Students can access the CBSE Sample Papers for Class 11 Accountancy with Solutions and marking scheme Set 4 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 11 Accountancy Set 4 with Solutions

Time Allowed : 3 hours

Maximum Marks: 70

General Instructions:

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts, Part A and B.

- Question Nos. 1 to 15 and 25 to 29 carries 1 mark each.

- Questions Nos. 16 to 18,30 to 32 carries 3 marks each.

- Questions Nos. 19,20 and 33 carries 4 marks each

- Questions Nos. from 21 to 24 and 34 carries 6 marks each

- There is no overall choice. However, an internal choice has been provided in 7 questions of one mark, 2 questions of three marks, 1 question of four marks and 2 questions of six marks

Part – A (Financial Accounting – I)

Question 1.

Accounting requires events to be expressed in terms of money. Transactions should involve transfer or exchange of monetary value between the business entity and outsiders. Which characteristic of Accounting is described here?

(A) Economic events

(B) Identification, measurement, recording and communication

(C) Users of information

(D) None of the above [1]

Answer:

(A) Economic events

Question 2.

Assertion: Accounting information should be comparable.

Reason: The role of accounting has been changing with the changes in economic development increasing societal demands’

(A) Both A and R are correct, and R is the correct explanation of A.

(B) Both A and R are correct, but R is not the correct explanation of A.

(C) A is correct but R is incorrect.

(D) A is incorrect, but R is correct. [1]

Answer:

(B) Both A and R are correct, but R is not the correct explanation of A.

Explanation: It is not sufficient that financial information is relevant and reliable at a particular time in a particular circumstance or for a particular reporting entity. The users of the general purpose financial reports need to be able to compare various aspects of an entity at one time and over the time; and between entities at a time and over the time.

Question 3.

Tashi, an owner of electronics shop sells a television to Umang. If Umang has not paid for the television immediately, which account will be debited in such a case?

(A) Sales

(B) Umang

(C) Tashi

(D) Cash [1]

OR

Aashi purchased a machinery from Namita Enterprises for ₹ 2,00,000. While installing the machinery in her factory she paid Vivek ₹ 14,000. What is the nature of the installation charges as paid by her to Vivek?

(A) Capital Receipt

(B) Revenue Receipt

(C) Capital Expenditure

(D) Revenue Expenditure [1]

Answer:

(B) Umang

Explanation: In this case the television is sold on credit. In the case of credit sales, the accounts that are affected are the sales account and the debtor’s account. Thus, Umang’s Account will be debited to sales account in this case.

OR

(C) Capital Expenditure

Explanation: It is an example of capital expenditure as installation expenses are non-recurring in nature and will be directly added to the cost of the asset, that is, machinery in this case.

Question 4.

accounts are the accounts which record dealings of profits, gains, expenses and losses.

(A) Nominal

(B) Personal

(C) Real

(D) None of the above [1]

OR

……………….. account should be debited if wages are paid for installation of a machinery.

(A) Installation

(B) Machinery

(C) Wages

(D) Capital [1]

Answer:

(A) Nominal

OR

(B) Machinery

Question 5.

Consider the following statements with regard to Cash Basis of Accounting:

(i) Suitable for Non-profit organizations and other organizations that mainly deal in cash transactions.

(ii) Not recognized under the Companies Act.

(iii) Does not give a true and fair view of Profit and Loss and Balance Sheet, as expenses relating to outstanding and prepaid and incomes relating to advance and accrued are not adjusted as required under the Matching Principle.

(iv) Does not distinguish between capital and revenue expenditure, making comparisons between two years inconsistent and impractical.

Which of the following alternatives state the disadvantage of using such a basis of accounting:

(A) (i), (ii) and (iii)

(B) (ii), (iii) and (iv)

(C) (i), (ii) and (iv)

(D) (ii) and (iv)

Answer:

(B) (ii), (iii) and (iv)

Question 6.

Pick the odd one out:

(A) Cash in Hand

(B) Cash at Bank

(C) Debtors

(D) Creditors [1]

OR

As it is beyond human capabilities to remember each and every business transaction, accounting plays an important role in recording these transactions in the books of accounts. Which role of accounting is explained here?

(A) Assistance to management

(B) Substitute to memory

(C) Evidence in the court of law

(D) Comparative study [1]

Answer:

(D) Creditors

Explanation: Only creditor is a current liability for the firm whereas all the rest that is Cash in Hand, Cash at Bank and Debtors are current assets.

OR

(B) Substitute to memory

Question 7.

Assertion: Under Accrual Basis of Accounting, expenses and revenues are recorded when the transaction is done and not when the amount is actually received.

Reason: A business transaction involves the exchange of money and goods or services for money or for a right to claim money in future.

(A) Both A and R are correct, and R is the correct explanation of A.

(B) Both A and R are correct, but R is not the correct explanation of A.

(C) A is correct, but R is incorrect.

(D) A is incorrect, but R is correct. [1]

Answer:

(B) Both A and R are correct, but R is not the correct explanation of A.

Explanation: One-sided errors are those errors which affect the agreement of the trial balance. These errors affect only one account and only one side i.e. debit or the credit side of the account.

Question 8.

Which error will not affect the Trial Balance ?

(A) One sided error

(B) Two-sided error

(C) Both (A) and (B)

(D) None of the these [1]

OR

What is an account called in which the amount of difference between two sides of the Trial balance is transferred temporarily ?

(A) Suspense Account

(B) Profit and Loss Account

(C) Transfer Account

(D) Correction Account [1]

Read the following hypothetical situation, answer question nos. 9 and 10.

On 31st March, 2019 the bank column of the Cash Book of Mr. Keshav disclosed an overdraft balance of ₹ 8,300. On examining the cash book and bank statement you find that:

- Cheques were deposited into bank for ₹ 16,000 but of these cheques for ₹ 4,600 were cleared and credited in April 2015.

- Cheques were issued for ₹ 7,500 out of which cheques for ₹ 6,000 had been presented for payment in March 2019.

- In March Mr. Keshav had discounted with bank a bill of exchange for ₹ 10,000 and had entered this amount in the

- Cash Book, but the proceeds credited as shown by the Pass book, amounted to ₹ 9,600.

- No entry is made in the Cash Book of an amount of ₹ 6,100 directly deposited by a customer in the bank accounts.

- Bank Column of the payment side of the Cash Book was undercast by ₹ 1,000.

- Payment of Insurance premium of ₹ 2,000 and receipt of insurance claim of ₹ 8,000 appear in the Pass book but not entered in the Cash Book.

- A cheque for ₹ 3,500 issued to Mr. Kapil was omitted to be recorded in the Cash Book.

- A cheque for ₹ 2,800 issued to Mr. Darshan was entered in the cash column of the Cash Book.

Answer:

(B) Two-sided error

Explanation: One-sided errors are those errors which affect the agreement of the trial balance. These errors affect only one account and only one side i.e. debit or the credit side of the account.

OR

(A) Suspense Account

Explanation: Suspense account is an account in which the difference in the trial balance is put until such time that errors are located and rectified. It facilitates the preparation of financial statements even when the trial balance does not tally. When all the errors are located and rectified, the suspense account stands disposed of.

Question 9.

Which of the following amount will be shown in the plus item column of the bank reconciliation statement with regard to the cheques that were issued but not presented to the bank:

(A) ₹ 7,500

(B) ₹ 6,000

(C) ₹ 1,500

(D) None of the these [1]

Answer:

(C) ₹ 1,500

Question 10.

Where will the payment of insurance premium be recorded?

(A) Plus item side

(B) Minus item side

(C) Not recorded

(D) Both (A) and (B) [1]

Answer:

(B) Minus item side

Question 11.

Accounting standards help in assessing managerial skills in ensuring profitability of the enterprise and in measuring the effectiveness of management’s stewardship. It will be difficult for the management to manipulate financial data. Which advantage of accounting standards is highlighted in the above case?

(A) Creditability and reliability of financial statement

(B) Beneficial to accountants and auditors

(C) Managerial accountability

(D) Development of accounting theory [1]

Answer:

(C) Managerial accountability

Question 12.

When information about two different enterprises has been prepared and presented in a similar manner, the information exhibits the characteristic of:

(A) Verifiability

(B) Relevance

(C) Reliability

(D) None of these [1]

Answer:

(D) None of these

Explanation: When the accounts are prepared and presented in the same manner, it can be used to compare the financial status of both firms.

Question 13.

Aryan records the expenses as soon as they arise and the income are recorded by him only when they are recovered. Under which accounting concept is this done?

(A) Conservatism

(B) Going Concern

(C) Dual Aspect

(D) Business Entity [1]

Answer:

(A) Conservatism

Question 14.

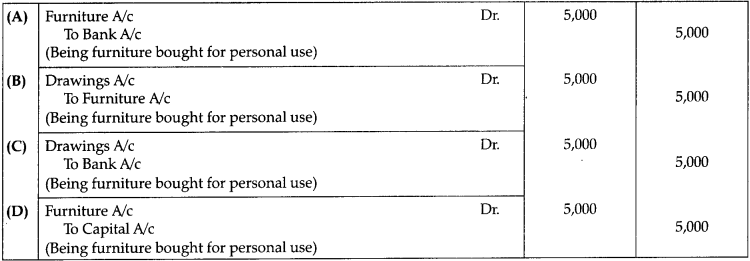

Prashant bought furniture for his house from the firm’s bank account. Pass the following journal entry?

Answer:

Option (C) is correct.

Explanation: As furniture is purchased for the house, it will be treated as drawings. So, drawings account is debited and bank account will be credited.

Question 15.

Which of the following is a book of prime entry:

(A) Ledger

(B) Journal

(C) Trading Account

(D) Subsidiary Books [1]

OR

Pick the odd one out:

(A) Journal

(B) Ledger

(C) Trial Balance

(D) Cash Book

Answer:

(B) Journal

Explanation: The entries are first recorded in the journal, that is why journal is called a book of prime entry.

OR

(C) Trial Balance

Explanation: TriaL Balance is a statement prepared on a particular date to check the ledger posting, while Journal

and Cash Book are books of primary entry and Ledger helps in the calculation of balances of respective accounts.

Question 16.

Describe the role of accounting in the modern world. [3]

OR

What do you mean by accounting standards? Explain the nature of accounting standards. [3]

Answer:

The role of accounting has been changing over the period of time. In the modern world, the role of accounting is not only limited to recording financial transactions but also to provide a basic framework for various decision-making, providing relevant information to various users and assist in both short-run and long-run planning. The role of accounting in the modern world is given below:

(i) Assisting management : Management uses accounting information for short-term and long-term planning of business activities to predict the future conditions, prepare budgets and various control measures.

(ii) Comparative study : In the modern world, accounting information helps us to know the performance of the business by comparing current year’s profit with that of the previous years and also with other firms in the same industry.

(iii) Substitute of memory : In the modern world, every business incurs large number of transactions and it is beyond human capability to memorise each and every transaction. Hence, it is very necessary to record transactions in the books of accounts.

(iv) Information to end user : Accounting plays an important role in recording, summarising and providing relevant and reliable information to its users, in the form of financial data that helps in decision-making.

OR

According to Kohler, “Accounting Standard is a code of conduct imposed on the accountants by custom, law and a professional body.”

Following points highlight the nature of accounting standards :

(i) Accounting standards are the norms of accounting policies and practices to be adopted by the accountants.

(ii) Accounting standards make accounting procedures universally acceptable by removing the diverse accounting practices and policies.

(iii) Accounting standards serve as a guide for solving one or more accounting problems.

(iv) Accounting standards provide the basis upon which financial statements are prepared.

(v) Accounting standards are codified principles to be followed by public accountants.

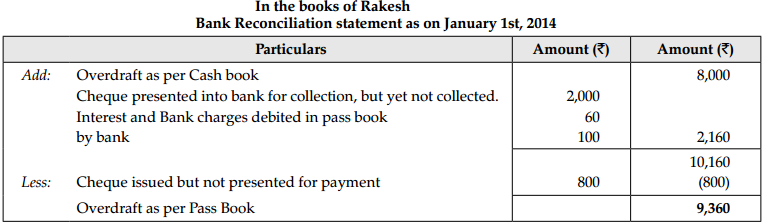

Question 17.

On 1st January, 2014 Rakesh had an overdraft of ₹ 8,000 as showed by his cash book. Cheques amounting to ₹ 2,000 had been paid by him but were not collected by the bank by 1st January, 2014. He issued cheques of ₹ 800 which were not presented to the bank for payment up to that day. There was a debit in his pass book of ₹ 60 for interest and ₹ 100 for bank charges. Prepare Bank Reconciliation Statement for comparing both the balances. [3]

Answer:

Question 18.

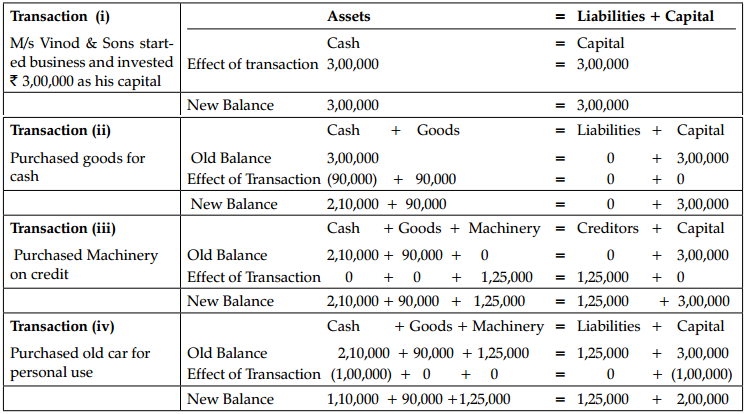

M/s Vinod & Sons show following transactions, prepare accounting equation for the same:

(i) Commenced business with cash ₹ 3,00,000

(ii) Purchased goods for cash ₹ 90,000

(iii) Purchased machinery on credit ₹ 1,25,000

(iv) Purchased old car for personal use ₹ 1,00,000 [3]

Answer:

Question 19.

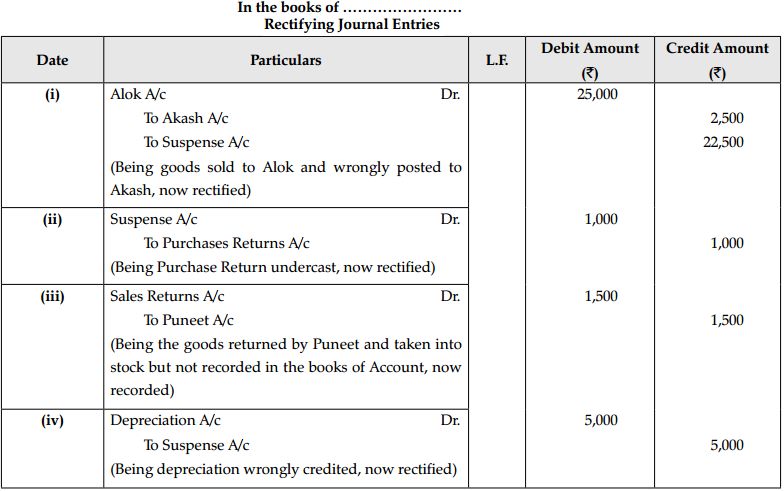

Rectify the following errors using Suspense Account where necessary:

(i) Goods amounting to ₹ 25,000 sold to Alok were correctly entered in the sales book but posted to Akash’s account for ₹ 2,500.

(ii) Purchase Return book was undercast by ₹ 1,000.

(iii) Goods invoiced at ₹ 1,500 and debited on 21st December to Puneet were returned on 25th December and taken into stock on 31st December but no entries made in the books of the account.

(iv) Depreciation charged on Plant of ₹ 25,000 @10%, credited to Depreciation Account. [4]

Answer:

Question 20.

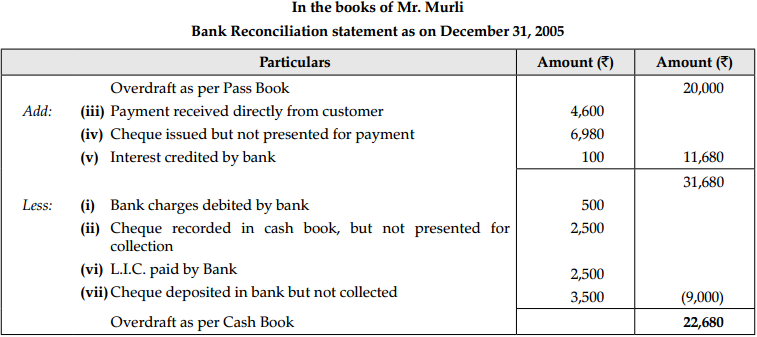

The overdraft shown by the pass book of Mr. Murli is ₹ 20,000. Prepare Bank Reconciliation Statement dated December 31,2005.

(i) Bank charges debited as per pass book ₹ 500.

(ii) Cheque recorded in the cash book but not sent to the bank for collection ₹ 2,500.

(iii) Received a payment directly from customer ₹ 4,600.

(iv) Cheque issued but not presented for payment ₹ 6,980.

(v) Interest credited by pass book ₹ 100.

(vi) LIC paid by bank ₹ 2,500.

(vii) Cheques deposited with the bank but not collected ₹ 3,500. [4]

Answer:

Question 21.

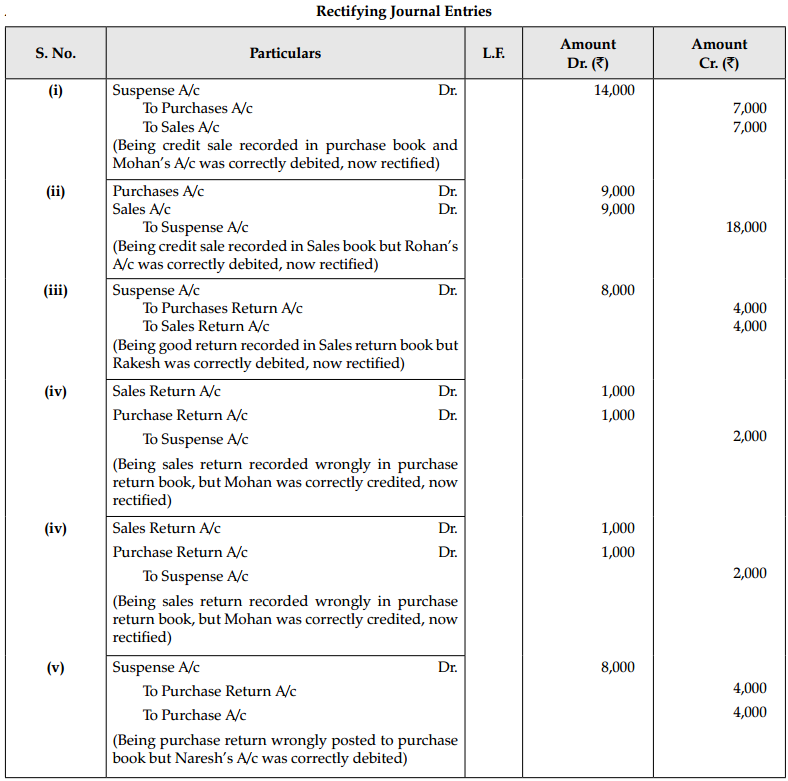

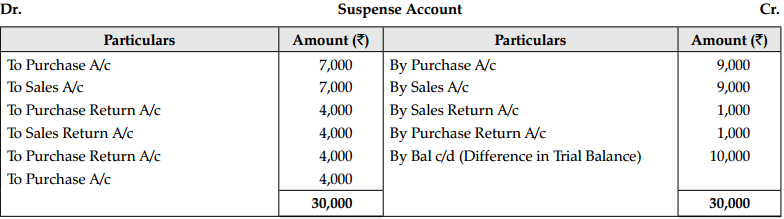

Rectify the following errors assuming that a suspense account was opened. Ascertain the difference in trial balance:

(i) Credit sales to Mohan ₹ 7,000 were recorded in Purchase Book. However, Mohan’s account was correctly debited.

(ii) Credit purchases from Rohan ₹ 9,000 were recorded in sales Books. However, Rohan’s account was correctly debited.

(iii) Good returned to Rakesh ₹ 4,000 were recorded in Sales Returns Book. However, Rakesh’s account was correctly debited.

(iv) Goods returned by Mahesh ₹ 1,000 were recorded through Purchases Returns Book. However, Mahesh’s account was correctly credited.

(v) Goods returned to Naresh ₹ 14,000 were recorded through Purchase Book. However, Naresh’s account were correctly debited. [6]

OR

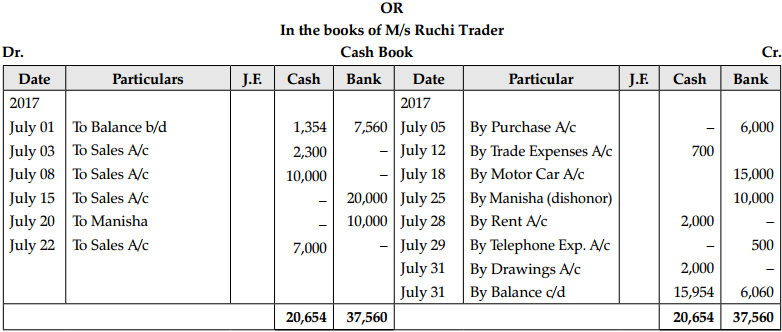

M/s Ruchi Trader started their cash book with the following balances on 1st July 2017 : Cash in hand ₹ 1,354 and balance in Bank Current Account ₹ 7,560. Following transaction took place in the month of July On 1st January, 2017

| Date | Particulars | ₹ |

| July 03 | Cash sales | ₹ 2,300 |

| July 05 | Purchased goods, paid by cheque | ₹ 6,000 |

| July08 | Cash sales | ₹ 10,000 |

| July 12 | Paid trade expenses | ₹ 700 |

| July 15 | Sold goods, received cheque (deposited same day) | ₹ 20,00o |

| July 18 | Purchased Motor car paid by cheque | ₹ 15,000 |

| July20 | cheque received from Manicha | ₹ 10,000 |

| July 22 | Cash sales | ₹ 7,000 |

| July 25 | Manisha’s cheque returned dishonored | – |

| July 28 | Paid rent | ₹ 2,000 |

| July 29 | Paid telephone expenses by cheque | ₹ 500 |

| July 31 | Cash withdrawn for personal use | ₹ 2,000 |

Answer:

Question 22.

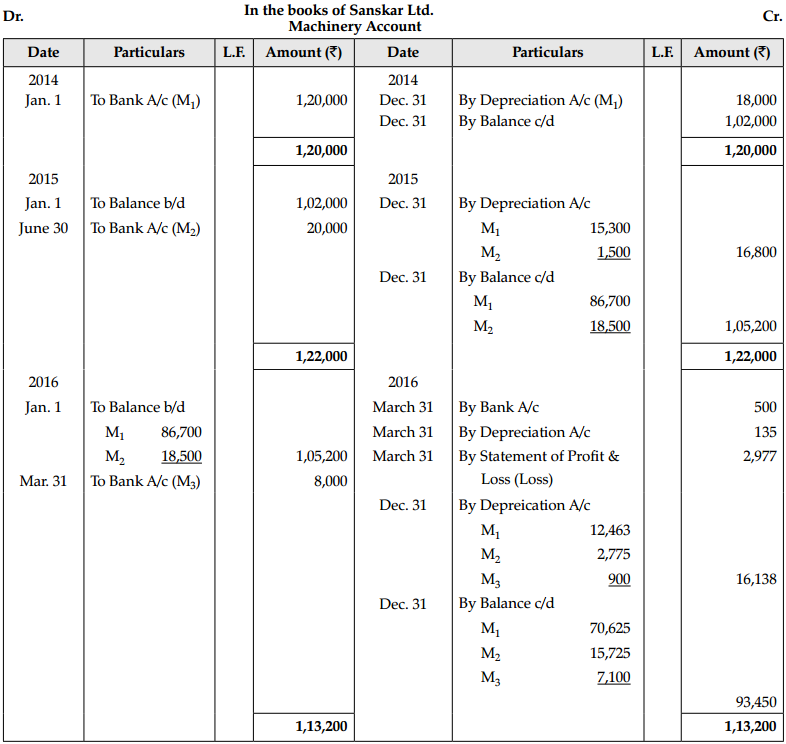

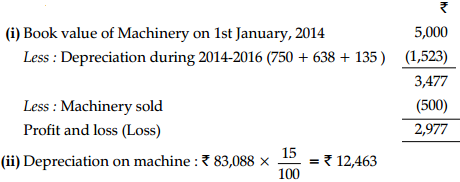

On 1st January, 2014 Sanskar Ltd. purchased machinery for ₹ 1,20,000 and on 30th June, 2015 it acquired additional machinery at a cost of 20,000. On 31st March, 2016, one of the original machines (purchased on 1st January, 2014) which had cost of ₹ 5,000 was found to have become obsolete and was sold as scrap for f500. It was replaced on that date by a new machine costing ₹ 8,000. Depreciation is to be provided @ 15% per annum on the written down value. Show the Machinery Account for the first 3 years. Books close on 31st December every year. [6]

OR

Sanskar Ltd. purchased machinery for ₹ 1,20,000 and on 30th June, 2015 it acquired additional machinery at a cost of ₹ 20,000. On 31st March, 2016, one of the original machines (purchased on 1st January, 2014) which had cost of ₹ 5,000 was found to have become obsolete and was sold as scrap for ₹ 500. It was replaced on that date by a new machine costing ₹ 8,000. Depreciation is to be provided @ 15% per annum on the written down value. Show the Machinery Account for the first 3 years. Books close on 31st December every year. [6]

OR

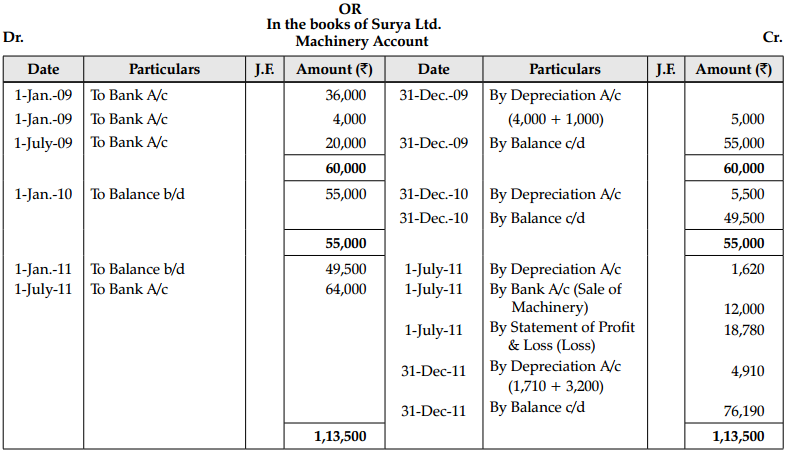

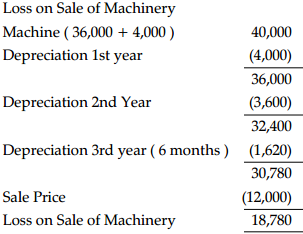

Surya Ltd. purchased on 1st January, 2009 machinery for ₹ 36,000 and spent ₹ 4,000 on its installation. On 1st July, 2009 another Machine was purchased for ₹ 20,000. On 1st July, 2011 machine bought on 1st January, 2009 was sold for ₹ 12,000 and a new machine was purchased for ₹ 64,000 on the same date. Depreciation is provided on 31st

Answer:

Working Notes:

Working Notes:

Question 23.

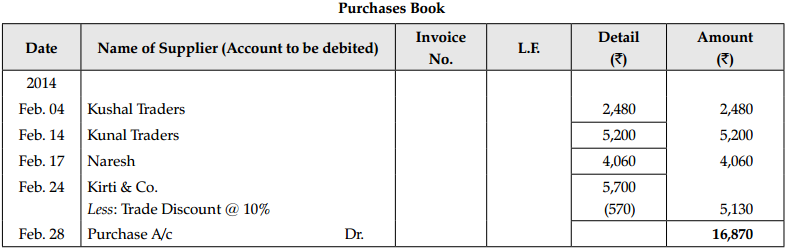

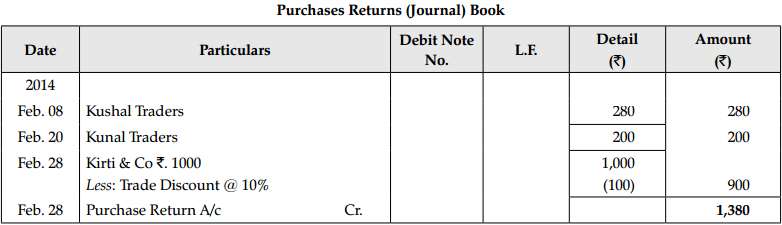

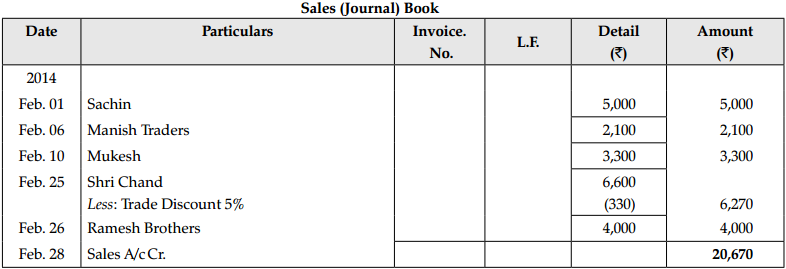

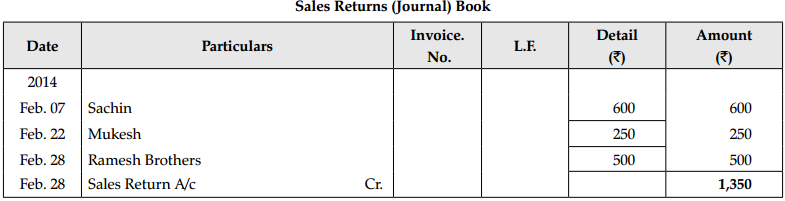

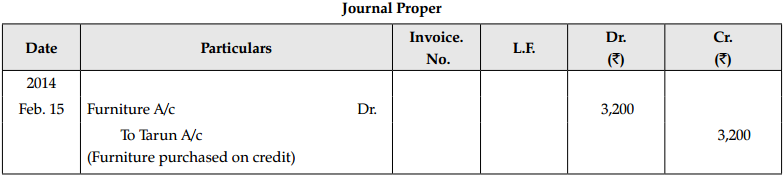

December @ 10% p.a. on the written down value method. Prepare Machinery A/c from 2009 to 2011. Prepare Proper Subsidiary Journal (Books) from the following transactions for the month of February 2014:

| February 1 | Goods sold to Sachin | ₹ 5,000 |

| Feb. 4 | Purchase from Kushal traders | ₹ 2,480 |

| Feb. 6 | Sold goods to Manish Traders | ₹ 2,100 |

| Feb. 7 | Sachin returns the goods | ₹ 600 |

| Feb. 8 | Returns to Kushal Traders | ₹ 280 |

| Feb. 10 | Sold to Mukesh | ₹ 3,300 |

| Peb. 14 | Purchase from Kunal Traders | ₹ 5,200 |

| Feb. 15 | Furniture purchase from Tarun | ₹ 3,200 |

| Feb. 17 | Bought from Naresh | ₹ 4,060 |

| Feb. 20 | Return to Kunal Traders | ₹ 200 |

| Feb. 22 | Return Inward from Mukesh | ₹ 250 |

| Feb.24 | Purchase Goods from Kirti & Co. for list price of | ₹ 5,700 |

| Less 10% Trade Discount | ||

| Feb.25 | Sold to Shri Chand Goods Less 5% Trade Discount | ₹ 6,600 |

| Feb; 26 | Sold to Ramesh Brothers | ₹ 4,000 |

| Feb. 28 | Return outwards to Kirti & Co. for Less 10% Trade Discount | ₹ 1 ,000 |

| Feb. 28 | Ramesh Brothers return the goods | ₹ 500 |

Answer:

Question 24.

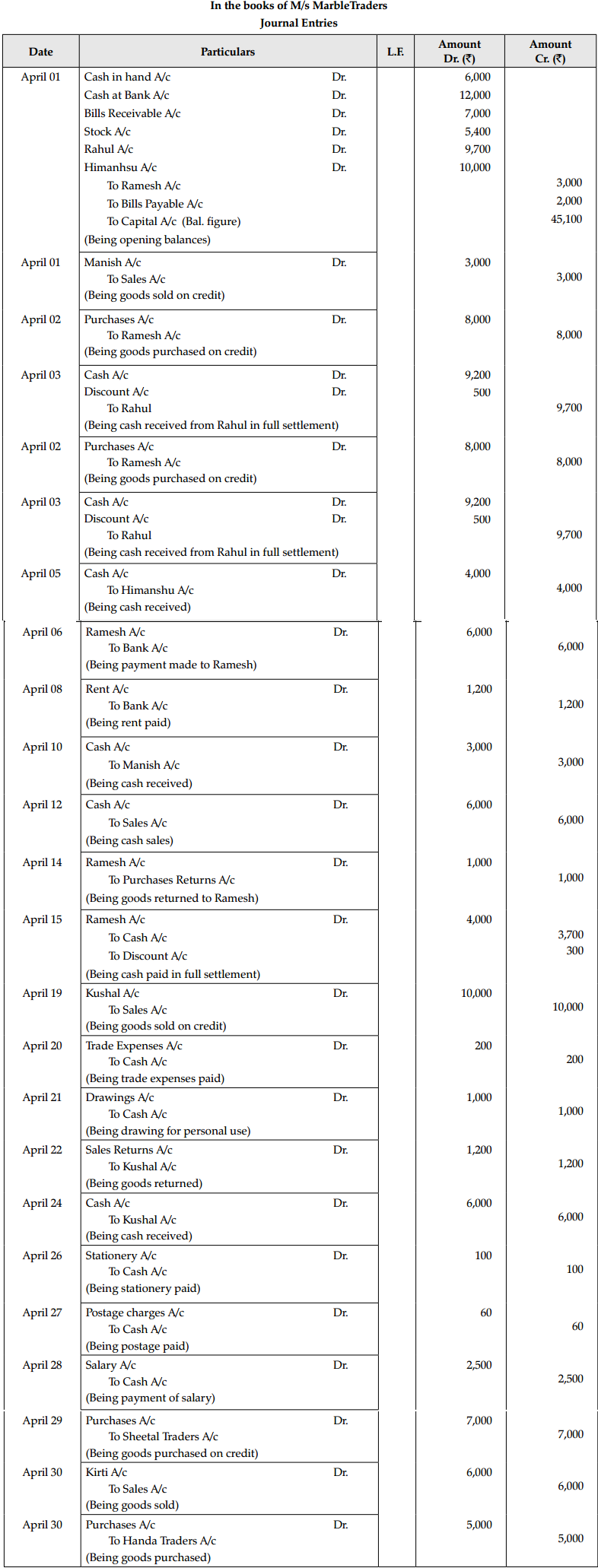

Following are the balances of ledger of MIs Marble Traders on April 01, 2014:

| 2014 | Particulars | ₹ |

| April | Cash in hand | 6,000 |

| Cash at Bank | 12,000 | |

| Bills Receivable | 7,000 | |

| Ramesh (Cr.) | 3,000 | |

| Stock (Goods) | 5,400 | |

| Bilis Payable | 2,000 | |

| Rahul (Dr.) | 9,700 | |

| Himanshu (Dr.) | 10,000 |

Transactions during the month were:

| April | Particulais | 3,000 |

| 01 | Goods sold to Mamsh | 8,000 |

| 02 | Purchase goods from Ramesh | 9,200 |

| 03 | Received cash from Rahul in full settlement | 4,000 |

| 05 | Cash received from Himanshu on account | 6,000 |

| 06 | Paid to Ra mesh by cheque | 1,200 |

| 08 | Rent paid by cheques | 3,000 |

| 10 | Cash received from Manish | 6,000 |

| 12 | Cash sales | 1,000 |

| 14 | Goods return to Ramesh | 3,700 |

| 15 | Cash paid to Ramesh in full settlement | |

| (Discount received 300) | ||

| 19 | Goods sold to Kushal | 10,000 |

| 20 | Paid trade expenses | 200 |

| 21 | Drew for personal use | 1,000 |

| 22 | Goods return from Kushal | 1,200 |

| 24 | Cash received from Kushal | 6,000 |

| 26 | Paid for stationery | 100 |

| 27 | Postage charges | 60 |

| 28 | Salary paid | 2,500 |

| 29 | Good purchased from Sheetal Traders | 7,000 |

| 30 | Sold goods to Kirti | 6,000 |

| 30 | Goods purchased from Handa Traders | 5,000 |

Journalise the above transactions.

Answer:

Part – B (Financial Accounting – II)

Question 25.

Which of the following is a basic financial statement:

(A) Income statement

(B) Position statement

(C) Both (A) and (B)

(D) None of the these [1]

OR

Trading account discloses:

(A) Net Profit or Net loss

(B) Gross Profit or Gross Loss

(C) Operating Profit or Operating Loss

(D) None of the these Ill

Answer:

(C) Both (A) and (B)

Explanation: Financial Statement comprises of Income Statement like Trading and Profit and Loss Account or Statement of Profit and Loss and Position Statement like Balance Sheet.

OR

(B) Gross Profit or Gross Loss

Explanation: A Trading Account helps in determining the gross profit or gross loss of a business concern,made strictly out of trading activities.

Question 26.

While preparing the financial statements, the accountant has to put together items of similar nature under a common heading. This process is called.

(A) Grouping

(B) Marshalling

(C) Both (A) and (B)

(D) None of the these [1]

Answer:

(A) Grouping

Question 27.

Statement I: Even though statement of affairs resembles balance sheet, it is not called a Balance Sheet.

Statement II: Correct ascertainment and evaluation of financial result of business operations cannot be made in

the case of accounting with incomplete record.

(A) Both Statements are correct.

(B) Both Statements are incorrect.

(C) Statement I is correct and Statement ¡lis incorrect.

(D) Statement lis incorrect and Statement Il is correct. [1]

OR

Consider the following statements:

(i) The businessman may be ignorant of the separate legal entity.

(ii) The businessman may be ignorant of the double entry accounting principle.

(iii) The businessman may not intentionally maintain proper accounts to evade taxation.

(iv) Destruction of the books of accounts due to fire, flood, etc.

Which of the statement/s state the reason for following the single entry system of accounting?

(A) (i), (ii) and (iv)

(B) (i), (ni) and (iv)

(C) (i), (u) and (iii)

(D) (i), (u), (iu) and (iv)

Answer:

(A) Both Statements are correct.

OR

(C) (i), (u) and (iii)

Question 28.

The type of income to be shown in the Liabilities side of Balance Sheet is.

(A) Income received in advance

(B) Income not yet received

(C) Both (A) and (B)

(D) Neither (A) nor (B) [1]

Answer:

Option (A) is correct.

Explanation: Advance or unaccrued on unearned income are certain items received by a business enterprise but the whole amount of it does not belong to the current period. Such portion of income which belongs to the next accounting period is income received in advance and is known as “unearned income”. This is to be deducted from the relevant income in the Trading A/c, Profit & Loss Account and shown at the liabilities side of the Balance Sheet.

Question 29.

What is the treatment of bad debts if it is shown as a balance in Trial Balance?

(A) Shown in the credit side of Profit and Loss Account

(B) Shown in the debit side of Profit and Loss Account

(C) Added to debtors in the asset side of the Balance Sheet

(D) Subtracted from the debtors in the asset side of the Balance Sheet [1]

Answer:

(B) Shown in the debit side of Profit and Loss Account

Question 30.

Opening Capital 3,60,000, Drawings 1 ,00,000, Capital added during the year ₹ 1,20,000, Closing Capital ₹ 4,90,000.

Calculate profit or loss. Also give two differences between opening and closing capital. 131

OR

Operating profit earned by M/s Jayant Raj Enterprises in 2022-23 was ₹ 27,80,000. Its non operating incomes were ₹ 11,58,000 and non operating expenses were ₹ 13,36,000. Calculate the amount of net profit earned by the firm. Also explain the term operating profit and how is it different from net profit? [3]

Answer:

Profit = Closing Capital + Drawings – Additional Capital – Opening Capital.

= ₹ 4,90,000 + ₹ 1,00,000 – ₹ 1,20,000 – ₹ 3,60,000.

= ₹ 1,10,000 [3]

1. Opening capital is the capital at the beginning of the year and closing capital is the capital at the end of the year.

2. Opening capital increases due to net profits and additional capital introduced or may reduce due to drawings

and net losses giving the closing capital for the yearosses to give closing capital

OR

Net Profit = Operating Profit + Non- operatingIncome – Non-operating Expenses

= ₹ 27,80,000 + ₹ 11,58,000 – ₹ 13,36,000 = ₹ 26,02,000

Net profit earned by M/s Jayant Raj Enterprises in 2022-23 was ` 26,02,000. [3]

Operating profit means the net income that results from a firm’s core operations or main business activities. When non-operating expenses are deducted and non-operating incomes are added to the operating profit, it results in net profit which means the profit that remains once all costs incurred are deducted.

Question 31.

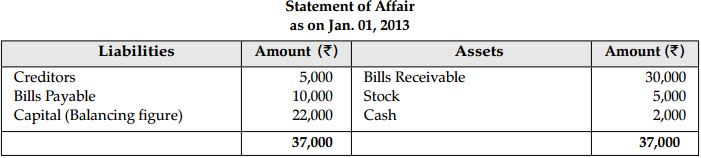

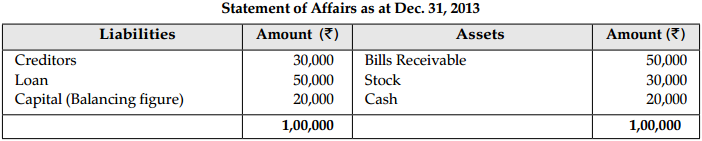

From the following information given below, calculate the closing capital:

| Particulars | Jan. 01, 2013 | Dec. 31, 2013 |

| Creditors | 5,000 | 30,000 |

| Bills Payable | 10,000 | – |

| Loan | – | 50,000 |

| Bills Receivable | 30,000 | 50,000 |

| Stock | 5,000 | 30,000 |

| Cash | 2,000 | 20,000 |

Also calculate the profit or loss and ascertainment of statement of affairs at the end of the year. [3]

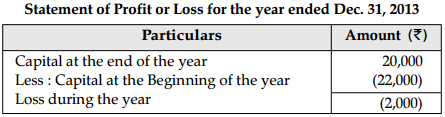

Answer:

Question 32.

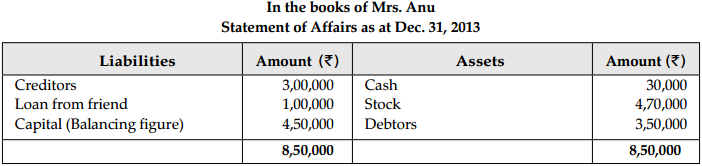

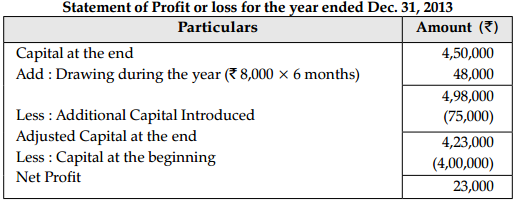

Mrs. Anu started a firm with a capital of ₹ 4,00,000 on 1st July, 2013. She borrowed from her friends sum of ₹ 1,00,000 @ 10% p.a. (interest paid) for business and brought an additional capital of ₹ 75,000. On Dec. 31, 2013, her financial position was:

| Particulars | ₹ |

| Cash | 30,000 |

| Stick | 4,70,000 |

| Debtors | 3,50,000 |

| Creditors | 3,00,000 |

She withdrew ₹ 8,000 per month for personal use. Calculate profit or loss for the year and show your working clearly. [3]

Answer:

Opening Capital on July 1st, 2013 = ₹ 4,00,000

Accounting period = 6 months

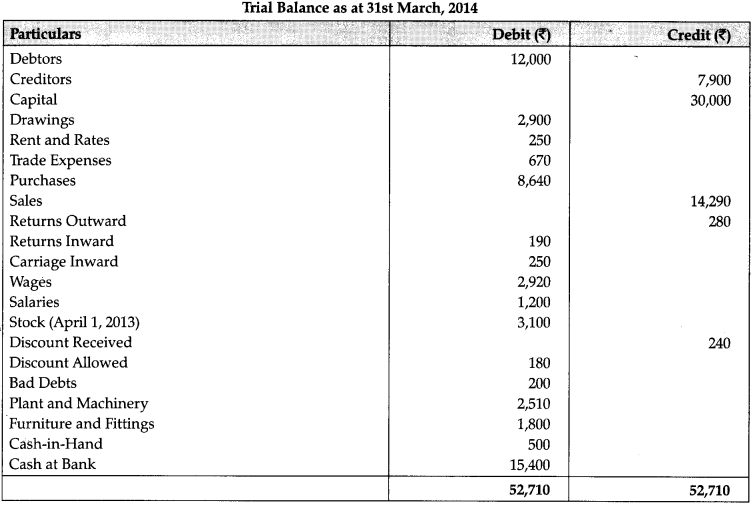

Question 33.

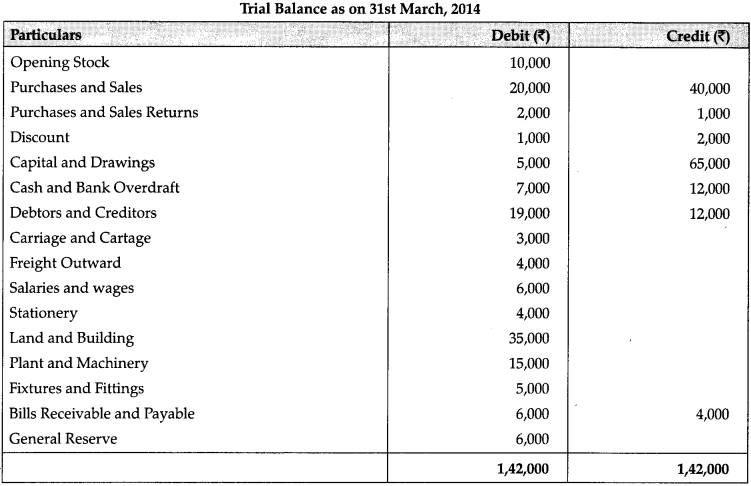

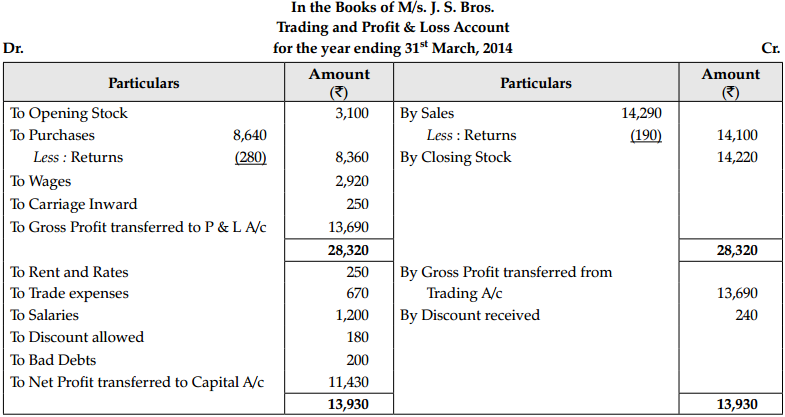

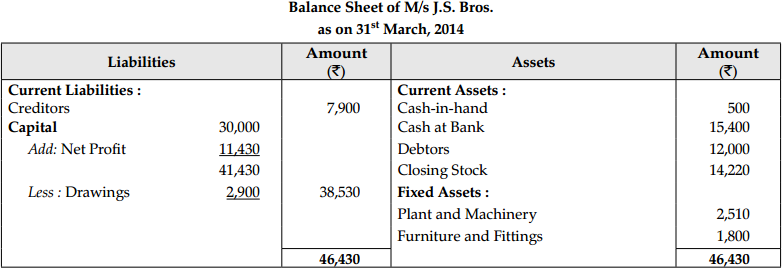

The following Trial balance was extracted from the books of M/s. J. S. Bros, on March 31,2014. Prepare Trading and Profit & Loss Account and a Balance sheet as on that date.

The closing stock amounted to ₹ 14,220 [4]

OR

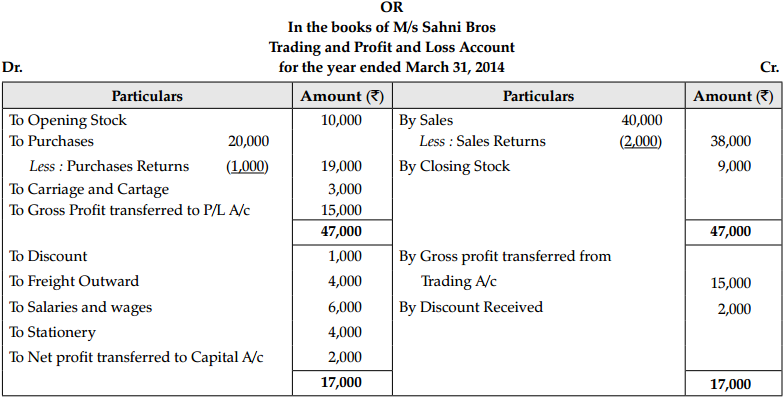

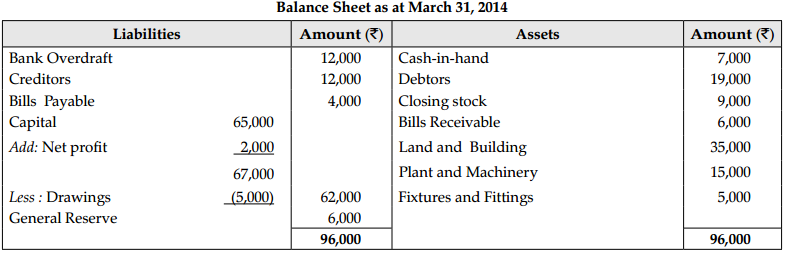

Prepare Trading and Profit & Loss Account and a Balance Sheet as on 31st March, 2014 from the under mentioned Trial balance of M/s Sahni Bros.

Closing stock was valued at ₹ 9,000.

Answer:

Notes : (i) Returns outward (purchases returns) has been deducted from purchases at the debit side of Trading Account. In the same way, returns inward has been deducted from sales.

(ii) Carriage inward is a direct expense.

(iii) Drawings has been shown as deduction from capital at the liabilities side of balance sheet.

(iv) Closing stock belongs to adjustment, so it has been shown at two places, i.e., credit side of Trading Account

and assets side in Balance Sheet.

Question 34.

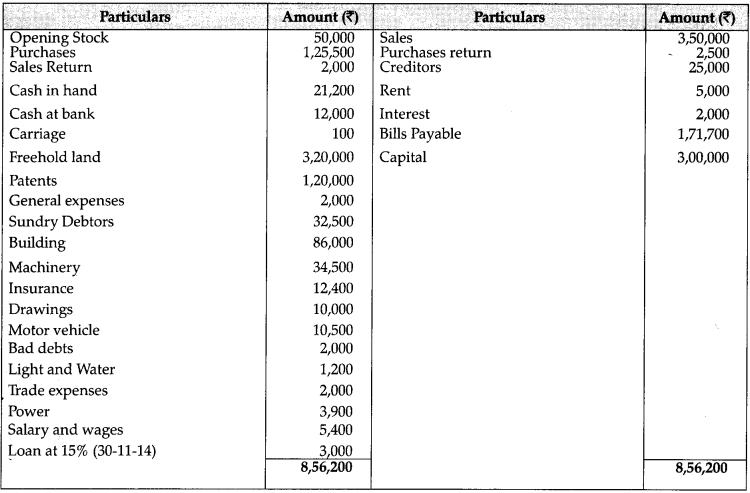

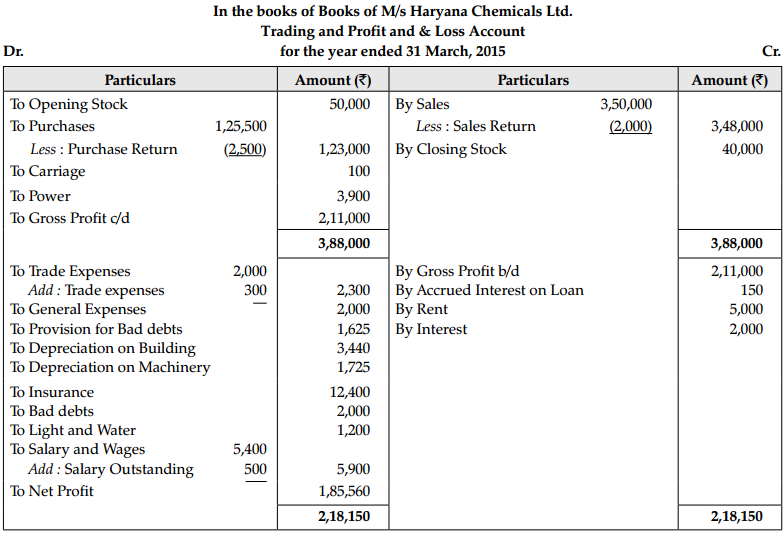

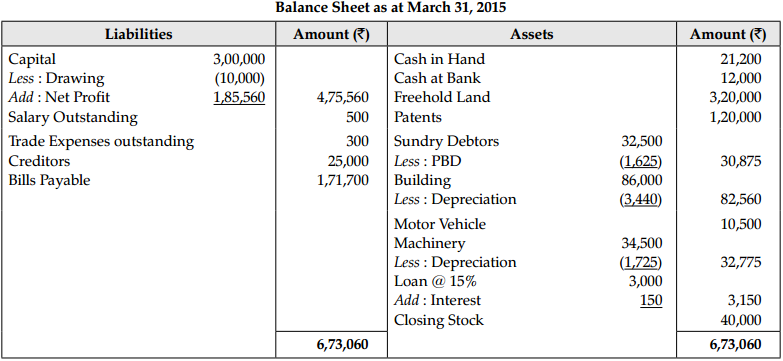

The following balances have been extracted from the trial of M/s Haryana Chemical Ltd. You are required to prepare a Tading and Profit and Loss Account and Balance Sheet as on 31st March, 2015 from the given information.

Adjustments:

(i) Closing stock was valued at the end of the year ₹ 40,000.

(ii) Salary amounting ₹ 500 and trade expense ₹ 300 are due.

(iii) Depreciation charged on building and machinery @ 4% and (i 5% respectively).

(iv) Make a provision @ 5% on sundry debtor.

Answer:

Working Notes :

(i) Depreciation on Building = ₹ 86,000 × \(\frac {4}{10}\) = ₹ 3,440

(ii) Machinery Depreciation = ₹ 34,500 × \(\frac {5}{100}\) = ₹ 1,725

(iii) Interest on loan from 01-12-14 to 31-03-15 = ₹ 3,000 × \(\frac{15}{100} \times \frac{4}{12}\) = ₹ 150