled to 4.4% from 2% in 2005: WTO-World Bank.”

Under which head of Balance of Payment Account of India, Commercial Service Exports will be recorded?

(a) Balance of Foreign Lending

(b) Unilateral Transfer Balance

(c) Invisibles Balance

(d) Merchandise trade Balance

Answer:

(c) Invisibles Balance

Explanation: Exports of Services i.e. communication, consultation, insurance etc. will be recorded in Balance of Invisibles. It includes export and import of services; unilateral transfers from and to rest of the world. Foreign lending is a part of capital account of BOP, and merchandise trade balance records export and import of goods only.

Question 5.

“Anil worked as an employee in Noida in MNC. Due to Corona crisis, he lost his job and decided to start his own business in his home town Lucknow. He sold his 3 BHK flat in Noida and bought a plot in Lucknow to live in. ” [1]

On the basis of above information, identify the Function of Money.

(a) Standard of Deferred Payments

(b) Transfer of Value

(c) Storage of value

(d) None of these

Answer:

(b) Transfer of Value

Explanation: ‘Transfer of Value’ function of money states that Value of Money can be transferred from one place to another. In the information given above, he received money from selling an asset (flat) in Noida and used this money for purchasing another asset (plot) in Lucknow. Since, money is transferred from Noida to Lucknow, it represents ‘Transfer of value’, function.

![]()

Question 6.

Identify the correct sequence of alternatives given in ColumnII by matching them with respective items in Column I: [1]

| Column I | Column II |

| A. Commercial bank | (i) Borrowings of people |

| B. Secondary Deposits | (ii) Selective Credit control |

| C. Statutory Liquidity Ratio | (iii) Accepting deposits from People |

| D. Marginal Requirement of Loans | (iv) Apex Monetary Authority |

Choose the correct alternative:

(a) A-(iii); B-(i); C-(iv); D-(ii)

(b) A-(i); B-(ii); C-(iii); D-(iv)

(c) A-(iv); B- (i); C-(ii); D-(iii)

(d) A-(ii); B- (iv); C-(i); D-(iii)

Answer:

(a) A-(iii); B-(i); C-(iv); D-(ii)

Explanation:

(i) Function of Commercial bank is accepting deposits from people and advancing them loans.

(ii) Secondary deposits are those deposits which arise due to loans given by bank to people. These are also known as derivative deposits. These are reflected as a part of demand deposits of the banks.

(iii)Statutory Liquidity Ratio (SLR) is fixed by Apex Monetary Authority i.e. Central bank of a country. In India, it is Reserve Bank of India i.e., (RBI).

(iv)Marginal requirement of loans is a qualitative or selective tool of monetary policy to control credit in the economy.

Question 7.

Graphically, Saving Curve is __________ (i) ________ sloped having __________ (ii) __________ Shape. It is due to _______ (iii) _________. [1]

Choose the correct alternative to fill in the blanks.

(a) (i) Negative (ii) Curved (iii) Falling APS

(b) (i) Positive (ii) Linear (iii) Rising APS

(c) (i) Positive (ii) Linear (iii) Constant MPS

(d) (i) Negative (ii) Curved (iii) Rising MPS

Answer:

(c) (i) Positive (ii) Linear (iii) Constant MPS

Explanation:

(i) Saving increases with increase in Income. So, it is positively sloped.

(ii) Saving Curve is a straight line or linear. The slope of Saving Curve is marginal Propensity to Save (MPS). If MPS is constant due to increase in Income, then Saving Curve will be straight line or linear.

Question 8.

Identify the correct Impact(s) of situation highlighted in the given picture: [1]

I. Increase in credit side of balance of trade

II. Increase in debit side of balance of trade

III. Increase in Imports of visible goods

IV. Increase in exports of visible goods

(a) I and IV

(b) II and III

(c) I and II

(d) II and IV

Answer:

(b) II and III

Explanation: Trade deficit refer to a situation where the country’s import dues exceed the receipts from the export. The given pictures shows trade deficit i.e. excess of import of goods over export of goods. Increased imports lead to greater outflow of foreign exchange. It signifies increase in payment or debit side of balance of trade.

![]()

Question 9.

In an Economy, Investment Expenditure increased by ₹1,500 crores and Marginal Propensity to consume is 0.5. National Income will increase by __________ crores and Saving will increase by ____________ crores. (Choose the correct alternative to fill in the blanks) [1]

(a) 1,500, 3,000

(b) 3,000, 1,500

(c) 7,500, 1,500

(d) 750, 375

Answer:

(b) 1,500, 3,000

AI = 1,500 crores

MPC = 0.5

\(\frac{1}{\mathrm{MPC}}=\frac{1}{0.5}=2\)

\(\begin{aligned} K & =\frac{\Delta Y}{\Delta \mathrm{I}} \\ 2 & =\frac{\Delta \mathrm{Y}}{1,500}\end{aligned}\)

2×1,500 = ΔY

3,000 = ΔY

MPS =1- MPC =1- 0.5 = 0.5

\(MPS =\frac{\text { Change in saving }}{\text { Change in income }}\)

\(\mathrm{MPS}=\frac{\Delta \mathrm{S}}{\Delta \mathrm{Y}}\)

\(0.5=\frac{\Delta S}{3,000}\)

0.5×3000 = ΔS

1500 = ΔS

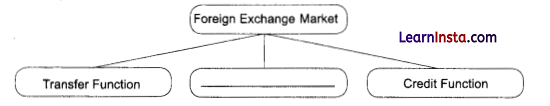

Question 10.

Read the following chart carefully and choose the correct alternative: [1]

Alternatives:

(a) Import Function

(b) Export Function

(c) Exchange Function

(d) Hedging Function

Answer:

(d) Hedging Function

Explanation: Foreign exchange market performs 3 functions:

- Transfer of purchasing power in terms of foreign exchange across the countries.

- Provides credit in terms of foreign exchange for export and import of goods and services across the countries.

- Protection against risk related to fluctuations in foreign exchange market. It is known as hedging function of foreign exchange market.

Question 11.

“Indian Stock Market received an investment of ₹2,000 crores through Fils.” [3]

State the meaning of FII and discuss under which account of Balance of Payments will it be recorded and Why?

Answer:

- FII stands for Foreign Institutional Investment.

- FII refers to investment made by foreign companies, institutions or individuals by purchasing the shares or stocks of domestic companies.

- It gives them ownership right in the domestic companies but no right to control and manage the same.

- It is a kind of foreign investment and hence,it will be shown under Capital Account of BOP, because Capital Account of BOP records those transactions with rest of the world which impact asset and liabilities of the country.

- It is a positive or credit item of BOP because of inflow of foreign exchange into the country.

![]()

Question 12.

(A) On the Basis of given data, estimate the value of “Intermediate Consumption”: [3]

| Items | Amount (in ₹ crores) |

| Net Value Added At Factor Cost | 4,000 |

| Subsidies | 400 |

| Net Factor Income From abroad | 80 |

| Closing Balance of Inventory | 1,200 |

| Opening Balance of Inventory | 200 |

| Value of Sales | 10,000 |

| Consumption of fixed Capital | 1,400 |

OR

(B) State the meaning of following: [3]

(i) Net Factor Income from Abroad

(ii) Intermediate Goods

(iii) Circular Flow of Income

Answer:(A)

NDPFC = 4,000 crores

GDPMP = NDPFC + Consumption of Fixed Capital + Net Indirect Taxes

= 4,000 + 1,400 +(- 400) = 5,000 crores

Net Indirect Taxes = Indirect Taxes- Subsidies

= 0- 400 =- 400 crores

Value of Output = Sales + Change in Inventories

= 10,000 + 1,000 = 11,000 crores

Change in Inventories= Closing Inventory- Opening Inventory

= 1,200- 200 = 1,000 crores

GDPMP = Value of Output-Intermediate consumption

5,000 = 11,000- Intermediate Consumption

Intermediate Consumption = 11,000- 5,000 = ₹6,000 crores

OR

(B) (i) Net Factor Income from abroad: It is the difference between Factor Income earned by normal residents of a country from abroad and Factor income earned by non-residents from the country.

(ii) Intermediate Goods: Those goods which are within the boundary line of production or value is still to be added or is not ready for sale to final users. For e.g., wood used in making of furniture. These are goods that are used by businesses for producing goods or service.

(iii) Circular flow of Income: It refers to the never ending flow of Income across different sectors of the economy. It consists of three phases- Production, Income generation and expenditure of Income.

Question 13.

In an Economy, C = 400 + 0.5Y is the consumption function where C is Consumption Expenditure and Y is National Income. Investment Expenditure is ₹800 crores. Is the Economy in equilibrium at an income level of ₹3,000 crores? Justify your answer. [4]

Answer:

Given :

C = 400 + 0.5Y

I = 800 crores

To Find: Is Economy in equilibrium when Y = 3,000 crores

Solution: For an economy to be In Equilibrium, AD should be equal to AS or Y = C +1

AD = AS

AD =C +I

AS =Y

Y =C +I

3,000 = 400 + 0.5 Y + 800

3,000 = 1,200 + 0.5 (3,000)

3,000 = 1,200 + 1,500

3,000 ≠ 2,700

Economy is not in Equilibrium as here Y ≠ C +1 or AD ≠ AS

![]()

Question 14.

(A) Discuss the components of Aggregate Demand In a four-sector economy.[4]

OR

“With an objective to correct deflation. Reserve Bank of India may decrease margins requirement.”

Explain the role of RBI for correcting the deflationary gap.

In a four sector economy, AD = C +I + G + (X-M)

Causes:

- Household Consumption Expenditure (C): It is the expenditure incurred by household on purchase on final goods and services. It is dependent on Personal Disposable Income.

- Private Investment Expenditure (I): It is the expenditure incurred by producer sector on addition of capital goods. It is dependent on rate of interest and marginal efficiency of capital.

- Government Expenditure (G): It is the expenditure incurred by government on consumption and investment in the country. And it is independent of the income level or expected profitability.

- Net Exports (X-M): It is difference between exports and imports. These transactions are done with rest of the world.

OR

(B) Deflationary gap refers to a situation when at full employment level of income, AD falls short of AS. It is called deficient demand. Margin requirements refers to the margin on the security provided by the borrower. When margin is lower, the borrowing capacity of the borrowing is higher. When Central Bank lowers the margin, the borrowing capacity of the borrowers increase. This raise AD. Thereby, role of margin requirements helps in correcting the deflationary gap.

Question 15.

Elaborate various method of qualitative credit control by RBI.[4]

Answer:

Credit control, which is also called control of money supply, is most important function of Reserve Bank of India under the monetary policy regulations. It is required for the smooth functioning of the economy. The RBI controls the Credit granted/allocated by commercial banks. RBI tries to regulate price level in the economy by adopting two types of methods:

(i) Quantitative control to regulate the volume of total credit.

(ii) Qualitative Control to regulates the flow of credit.

Qualitative Measures: These are used by the RBI for selective purposes.

Some important measures under this category are as follows:

(a) Consumer Credit Regulation: This refers to issuing rules regarding down payments and maximum maturities of instalment credit for purchase of goods.

(b) Margin requirements: This refers to difference between the securities offered and amount borrowed by the banks. By using this method, during the period of inflation with a view to control credit, the RBI raises the margin and during deflation it lowers the margin to expand the credit. This method also enables the commercial banks to direct their funds to essential activities rather than speculative activities.

(c) Moral Suasion: Moral suasion aims at strengthening natural confidence and understanding between the monetary authority and the banks as well as financial institutions. It is not a statutory obligation. It is only a persuasion of commercial banks not to apply for further accommodation from RBI.

(d) Direct Action: This step is taken by the RBI against banks that don’t fulfill conditions and requirements. RBI may refuse to rediscount their papers or may give excess credits or charge a penal rate of interest over and above the Bank rate, for credit demanded beyond a limit.

(e) Rationing of credit: It is made by regulating the purposes for which the loans are given among the various member banks. Finance is to be distributed to various sectors as per their individual requirements.

(f) Credit Authorization Scheme: Under the scheme, commercial banks were asked to obtain prior approval of RBI for giving any fresh credit to any single party.

(g) RBI Guidelines: RBI issues oral, written statements, appeals, guidelines, and warnings etc. to the banks.

It is clear that under the selective or qualitative credit control methods, the RBI encourages flow of credit only to certain types of industries and discourages the use of bank credit for certain other purposes.

![]()

Question 16.

(A) On the basis of given information, calculate the value of:[3]

(i) Capital Expenditure

(ii) Interest Payments [2]

| Items | Amount (in ₹ thousand crores) |

| Revenue Receipts other than Tax | 60 |

| Borrowings | 200 |

| Revenue Deficit | 60 |

| Non- debt Capital Receipts | 280 |

| Tax Receipts | 100 |

| Primary Deficit | 160 |

(B) State the meaning of Disinvestment with Suitable Example. [1]

OR

(C) Giving valid reason(s), categorise the following as Direct Tax or Indirect Tax: [3]

(i) Government of India decided to Impose 28% GST on online gaming.

(ii) Income tax collections grew 20% in financial year 2022-23.

(D) “The Finance Ministry has targeted to bring down the fiscal deficit to 5.9 percent of GDP in FY-24 from 6.4 percent of GDP in the preceding year.” [3]

– Business Standard, June 30, 2023.

State one positive and one negative impact of Fiscal Deficit on Indian Economy.

Answer:

(A) Fiscal Deficit = Borrowings = 200

Revenue Deficit = Revenue Expenditure- Revenue Receipts

60 = Revenue Expenditure- (Tax receipts + Non-tax Receipts)

60 = Revenue Expenditure- (100 + 60)

60 = Revenue Expenditure- 160

Revenue Expenditure = 160 + 60 = 220

Fiscal Deficit = (Capital Expenditure + Revenue Expenditure)- (Revenue Receipts + Non-debt Capital Receipts)

200 = ( Capital Expenditure + 220 )- ( 160 + 280)

200 = Capital Expenditure + 220- 440

Capital Expenditure = 200- 220 + 440

Capital Expenditure = 420

Primary Deficit = Fiscal Deficit- Interest Payments

160 = 200- Interest Payments

Interest Payments = 200- 160 = 40

(B) Disinvestment: It refers to selling off the share of Public Sector Undertaking to private sector. It is a step taken by government towards privatisationin the country. It can also be defined as selling an asset or subsidiary. For e.g., Sale of Air India to Tata group.

(C) (i) It is an Indirect tax. Indirect tax is imposed on goods and services. In India, it is GST which is imposed on goods and services. Online gaming is a platform which provides services to people play online and earn money. Its burden is shifted to consumers who use this service and paid by service providers to the government.

(ii) Income tax is a direct tax. Direct tax is imposed on income, profits and wealth of people. As income increases, rate of tax also increases and its burden cannot be shift to another person.

(D) (i) Positive Impact of Fiscal Deficit: Fiscal deficit means excess of Government expenditure over Government, receipts. And Increased Fiscal Deficit indicates increased Government. Expenditure on welfare programmes like roadways, education, health, communication, power etc. it increases the GDP growth and employment in the country. It can lead to inflation, devaluation of the currency and an increase in the debt burden.

(ii) Negative Impact of Fiscal Deficit: Fiscal deficit not only indicates borrowings but also interest payments on borrowings. When the situation becomes severe, sometimes, borrowings have to be undertaken even to pay interest payments.It puts the economy into debt trap which hurts the country’s credibility.

![]()

Question 17.

(A) Giving valid reasons, explain how the following would be treated while estimating domestic income. [3]

(i) Free accommodation facility given to an employee.

(ii) Winning of a lottery prize.

(B) “All Producer Goods are Capital Goods.” Do you agree with the given statement? Give any one valid reason in support of your answer. [3]

Answer:

(A) (i) Free accommodation facility given to employee by his company is “Wages and salaries in kind”. It is given for furnishing his services and hence, will be included in National Income.

(ii) Winning of a lottery prize does not result in flow of goods and services in economy, hence it is not included in national income.

(B) No, I don’t agree with the given statement.

Reason:

(i) Producer goods are those which are used in the process of production of other goods. It Includes (i) Capital Goods and (ii) Raw materials.

(ii) Capital Goods are fixed assets used in production like Plant and Machinery. These are of very high value and are repeatedly used over a large number of years. Depreciation is incurred on these and need replacement after years.

(iii) Raw materials are single use producer goods like cotton used in making cloth. These are of less value and are not repeatedly used over years. Depreciation is not incurred on these and do not need substitution after years.

(iv) So, All Producer goods are not capital goods as it includes capital goods as well as raw materials.

Section-B (40 Marks)

Indian Economic Development

Question 18.

Read the following statements carefully and choose the correct alternative: [1]

Statement 1: Planning Commission was established in 1950 in India.

Statement 2: The objective of first five year plan was industrializationin the country.

(a) Statement 1 is true and Statement 2 is false.

(b) Statement 1 is false and Statement 2 is true.

(c) Both Statements 1 and 2 are true.

(d) Both Statements 1 and 2 are false.

Answer:

(a) Statement 1 is true and Statement 2 is false.

Explanation:

- Planning commission was setup in 1950 while the first five year plan introduced in 1951.

- The focus of first five year plan was on agriculture and second five year plan focused on industrialisation in the economy.

Question 19.

“India has improved various health and economic indicator since Independence.” [1]

Which one of the following Indicators are not considered while measuring Human Development Index of a country?

(a) Life expectancy rate

(b) Constitutional rights of citizens

(c) Percentage of undernourished population

(d) Infant mortality rate

Answer:

(b) Constitutional rights of citizens

Explanation: Constitutional rights of citizens fall under liberty indicators. It measures the extent to which citizens are given freedom to their rights and participation in decision making of government. And it is not considered while measuring HDI of a country.

![]()

Question 20.

Identify the correct sequence of alternatives givenin ColumnII by matching them with respective items in Column I: [1]

| Column I | Column II |

| A. Green Revolution | I. Labour Intensive |

| B. Small Scale Industry | II. Protection to domestic industry |

| C. Land Reforms | III. Rise in area under cultivation |

| D. Inward Looking Trade Strategy | IV. Ceiling on Land Holdings |

(a) A-(II); B-(III); C-(IV); D-(I)

(b) A-(I); B-(II); C-(IV); D-(III)

(c) A-(IV); B-(II); C-(I); D-(III)

(d) A-(III); B-(I); C-(IV); D-(II)

Answer:

(d) A-(III); B-(I); C-(IV); D-(II)

Explanation:

- Green Revolution focused on use of HYV seeds, fertilizers, pesticides and spread of irrigational facilities which resulted in spurt rise in wheat and rice. It induced the farmers to increase in estate i.e., area under cultivation.

- Small Scale Industry uses that technology, uses more of labour and less of capital. So,it is Labour intensive industry.

- Land Reforms were taken by the Government so as to reduce the inequalities in Agriculture, and Ceiling on land holdings was donein this direction. A maximum limit of land holding was fixed and surplus land was distributed among small or landless farmers.

![]()

Question 21.

Study the following picture and answer the given question: [1]

Under this system, Government provides essential commodities especially foodgrains to poor people at

affordable prices through fair price shops across the country. Such kind of system is called ____________.

(a) Micro credit System

(b) Public Distribution System

(c) Self-help Group System

(d) Marginal Support Price System

Answer:

(b) Public Distribution System

Explanation: Under PDS( Public .Distribution System), essential commodities like wheat, rice, kerosene, sugar, oil etc are distributed to poor people at a very less price than market price through fair price shops called ‘Ration Depots’ across the country.It ensures food guarantee to all the people in the country.

Question 22.

Read the following statement: Assertion (A) and Reason (R). Choose the correct alternative from those given below: [1]

Assertion (A): Profit making public sector units was given the status of Navratnas.

Reason (R): Goods and Services tax was introduced in 1991 as a major tax reform.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) isnot the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(c) Assertion (A) is true, but Reason (R) is false.

Explanation: Profit making PSUs was given the status of Navratnas. For e.g., ONGC, IOL, SAIL. This status was first given to a set of 9 public sector enterprises, which increased to 13 companies in India now. Goods and services tax was introduced in 2017 as a major tax reform.

Question 23.

Economy of China is ahead ofIndia and Pakistan. It is due to highest ___________ sector contribution to GDP. [1]

Choose the correct alternative:

(a) Primary Sector

(b) Secondary Sector

(c) Tertiary Sector

(d) None of these

Answer:

(b) Secondary Sector

Explanation: China’s highest contributionin GDP is related to Secondary Sector. Secondary sector is manufacturing sector. And China focuses on manufacturing rather than primary and service sector. FDI through special economic zones paved the way for China to be a manufacturing hub.

![]()

Question 24.

Identify the correct sequence of alternatives givenin ColumnII by matching them with respective items in Column I: [1]

| Column I | Column II |

| A. Minimum Support Price | (i) Distribution of food grains to BPL families |

| B. Organic Farming | (ii) Less yield and high cost |

| C. Buffer Stock | (iii) Assurance to farmers for their produce |

| D. Micro credit programme | (iv) Self-help groups |

Choose the correct alternative:

(a) A-(i); B-(ii); C-(iii); D-(iv)

(b) A-(iii); B-(ii); C-(i); D-(iv)

(c) A-(ii); B-(i); C-(iv); D-(iii)

(d) A-(iv); B-(iii); C-(ii); D-(i)

Answer:

(b) A-(iii); B-(ii); C-(i); D-(iv)

Explanation:

(i) Minimum Support Price (MSP) is the minimum price offered by the government to the farmers for purchasing their produce.

(ii) Organic farming uses organic methods to produce crops but it gives less yield and involves huge cost as comparative to farming using HYV technology.

(iii)Food grains purchased by government from farmers are stored into warehouse. It is known as buffer stock which is used to distribute at affordable prices to the poor people.

(iv)Self-help groups are micro-credit programmes in rural areas in which people pool their small savings and provide loan to their members.

Question 25.

Which of the following Statement is incorrect regarding performance of Economies of India and its Neighbours? [1]

(a) GLF campaign launched to start the industrialisation in China.

(b) Pakistan initiated process of economic reformsin 1988.

(c) Dual pricing was adopted by India during reform period.

(d) India adopted the mixed economic system.

Answer:

(c) Dual pricing was adopted by India during reform period

Explanation: Dual pricing was adopted by China which was adopted during second phase of economic reforms. Under it, government fixed prices for farmers and industries for purchase and sale of goods, and price for other transactions were left to the market forces.

Question 26.

Read the following statements carefully:

Statement 1: Commune system of agriculture was implemented in China in 1958. [1]

Statement 2: Pakistan is not a member country of Group of 20 nations (G- 20)

Alternatives:

(a) Statement 1 is true and Statement 2 is false.

(b) Statement 2 is true and Statement 1 is false.

(c) Both Statements 1 and 2 are true.

(d) Both Statements 1 and 2 are false.

Answer:

(c) Both Statements 1 and 2 are true.

Explanation:

(i) Commune system of agriculture was introduced in China in 1958. It refers to collective farming in which Farmers pooled their land to create large sizes so as to reap the benefit of greater output and less cost.

(ii) China and India are member countries of G-20, while Pakistan is not its member country.

Question 27.

Choose the correct Chronological order: [1]

(i) Make in India

(ii) Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA).

(iii) Pradhan Mantri Gram Sadak Yojna

(iv) Pradhan Mantri MUDRA Yojna

(a) (iv), (iii), (i), (ii)

(b) (ii), (iii), (iv), (i)

(c) (iii), (ii), (i), (iv)

(d) (i), (ii), (iii), (iv)

Answer:

(c) (iii), (ii), (i), (iv)

Explanation: The correct choronological order are:

Pradhan Mantri Gram Sadak Yojana- 2000

MNREGA- 2005

Make in India -2014

Pradhan Mantri MUDRA Yojana – 2015

![]()

Question 28.

“During the Colonial Period, Britishers didn’t pay more attention to the agriculture especially food grains and forced farmers to produce cash crops.” [3]

Discuss this step taken by British rule which led to reduction of food crops

OR

“India had surplus balance of trade before Independence yet was economically backward.”

Justify the given statement with valid explanation

Answer:

Step Taken under British Rule: Forced Commercialisation of Agriculture:

- Commercialisation of agriculture means a shift from subsistence farming to commercial farming i.e., farming for self- consumption to farming for sale in the market.

- Farmers were forced to grow commercial crops like tea, jute, indigo instead of wheat and rice as it would provide raw materials for Britain. Farmers were given advance payments to grow cash crops especially indigo for textile industry in Britain.

- Due to this, Production of food grains reduced acutely.

OR

India had surplus BOT during British rule yet was economically backward.

Arguments:

- Surplus BOT means excess of export of goods over import of goods which should be a good sign for economy but it was not so because of Discriminatory tariff policy of British rule.

- Export of primary goods only contributed to surplus trade balance.

- Production of food grains reduced in the domestic territory because of forced commercialisation.

- This surplus was used by Britishers to meet war and administrative expenses and not on country’s welfare. That’s why, Indian Economy remained economically backward.

Question 29.

“Pradhan Mantri Kaushal Vikas Yojna 4.0, to be launched to skill lakhs of youth within the next three years covering new age courses for industry 4.0 like coding, AI, robotics, mechatronics, IOT, 3D printing, drones and soft skills.” [3]

Explain the impact of this yojna on human capital formation in India.

Answer:

Impact of PMKVY 4.0 on human capital formation:

- It focuses on providing skill based courses which are on high demand in the world of technology.

- It imparts practical knowledge rather than theoretical knowledge to the youth which increases the competitiveness at the national and international level.

- Enhanced skills of the modern age will increase their productivity and efficiency of lakhs of youth which helps in building a large base for human capital formation.

- Youth with advanced skills will definitely prove an asset not only for themselves, but for nation as well.

Question 30.

“India (142 billions) overtakes China (141 billions) as the world’s most populous country.” [4]

Elaborate its possible impacts on human development index of India.

Answer:

Human Development Index is an index of development of a country based on social and economic factors like health, education and standard of living, and increased population certainly affects HDI of a country.

Possible Impacts of HDI of India:

- Increased number of people on a limited piece of land puts pressure on the resources.

- Nature has given limited resources. It disturbs the balance of supply and demand of resources.

- Increased demand of population cannot be met from limited resources.

- It badly influence the environment in terms of increased pollution of air, water and noise, puts burden on land, cutting of forests etc.

- To fulfil the Educational and health needs of a large number of population becomes a challenge for the country.

- Objective of providing employment to all cannot be achieved easily.

So, overtaking China in terms of population is not a good sign for improving HDI of India.

![]()

Question 31.

(A) State and Elaborate whether the following statements are true or false, with valid arguments:

(i) Moneylenders and landlords are important sources of institutional credit in rural areas. [2]

(ii) State Bank of India is an apex institution for planning and policy-making for rural credit. [2]

OR

(B) “Labour force of a country is quite different from work force of a country.”

Do you agree with the given statement? Justify your answer.

Answer:

(A) (i) False. Moneylenders and landlords are traditional or non-institutional sources of credit in rural areas. Institutional sources of credit include commercial banks, regional rural banks and cooperative societies.

(ii) False. National Bank for Agriculture and Rural Development (NABARD) is the apex institution for planning and policy making for rural credit. Whereas, SBI is a commercial bank, which works under the guidance of NABARD and helps in expanding rural credit.

OR

(B) Yes, I do agree with the given statement.

Arguments:

- Labour Force refers to the number of workers actually working and not working but willing to work.

- Work Force refers to the number of workers actually working.It does not include those people who want to work but are not getting job.

- Labour force is a wider concept as it includes work force as well as unemployed people.

- Work force is narrow concept as it is a part of Labour force of a country.

- Labour Force = Work Force + Unemployed.

- Workforce = Labour Force- Unemployed.

- While measuring the participation rate in population, work force is considered rather than labour force because work force contributes in the value addition in the economy rather than labour force which includes unemployed people as well.

Question 32.

Identify the type of unemployment depicted in the above image. State three causes behind this situation in agricultural sector. [4]

Answer:

The above image depicts Disguised Unemployment. It refers to that situation when number of people employed is greater than actually required, and it is most prevalent in agriculture sector.

Causes of Disguised Unemployment:

- Lack of job opportunities in rural areas force the people to work on fields.

- People in rural areas do not have sufficient skills and education to work in other sectors.

- Due to joint family system, every member of the family is engaged in farm activities. They seem to be employed but in actually they are not working.

- Land holding size is also decreasing in agriculture, but still same number of people is working on it. It leads to increase in disguised unemployment.

- There is a lack of bank branches and cooperative societies in rural areas which could provide credit for non-farming activities like dairy farming, poultry etc. It adds to increase in disguised unemployment.

Question 33.

(A) “Institutional Reforms were initiated by Indian Governmentin the field of Agriculture.” [3]

Outline any three steps taken by government in this regard.”

(B) “Pre-reforms Era is also known as License- Permit- Quota Raj.” [3]

Justify the given statement with valid argument(s).

OR

(C) “Under NEP, 1991, it was decided to give freedom to production units from direct controls of govt.” [3]

In the light of given statement, discuss the reforms related to trade and investment in the country.

(D) “Globalisation aimed at integrating the economy with rest of the world, and outsourcing is an outcome of it.” Discuss it. [3]

Answer:

(A) Institutional Reforms in Agriculture:

- Abolition of Zamindari system: Zamindars were removed and actual tillers of the soil were given ownership rights. Now they directly pay land revenue to the government instead of any intermediary.

- Consolidation of land holdings: It means to consolidate the land at one place instead of scattered lands here and there. It saved the cost of production.

- Ceiling on land holdings: A maximum limit of ownership of land size was fixed and surplus land was distributed among small and landless farmers. It aimed at promoting equity in the distribution of land.

(B) Pre-reforms period is also known as License- Permit -Quota Raj because of following reasons:

- Industries in the private sector could be set up only after taking license from government.

- License was not only necessary for setting up a new enterprise, but also for expanding the production capacity of the existing firm.

- It gave rise to red tapism and corruption in the Public sector undertakings. Big industrial houses could easily take licensebutit was not so easy for small enterprises.

- Secondary sector needs industrial goods which could be imported from other countries, and quotas were fixed by the government for import of different goods from abroad.

- License and Quota system jeopardised the growth of Private sector and process of Industrialisation in the country.

OR

(C) Trade and Investment Reform under NEP 1991:

- Abolition of Import Licensing: Import licensing was removed except import of chemical and hazardous products. It was a big relief for Industrial Sector asit saved a lot of time and money for obtaining license for importing of capital goods.

- Reduction in Tariff: Tariff means tax on imports. It was reduced which led to fall in prices of imported goods especially capital goods. This step also favored importers from Industrial sector.

- Abolition of Export Duty: In 1991, export promotion policy was adopted instead of import substitution. To make prices ofIndian products competitive in the international market, export duty was removed. It gave a boost to the international trade from India to other countries.

(D) Outsourcing is an outcome of Globalisation.

Reasons:

- It refers to hiring services from rest of the world. For. e.g., consultancy, BPO, call centers, Software, coaching etc.

- Globalisation means to integrate the economy with rest of the world. It encourages using the world resources rather than the country’s resources.

- Indian Economy opened the doors for rest of the world in 1991, and India became an outsourcing hub for other countries.

- Now, Developed countries like UK, USA hire services from India because of cheap labour as compared to other countries.

- Growth inIT sector also enabled the youth to outsource their services.

![]()

Question 34.

Read the following text carefully and answer the given questions on the basis of the same and common understanding:

The Department of Forest and Wildlife Preservation has identified a total of 26,461 hectares non-forest land of 139 villages in four districts — Mahendragarh, Rewari, Gurugram and Nuh — for compensatory afforestation. It will ensure sustainable development of Great Nicobar Island, where an ambitious project will see the felling of a large number of trees.

“The Ministry of Environment, Forest and Climate Change examined the proposal and requested the UT Administration to explore the possibilities to identify land for compensatory afforestation on nonnotified forest areas instead of degraded forest lands preferably in forest deficit states like Haryana, Uttar Pradesh,” the sources said, adding that thereafter, the process to identify such land was initiated in the state.

“The identified land falls under special Section 4 and 5 of the PLPA/ Aravali Plantation/ Pahad. Therefore, it would be appropriate to utilise this land for afforestation purposes. Accordingly, the BDOs be directed to pass resolutions of villages under their jurisdiction as administrator of panchayats to enable the state government declare these areas as ‘protected forests’ so that the plantation, biodiversity and natural resources are conserved there.”

(i) What do you understand by the term Afforestation? [2]

(ii) “Rapid Economic development for present generation takes place at the cost of future generations. [4]

And to sustain the resources for future generation is need of the hour. ” Explain any two ways in this regard.

Answer:

(i) Afforestation: It refers to planting trees on a massive scale in those areas where there has been no plantation earlier. It helps in combating the environmental issues like global warming, reduction soil fertility, depletion of flora and fauna etc.

(ii) Economic development should be such thatit preserves the resources for future generation as well. It is called Sustainable Development.

Ways for Sustainable Development:

(a) Use of Solar Energy: Sum is the abundant source of energy. It is eco-friendly and a nonexhaustible source of energy. Use of solar panels at homes and in industries, generating power through solar energy can be helpful for sustainable development.

(b) Biocomposting: Use of organic manure in farming is helpful in maintaining the nutrients in the soil. It increases the soil fertility as it does not use harmful chemical fertilizers and pesticides.